North American financial regulator NASAA, protecting investors from Mexico, USA and Canada, last week recognized the controversial Dascoin project for fraud and sent to its founders - Netleaders (previously Coinleaders) - an order to cease operations. Dascoin was among more than thirty other entities recognized as engaged in illegal financial activities under the so-called Cryptosweep operation.

Netleaders problems

Entering the list of warnings from the North American regulator together with the order to cease operations is by far the most serious official opinion about the project and a significant problem for the creators of Dascoin. In the longer term, it may lead to a total ban on the promotion, offer and advertising of Netleaders in North America. It is also possible that next financial regulators will follow in the footsteps of NASAA in the near future. It is worth noting that one of the pioneers was the Polish Office of Competition and Consumer Protection (UOKiK), which in December last year initiated proceedings regarding the activities of, among others, Dascoina, warning against his business model similar to the scheme of the financial pyramid.

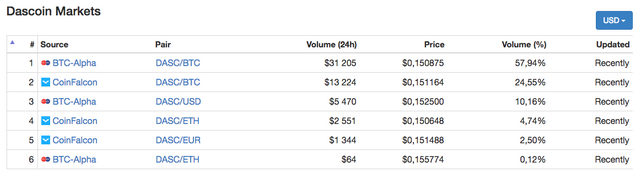

Dascoin is a cryptocurrency project based on a central issue by means of licenses and the cycles obtained through them, distributed in the multi-level marketing model (MLM). From April it is also available on cryptocurrency exchanges (including BTC Alpha and CoinFalcon). Although in the first quarter of 2018, a repository was made available on the Github portal Dascoin's portfolio is still the whole project should be considered as a closed source, as it is not known how the cycles purchased under the license and frequency (frequency lock) affect the process of minting tokens (minting) DASC. It is certain that the DASC utility token is based on Graphene blockchain, which belongs to the BitShares cryptocurrency architecture (BTS).

Last week (21 May) Dascoin began to be listed on CoinMarketCap, because its daily transaction volume exceeded at least several times the value of 100 thousand. dollars. This raises some doubts, since since the appearance at CMC, the daily volume very rarely exceeded even half of the required value (USD 50 thousand), which may suggest that the DASC market was artificially animated to meet the requirements imposed by Coin Market Cap. If the daily trading volume for a longer period will not exceed PLN 100,000 USD, Dascoin will most likely cease to be listed on the CMC.

So far, Netleaders' management has not officially addressed the North American regulator's warning.

What's next with DasPay?

After entering the list of warnings and receiving the order to cease activity, Dascoin may have considerable problems with the implementation of the DasPay solution, in which the highest hopes for the development and popularization of the project are placed. DasPay, according to the creators' promises, is to ensure acceptance of payments using DASC tokens in every place where Visa and Mastercard are accepted. The service is to be implemented by the Canadian company Carta Worldwide, which, however, may withdraw from cooperation with Netleaders after entering their project on the blacklist of NASAA, especially since the cease and desist order was issued through the Canadian British Securities Comission.

Cryptosweep operation

Cryptosweep (in free translation: Krypto-Order) is a large-scale warning campaign launched by NASAA in April 2018. It is a response to the alarming situation in the cryptocurrency market, which according to Joseph P. Borg of NASAA is constantly used by fraudsters, both in the form dishonest ICO, as well as Ponzi's schemes, offering products that pretend to be cryptocurrencies. Publication of a list of over 30 entities recognized as illegal is just the tip of the iceberg. NASAA will systematically publish further warnings, currently examining over 30,000. domains associated with cryptocurrencies. Dascoin was one of the largest projects on the list, and their full list can be found on the official NASAA website.

What is NASAA?

The North American Securities Administrators Association (NASAA) was founded in 1919, making it the oldest international organization protecting investors. It consists of 67 administrative units located in Mexico, the United States and Canada. NASAA acts as an international financial regulator for the three aforementioned countries to inform, warn and care for the safety and education of investors. Despite its officially sounding name, it should be remembered that NASAA is not an official financial regulator whose warnings and orders do not have the power - but they may be a clue and suggestion for government bodies, and have a large media coverage. The governmental financial regulator in the United States is the SEC and CFTC deals with the control of futures contracts.

source: fxmag.pl