We're experiencing quite a bloodbath these days, the crypto prices are plunging ahead of the Chinese new year and the mainstream media's gratuitous FUD doesn't help much either. If you've spent a little time checking out cryptocurrency discussion forums, then you already know that newbies buy into the "end of Bitcoin" propaganda, panic sell and encourage others to do the same.

But those of us who do a little research on our investments already know that the early year crypto crash is a recurring phenomenon (and those who were much wiser have sold their coins before Christmas and now take advantage of the opportunity to buy back in high volumes). But except for the blind trust that the Chinese and the speculators will buy back after February 12th 2018, what kind of guarantee do we have that the price will bounce back to new highs?

Well, it's simple and it's called Proof of Work

That's right, that reward system which hardcore Ethereum fans and concerned environmentalists deem obsolete is the best way for us to know that we're going to get new highs. When Satoshi Nakamoto conceived the mining algorithm (which is key to the decentralization), he/she/they made sure that the participating computers would have to solve mathematical problems that require more processing power and therefore more energy consumption after each block gets discovered. In a nutshell, Bitcoin gets harder and more expensive to mine block by block.

And it is in the miners' best interest to make a good profit: they have paid a lot for the mining rigs and consume enormous amounts of energy on a daily basis.

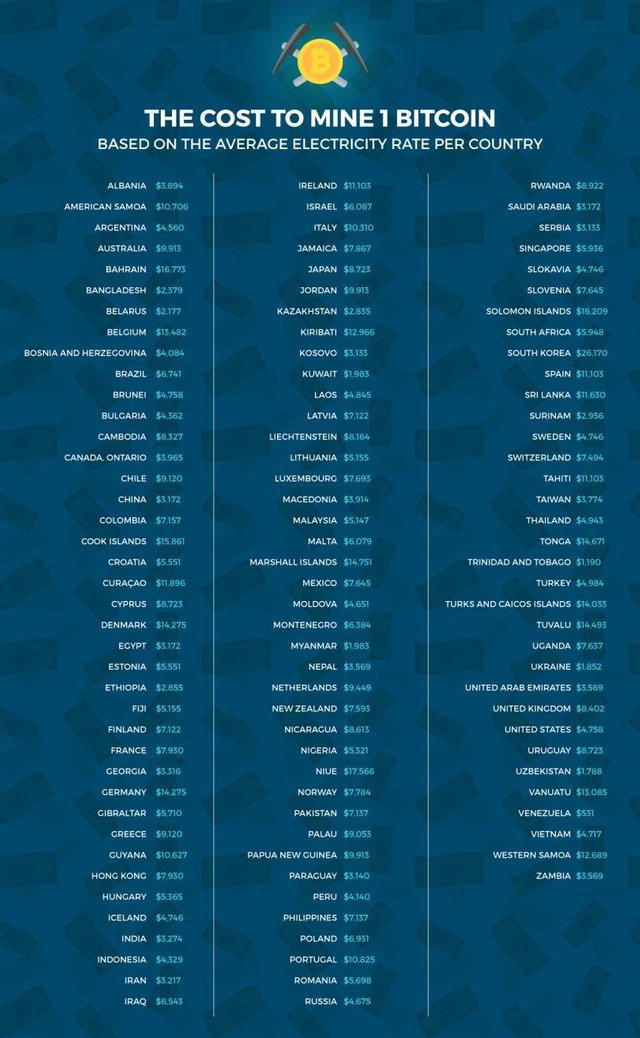

According to the statistics presented in an article by International Business Times, the average price for mining a bitcoin is around the $7000 value worldwide. Please note that the prices that are about to be presented only take into consideration the cost of electricity and completely neglect other expenses such as mining rigs, rent/deposit fees, employees, taxes, and maintenance.

The highest electricity costs are in South Korea (about $26.170), while the lowest is in Venezuela (about $531). However, due to the authoritarian nature of the Venezuelan government, it's highly unpractical and virtually impossible to move your mining farms into their country. So perhaps that the next good solution is Taiwan, where the electricity cost of one bitcoin is around $1190 - but even in this case, we're speaking about a country which isn't recognized by the United Nations and has strict trade rules.

If you live in the United States, then you should know that mining a bitcoin will cost you $4758. European countries like France and Italy have even higher electric energy costs which drive the process to $7930 and $10310 respectively, and China (where most mining rigs can be found nowadays) has an average cost of $3172. Just so you know, last November John McAfee stated in an interview that the cost of mining one bitcoin exceeds $1000 in electricity - and since it's most likely that his rigs belong to his Chinese friend Jihan Wu, we can assume that the price has tripled in 3 months.

At the current price, miners from almost half of the world are taking losses by running their rigs. And that's the best guarantee that the price will further increase!

So forget about the meaningless FUD and negative news, and remember that some of the biggest financial institutions have a stake in Bitcoin and other cryptocurrencies. The original cryptocurrency is the gold standard of the entire market, so the fate of all altcoins depends on the well-being of their king. Nobody wants to take a loss, there's a lot of money that was taken out in the last month, and it's very likely that the speculators will return and put an end to this massive plunge.

Will the price ever return to low values that barely make Bitcoin a sustainable choice for miners? Yes, it's very likely since this is an unregulated market that the whales use to further enrich themselves. But the best choice you can make is to HODL and buy the dip if you can afford to. Stay smart and informed, don't fall for FUD!

IB Times Article: http://www.ibtimes.com/bitcoin-mining-cost-lowest-venezuela-highest-south-korea-report-finds-2646191

This post is Powered by @superbot all the way from Planet Super Earth.

Follow @superbot First and then Transfer 0.100 STEEM/STEEM DOLLAR to @superbot & the URL in the

memo that you want Resteemed + get Upvoted & Followed By @superbot and 1 Partner Account.

Your post will Appear in the feed of 1000+ Followers :)

So don't waste any time ! Get More Followers and gain more Visibility With @superbot

#Note - Please don't send amount less than 0.100 Steem/Steem Dollar ,Also a post can only be resteemed once.

Thank you for using @superbot

If you would like to support this bot , Please don't forget to upvote this post :)

Stay Super !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Price has also fallen due to margin traders who got in December are now closing their margin trades. The crypto drop really hasn't been a surprise for me, and I saw this coming for February 2018

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're absolutely right. It was also one of the factors which drove the price down. Thank you for your comment1 :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article, lots of people are taking about cryptocurrencies these days, especially since BTC's all time high. Now we have blood on the streets, and the news is talking. Bad press is better than no press, IMHO it's a great time to buy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Personally, I will wait for a few more days to see how the market goes. I don't completely trust rebounds before the Chinese New Year.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now the cost of mining bitcoin is so high that you ignore the cost of mining equipment.

Bitcoins are increasingly difficult to calculate, making the current bitcoin diggers miserable.

I was the bitcoin digger in 2013, when the cost was low,

Thank you for your article my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey, I've had fun writing it and yes, you're right about the cost of mining rigs. I think I've also mentioned it in the article along with the costs involved by maintenance, hiring personnel, and taxes/rent.

I like to believe that this is an informative piece for the community. There's so much negative news going on and today I've logged into Facebook to see all the "I told you so" wiseasses who proclaim their intellectual victory as predictors of the decline. Yes we were in a bubble, but any price over $6000 is realistic at this point. And let's not forget that the rumor in November 2017 was that the price is only $1000, which means that the difficulty of solving problems has increased so much that $50.000 by the end of the year doesn't sound that ridiculous.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now it's all just speculation that the price of bitcoin now looks so exciting, like a roller coaster.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Informative share. I didn't even think about the current drop in relation to actual miners. Also, seeing the breakdown of energy costs worldwide is pretty cool, even outside of crypto mining. I wasn't freaking out too much, but seeing something positive does settle the nerves of a relative newbie. Good read

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is quite interesting and a new perspective. I agree with your assessment but do you think the miners really have the power to provide the major support that it needs? In a way it has to because as soon as it becomes unprofitable, the miners will shut down and then it will start to collapse on itself. Let's hope it does not get to that point :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The miners are also some of the biggest stakeholders and buyers. And most of them are from China, that's why their New Year is such a big deal in relation to the price. Sure, as @hustletoparadise mentioned above, margin trading has also affected the price and these big financial companies aren't doing the price any favors. But I'm not panic selling and will HODL for as long as it takes to make a profit out of my investment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Resteemed to over 10800 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollar and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

We are happy to be part of the APPICS bounty program. APPICS is a new social community based on Steem. The presale was sold in 26 minutes. The ICO will start soon. You can get a account over our invite link: https://ico.appics.com/login?referral=1fRdrJIW

@resteem.bot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit