- Markets Update: The Bitcoin Price Rocket Blasts Off Again

- Steemit Statistics & Big Data : End of September Update 🚀

- Don’t Fear Forks, There’s Only One Bitcoin

- Ready for Takeoff? Lufthansa Strikes Deal With Blockchain ICO Startup

- Collapse of Bitcoin Inevitable According to Harvard Economics Professor

- Accenture and BNP Paribas Experiment with Nxt Blockchain Technology

- Challenging China: Taiwan Supports Mainstream Adoption of ICOs and Bitcoin

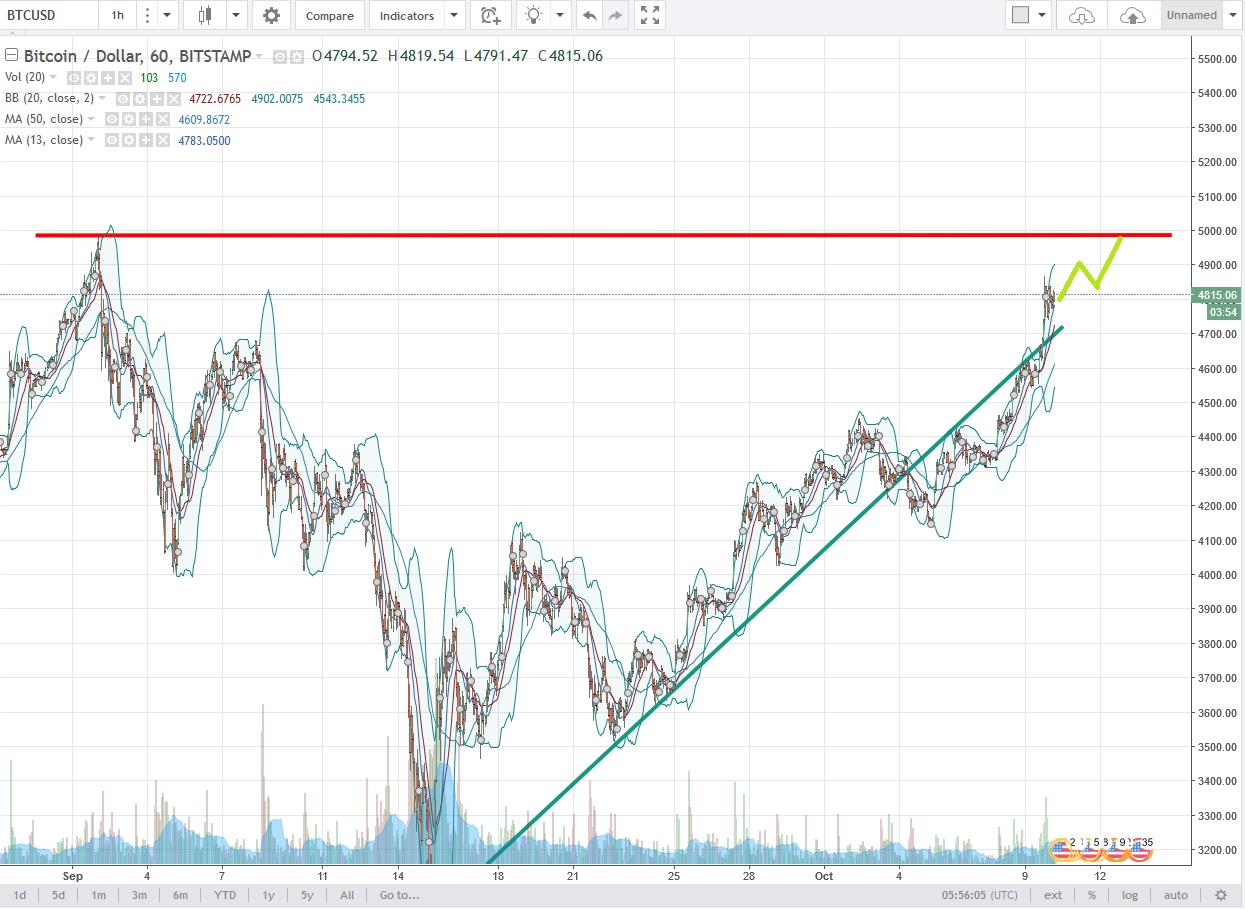

- BTC Trading Update by @cryptopassion

🗞 Markets Update: The Bitcoin Price Rocket Blasts Off Again

As we predicted in our last markets update, bitcoin markets were behaving like a shaken can of soda — waiting to pop. The bitcoin price rocket started its ascent yesterday surpassing the $4,500 zone. Then the price of bitcoin blasted to a high of $4,865 just 24-hours later on October 9. As the fork(s) loom in the backdrop, many people are speculating that altcoins are being sold off for BTC so people can get in on capturing split tokens.

Bitcoin’s Price and Trade Volume Surge

During the early morning hours of October 9, the price of bitcoin gradually lifted to the $4,650 range. However, the price train didn’t stop there as bitcoin’s value kept rising, reaching a high of $4,865 across global exchanges. Bitcoin trade volume has increased significantly since our last report reaching close to $2B in 24-hour trade volume. The decentralized currency’s price has wholly shaken off the 30 percent dip that took place during the first week of September. The top five exchanges pushing significant volume this week include Bitfinex, Bithumb, Bitflyer, Hitbtc, and the GDAX trading platform. Presently, these five exchanges are currently capturing roughly $544M in bitcoin trade volume.

The Verdict

Overall besides the scaling drama and the upcoming fork(s), most crypto-enthusiasts are still in high spirits. Lots of things are happening with bitcoin across the globe as the currency is trending in Japan, Russia, South Korea, and many more countries worldwide. There has been increased regulatory action from many nation-states, but officials are slowly starting to realize how powerless they are trying to deter bitcoin growth.

Bear Scenario:The price of bitcoin could hit some resistance and pull downwards from here. There’s a substantial floor between the $4,300-4,400 zone at press time. It would take a considerable sell-off to continue dropping below these price points, but if it does fall to $4,300 and the Stochastic and RSI is heading south, we could see a flat $4K range again or lower.

Bull Scenario: The price of bitcoin at this vantage point could easily crossover past the $5K zone. Fibonacci extensions show we could reach heights between the $5,200 through $5,800 territories. Currently, its a buyers market and it doesn’t seem like it will slow up for the next 12-hours unless something unexpected happens intermittently.

Read more & Source: https://news.bitcoin.com/markets-update-the-bitcoin-price-rocket-blasts-off-again/

🗞 Steemit Statistics & Big Data : End of September Update 🚀

Thanks to ALL of you, Steemit is growing fast!

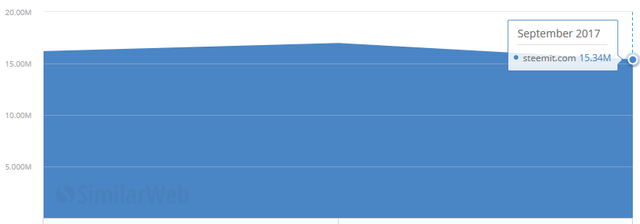

We reached 15,4mn visits in September ALONE

There is an important difference between total visitors to a site and unique ones. In this case the 15.4mn include the multiple times a person visited the website. Therefore, as a good Steemian you probably connect everyday which will make you count for a total of 30 visits.

Therefore, how many "unique users" does Steemit has?

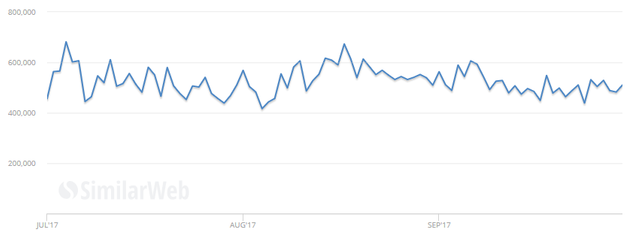

I] Traffic

Daily Steemit Traffic

Read more & Source: https://steemit.com/steemit/@vlemon/steemit-statistics-and-big-data-end-of-september-update

🗞 Don’t Fear Forks, There’s Only One Bitcoin

There’s been some panic lately over the various “forks” of the Bitcoin network, particularly among the less tech-savvy who hear inaccurate or incomplete news on the mainstream media. It’s important to clear up some confusion, because there are more so-called “forks” coming.

First, the most important thing to know is this: there will only ever be 21 mln Bitcoin in existence. Period. End of story.

The difference between a fork and chain split

Many less sophisticated investors get worried every time they hear about an upcoming fork. Calm down: there’s nothing wrong with a fork. Bitcoin and numerous altcoins have successfully forked countless times over the years with no ill effects. In fact, the currency Dash executes a carefully staged hard fork (called the “spork”) every time it does a protocol upgrade. None of these forks have ever caused a chain split.

What’s Bitcoin Cash?

When it became obvious the SegWit solution was going to be the winner in Bitcoin’s civil war, a group of disgruntled developers decided to create an alternate version of Bitcoin. This version, called Bitcoin Cash, would keep Bitcoin’s entire transaction history and all of its rules and structures. Only three things would be changed: the 1 MB blocksize limit would be increased, the SegWit code would be removed, and an “emergency difficulty adjustment” (EDA) was added.

Due to the nature of the fork, everybody who owned Bitcoin now owned an equivalent amount of Bitcoin Cash. Yet the two networks did not directly compete with one another. For one, Bitcoin Cash added a feature called “replay protection,” which prevented transactions on one network from affecting the other network.

What’s Bitcoin Gold?

Just as with Bitcoin Cash, Bitcoin Gold will be an altcoin. Bitcoin Gold will feature replay protection as well, and since virtually no miners will leave the Bitcoin network to mine Bitcoin Gold, it will not threaten Bitcoin’s network in any way. There is zero chance that Bitcoin Gold will “take over” or “kill” the main Bitcoin chain.

Read more & Source: https://cointelegraph.com/news/dont-fear-forks-theres-only-one-bitcoin

🗞 Ready for Takeoff? Lufthansa Strikes Deal With Blockchain ICO Startup

One of Europe's largest airlines is partnering with a blockchain travel platform as part of a bid to explore possible applications of the technology.

Announced today, Lufthansa Group has entered into a deal with Swiss startup Winding Tree, a decentralized business-to-business marketplace built on the ethereum blockchain.

As a result of the deal, Maksim Izmaylov, CEO of Winding Tree, said the startup will assist Lufthansa in building and testing decentralized, blockchain-based travel apps that meet the requirements of airlines, while Lufthansa will integrate its APIs with the Winding Tree platform.

In short, he said both Lufthansa and Winding Tree see the partnership as a win-win – one that allows Lufthansa exposure to new technology experts, and Winding Tree access to experts in the field.

The new partnership goes a step further, though, bringing Lufthansa into the trendy world of initial coin offerings (ICOs), the term denoting how startups are now leveraging custom cryptocurrencies as a way to fund early-stage startup development.

Notably, as part of the partnership, Lufthansa will also be investing in Winding Tree as part of its forthcoming sale of a token called LIF. Although the airline did not disclose how much it will be investing, the token will initially be used to fund the development of Winding Tree's platform

Read more & Source: https://www.coindesk.com/ready-takeoff-lufthansa-strikes-deal-blockchain-ico-startup/

🗞 Collapse of Bitcoin Inevitable According to Harvard Economics Professor

Bitcoin's future is undoubtedly tough to predict. The pundits either believe it will go to the moon or collapse. The latest to join the league of those predicting the demise of Bitcoin is Kenneth Rogoff, a professor of economics at Harvard University.

Who is Kenneth Rogoff?

Ken Rogoff is a professor of public policy and economics at Harvard University. He has a distinguished academic background, with degrees from Yale University and MIT. He served as the chief economist of the IMF from 2001 to 2003 and is a chess grandmaster. With such a background, it is inevitable that his views on Bitcoin attract a lot of attention.

Dim Views on Bitcoin

In a blog post in the Guardian, Ken Rogoff writes:

"Is the cryptocurrency Bitcoin the biggest bubble in the world today, or a great investment bet on the cutting edge of new-age financial technology? My best guess is that in the long run, the technology will thrive, but that the price of Bitcoin will collapse."

"The long history of currency tells us that what the private sector innovates, the state eventually regulates and appropriates. I have no idea where Bitcoin’s price will go over the next couple years, but there is no reason to expect virtual currency to avoid a similar fate."

Echoes Jamie Dimon's Arguments

Ken Rogoff's arguments for Bitcoin's eventual collapse seem to echo Jamie Dimon's views - that governments will not allow Bitcoin to become successful and will coerce Bitcoin users into abandoning it. When asked about the government's ability to shut down a currency which is virtual and knows no boundaries, Jamie had even added that governments could threaten Bitcoin users with jail. It is interesting to note that all the prophesies about Bitcoin's demise come from people within the establishment, whose very future Bitcoin threatens.

Eventually...

The professor has predicted that Bitcoin will eventually collapse, but has given no time frame for this to occur. Hence it is impossible for him to be proven wrong, even if each Bitcoin becomes worth a million dollars, as it might still eventually collapse. Analysts who work in the real world (as opposed to theoreticians) have to make time-bound predictions. There is a lot of difference between an asset's price doubling in two years and doubling in twenty years.

Remember Professor Bitcorn?

Comparisons with predictions made by another professor, Mark Williams, will be inevitable. Mark William was dubbed "Professor Bitcorn" after he bravely predicted in December 2013 that Bitcoins would be worth less than $10 by mid-2014. When Bitcoin remained at over $600 in June 2014, he remained defiant and stated that time would vindicate his prediction. By refusing to specify a time frame for his projection, Ken Rogoff has at least avoided Mark Williams' fate.

Read more & Source: https://cointelegraph.com/news/collapse-of-bitcoin-inevitable-according-to-harvard-economics-professor

🗞 Accenture and BNP Paribas Experiment with Nxt Blockchain Technology

The number of different cryptocurrencies coming to market over the years is almost impossible to count. Some of the older altcoins are still around today, although not everyone will remember most of them. Nxt is one of the older currencies in existence, though it is mainly known for its services to developers these days. Specifically, it now allows for more transparent bank transfers, which is of great interest to BNP Paribas and Accenture Spain.

Major Banks Appreciate Nxt Technology

Anyone who has been involved in cryptocurrency for more than three years will remember the Nxt currency. It was one of the first times we saw a new cryptocurrency which couldn’t be mined whatsoever. Instead, users had to rely on a type of “staking reward” for keeping their wallets open in the browser. The concept made a lot of sense at the time, and Nxt quickly became one of the leading cryptocurrencies.

BNP Paribas, on the other hand, is also making use of a blockchain solution based on Nxt. This is being done as a way to reduce limits on sending money or making purchases on a global scale. While the main purpose of this blockchain is to ease the burden among BNP customers, the ultimate goal is to turn the whole thing into a “borderless cash project”. That’s a rather vague description, although it’s obvious the institution aims to improve its position in the world of cross-border transfers.

This sudden interest in Nxt technology is not something people should be ignoring by any means. While neither bank has fully committed to using Nxt blockchain technology exclusively, this is an interesting decision on the part of both companies. After all, there are several dozen blockchain providers out there, and these banks seemingly have latched onto a project with roots deep within the cryptocurrency community itself. It is an interesting development and well worth keeping an eye on.

It is good to see Nxt’s voting feature get some love and attention. Blockchain technology has often been touted as a way to change the voting process as we know it today, yet there are very few tangible projects out there in this regard. Nxt is seen as an industry leader, based on the comments by these world-renowned banks. It is an interesting turn of events, although it remains to be seen whether other financial institutions will follow this lead.

Read more & Source : https://themerkle.com/accenture-and-bnp-paribas-actively-experiment-with-nxt-blockchain-technology/

🗞 Challenging China: Taiwan Supports Mainstream Adoption of ICOs and Bitcoin

Taiwan’s Financial Supervisory Commission (FSC) has expressed its support for the mainstream adoption of initial coin offerings (ICOs), virtual currencies, and Blockchain in the country. The move is similar to Japan’s friendly approach to the disruptive innovations and in contrast to the campaigns by China and South Korea against them.

In his comment on Koo’s statement, Hsu said that the parliament will also pass the “Financial Technology Innovation Experimentation Act” to support the government’s action. Under the bill, all financial technology (fintech) activities and Blockchain startup companies will be allowed to freely operate in the country’s deregulated industry.

“Just because China and South Korea are banning, doesn’t mean that Taiwan should follow suit – there is a huge opportunity for growth in the future. We should emulate Japan, where they treat cryptocurrency as a highly regulated, highly monitored industry like securities.”

Other cryptocurrency-related developments worldwide

The Chinese government earlier announced that it is banning ICO activities across China, stating that the coin sale is an illegal method of fundraising. This move was imitated by South Korea, which imposed a regional ban on ICOs.

In Japan, the government has declared that the leading digital currency Bitcoin can be accepted as a form of legal payment starting May 2017.

Read more & Source : https://cointelegraph.com/news/challenging-china-taiwan-supports-mainstream-adoption-of-icos-and-bitcoin

BTC Trading Update by @cryptopassion

The next resistance line that we have now to break is the previous higher high for the Bitcoin at 4988$ on Bitfinex.com :

We should test this resistance today and depending if we are able to break it or not quickly, we could be over 5000$ already in some hours.

🗞 Daily Crypto News, October 9th 💰

🗞 Daily Crypto News, October 7th 💰

🗞 Daily Crypto News, October 6th 💰

🗞 Daily Crypto News, October 5th 💰

🗞 Daily Crypto News, October 4th 💰

Copying/Pasting full texts is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One bad news to add to it unfortunately for me. Nepal has illrgalized Bitcoins and have arrested 7 people for trading already. Sigh 🤐🤐

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I almost put it in this Crypto News but I think it is just an autoritarian country not liking the freedom given by Bitcoin and other cryptos.

Thank you for the comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes. You are absolutely right. We are puppets in the hands of our leaders.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I bought some NEOs 2 days ago. What a bad trade. I ve lost more than %8 rn. :( . Im crying inside

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately this is the Crypto World...

Volatile and Risky. I hope it gest better for you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

img credz: pixabay.com

Nice, you got a 4.2% @minnowbooster upgoat, thanks to @vlemon

Want a boost? Minnowbooster's got your back!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @vlemon to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it will be interesting to see bitcoin reach 5000 mark, that will be ultimate high for any currencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like your post. @vlemon I have followed you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Of course bitcoin will collapse. There will eventually be a currency that innovates fater and is more techonologically advance than bitcoin. This is what happens in a free market. Look at pocket cameras, mp3 players, home phones, and pda's. All replaced by a cell phone.

The professor has a 50/50 chance for his prediction to be right and when he gives no time table then yes he'll eventually be right, but even a broken clock is correct two times a day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow grate post ....i like this..

i have some post .....you can check

here @letsmakes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit