Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value? One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put Ramco-Gershenson Properties Trust RPT stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

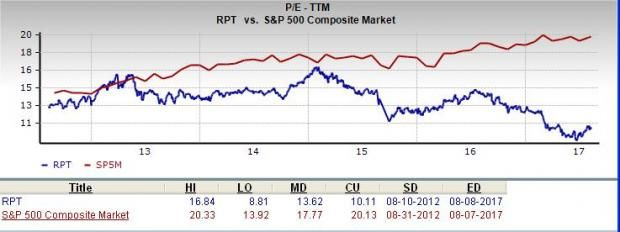

On this front, Ramco-Gershenson has a trailing twelve months PE ratio of 10.11, as you can see in the chart below:

This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 compares in at about 20.13. If we focus on the stock’s long-term PE trend, the current level puts Ramco-Gershenson’s current PE ratio below its midpoint over the past five years, with the number having risen rapidly over the past few months.

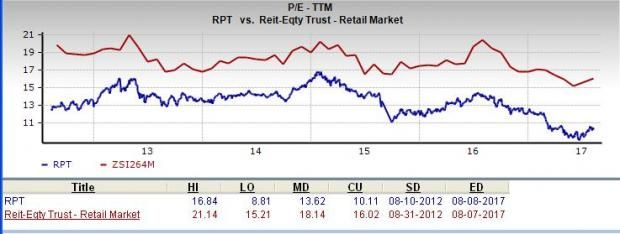

Further, the stock’s PE also compares favorably with the broader industry’s trailing twelve months PE ratio, which stands at 16.02. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

Source: www.yahoo.com

It is very good ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit