Actually, Ethereum enjoyed the nimbus of the white blockchain. While Bitcoin has the bad reputation of Darknet's currency, Ethereum is considered a good currency for banks and nerds.

This image has already swayed with the ICO hype. It turned out that unregulated crowdfunding is the first killer app from Ethereum. A new analysis of the transaction history has the potential to further scratch the image of Ethereum. At least the authors of the analysis claim to have discovered that the center of the economic activity of Ethereum is a "mixer". And where the mixer is, is usually money laundering in it, right?

Disposal Addresses in the Transaction Graph:-

The Cyberblog team has analyzed all Ethereum transactions from the Genesis block until September 15, 2017. In doing so, they have worked out clusters in transactional processes - they have searched for patterns that show that transactions are interrelated. We know this principle of Bitcoin, where different addresses or transactions can be linked together relatively easily and can be clustered into a wallet.

The cluster analysis of the Ethereum blockchain now led to a remarkable finding: There was a class of addresses that would be used as "disposable addresses". They received money, the money was transferred, and afterward, the address was never used again.

The amazing is not that there are such addresses. The astonishing is the mass. "The temporary addresses accounted for 46% of all active addresses and processed 65% of the absolute transaction volume in the time period under investigation." You have to take a quick breath to visualize these values. Almost half of all Ethereum addresses and about two-thirds of all values that have been passed!

However, the analysts probably do not intend to use these dramatically sound figures. The role of the mixer is less extreme, considering its share not in the value, but in the number of transactions. This is still high at 10 percent, but it is already clearly more manageable. The mixer has therefore hardly any influence on the number of Ethereum transactions that has risen rapidly since 2016, which is now between 300,000 and 500,000 a day.

A mixer between exchanges:-

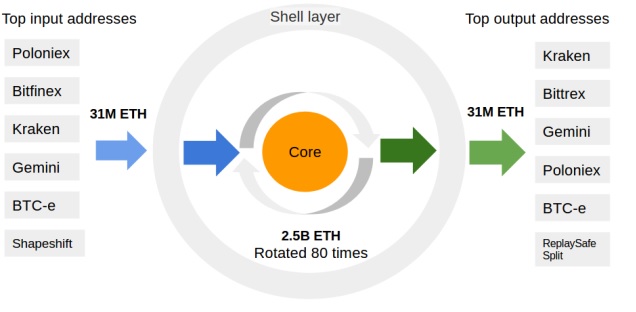

But let's return to what the analysts have found. They have investigated the starting points and objectives of the transactions around the disposable addresses. This interesting illustration has been made:

For the most part, there are six stock exchanges, which chase 31 million ethers into a mixer circuit, from which they go back to six exchanges. Between the stock exchanges, the ethers are rotated 80 times around themselves, generating blockchain transactions in the volume of 2.5 billion ethers (equivalent to 700 billion euros). Between the stock exchanges and the core of the mixer is a bowl, which consists of temporary and permanent (multiple used) addresses. The disposable addresses in the core of the mixer generally receive amounts of approximately 500, 1,000, 2,000, 3,000, 5,000 or 10,000 ETHs.

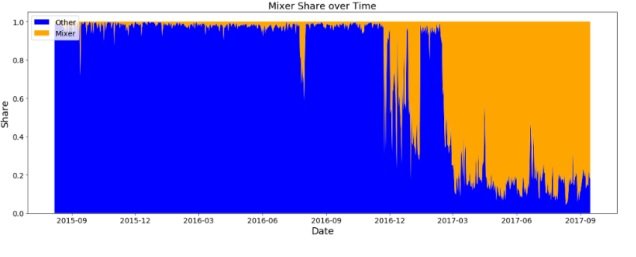

Another graph shows how the share of transactions of the mixer with the value of the Ethereum transactions increased over time.

Apparently, since the middle of 2015 the mixer has been running on a small flame. After a test in the late summer of 2016, he then turned to full activity at the end of 2016.

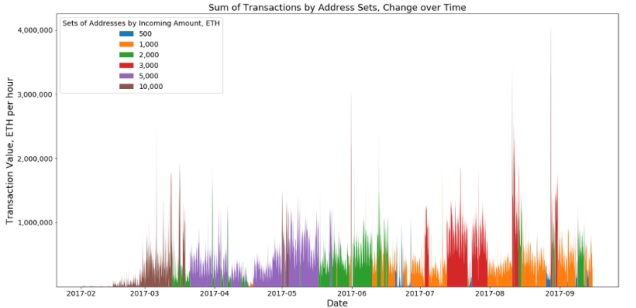

The exact analysis of the observed addresses reveals a particular scheme. The researchers have classified the addresses into six groups: addresses that receive 500, 1,000, 2,000, 3,000, 5,000 or 10,000 emitters via transaction. "The chart shows how these sets of addresses complement each other almost one to one. Take a set of addresses, such as those that receive about 1,000 Eths. After they are active for a while, they become inactive, and another set, such as one with addresses that receive 3,000 ETHs per transaction. It acts as if the behavior of the addresses is orchestrated, which leads us to the presumption that there is a certain system that coordinates these activities. "

The Mixer does not automatically mean criminal money laundering!

The cyberblog analysts call their catch "mixer" because this is obviously exactly what the addresses do - they mix ethers of different origins so that it is hardly possible to determine where the ethers come from. However, "mixer" does not mean that there is a criminal activity. Mixing cryptic dosages cannot be equated with money laundering, but is, in view of the high transparency of a blockchain, a necessary undertaking to achieve at least a piece of financial privacy.

Therefore, the analysts still speculate on the purpose of this powerful construct that they found on the blockchain. They have several assumptions. First, it might be that cryptos are mixing customer assets to pay their customers "clean money" that can not be associated with criminal activities; secondly, this mechanism could protect US citizens from coming into unwanted contact with the strict US regulators; thirdly, the various exchanges could use this blender to safely transfer money from stock market to stock exchange; and fourthly, it is also conceivable that the analysts have come across a system of organized, massive money laundering by Ethereum.

For the fourth alternative, some of the addresses used by the mixer seem to be related to hacked coins, like this one. On the other hand, chopped coins will inevitably land on stock exchanges sooner or later.

The ethereum community now has a fifth guess in the game: the analysts have encountered the wallets of Coinbase and / or GDAX. The largest market for Ether in the US is missing in the diagram via the inputs and outputs in and / or from the mixer. Therefore, it is well possible that the supposed mixer is only the wallet of Coinbase. This presumption is relatively plausible; it makes the catch of the blockchain analysts much less exciting than actually thought. It is a bit like a huge, dark, oddly ornate, mysterious building in the middle of Cologne, and it means that you have to make a message.

Vitalik Buterin from the Ethereum Foundation comments on the analysis critically. The Ethereum chief developer complains that the use of "transaction volume" is misleading in the article; in fact, it is easy to confuse this with the number of transactions. Even Zooko of Zcash messes up the. For Vitalik Buterin, the value of all transactions is a relatively useless chart, since you can manipulate it as you like, by pushing larger amounts often back and forth. 68 percent of the transaction volume cannot be equated with 68 percent of the economic activity.

Follow Me. & Upvote Me @wailabdalla!

@eileenbeach has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond. To be Resteemed to 4k+ followers and upvoted heavier send 0.25SBD to @minnowpond with your posts url as the memo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A awesome post. @wailabdalla followedd

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @jerryhuge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post, very well articulated. thank you so much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for reading my article!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

70% seems like a high% but great post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's study about Eth analyses and transactions a mixer

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great post, a hug @garimpodanet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thaks for enjoy post with me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great post.... follow me https://steemit.com/@hemon88

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post :) very well done..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for your time

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post deserve a upvote..plz visit my page also today I post some interesting content they are waiting for your your upvote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I visit your page and I see great post and I upvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit