Since Internet stocks, including Amazon.com Inc. in the dot-com era, bitcoin and cryptocurrencies could be the most lucrative trading opportunities. Everyone knows that trading cryptocurrencies, including bitcoin, comes at a high risk for many reasons, such as volatility. However, it is a real opportunity for both traders and investors right now.

However, investors should be careful when investing in bitcoin in the longer term. Since the birth of the cryptocurrency, bitcoin owners experienced great price drops, with some of them reaching 75 percent of previous peak values. Recently in June, bitcoin, along with the other cryptocurrencies, experienced a huge price fall of nearly 40 percent before bottoming out.

Looking behind all cryptocurrencies, both investors and traders should see the bigger picture since virtual currencies are the start of something grand. The reason for this is the blockchain technology behind all of the digital currencies. Since the super useful attribute of blockchain, which enables value transfer without middlemen, many companies, and financial institutes are planning to implement the new tech. According to Gordon Scott, contributor at Investopedia, who is also the Managing Director of the CMT program for the Market Technicians Association, the recent price surge of bitcoin’s price “is an indication that many more people are starting to believe these promises could actually be fulfilled.”

If bitcoin seems to be too fast for many, investors should look back to the dot-com crash in 2000, where many of the Internet stocks crashed, many were lowered in value but managed to recover, while some of the stocks rocketed to orbit and stayed there, such as Amazon and eBay.

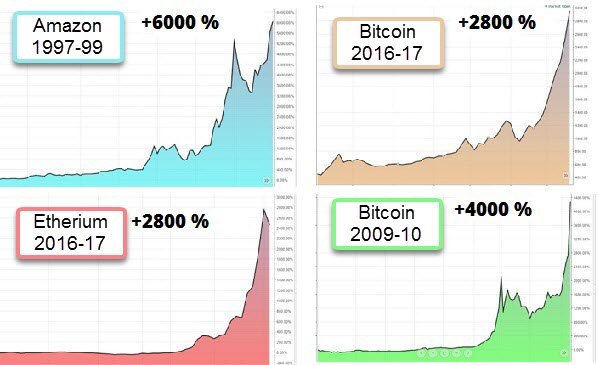

According to Scott, there is a worthwhile comparison between the prices of Amazon and bitcoin. Amazon, between the period of 1997 and 1999 increased its value by 6,000 percent. On the other hand, bitcoin’s price rose by 4,000 percent from 2009 to 2010 and further increased by 2800 percent from 2016 to 2017. Ethereum also experienced big price surges: the value of the cryptocurrency increased by 2,800 percent from 2016 to 2017.

At first, most of the people knew that Amazon had a great idea, however, no one could quantify the share value of the company accurately. Investors had to guess the value of the firm, which resulted in overestimating the possibilities for a time. The peak price from 1999 looks really cheap by comparison today.

Surprisingly, bitcoin’s performance in the cryptocurrency’s first two years only achieved approximately two-thirds of Amazon’s price increase. The past two years in both bitcoin’s and Ethereum’s life came with the most dramatic price surges, however, it was not enough to reach Amazon’s meteoric rise.