May Shocker

May 2019 started off with quite a shock with the much talked $40 million crypto heist. Well, not to place anyone in a bad light, but as a crypto exchange, we (XDAT) did not want to brace for such an impact. The big B got away with the whole community supporting them. But, it dawned to us that there is something that is still not right even with the best.

To cite an example, all of us are not aloof with bank robberies. But, that did not stop from us/customers depositing our/their money on banks. Instead, the banks took precautionary measures to fasten security measures, like coded secure vaults (industrial grade) that are simply tough to break into. Not only the brick and mortar ones but even the transactions that happened online were also made secure, through secure insured payment gateways.

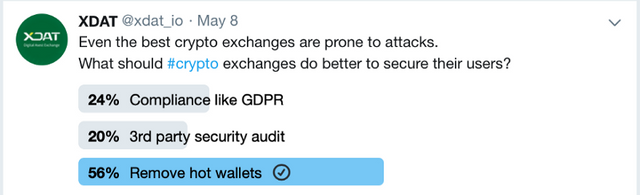

XDAT, an EU fiat to crypto exchange, conducted a Twitter poll to know what kind of reforms should crypto exchanges adopt to better secure the funds and wallets of their users. We had given the audience a set of three options:

-> Compliance like GDPR

-> Third party security audits

-> Remove hot wallets

Security measures are of the utmost importance when it comes to trading in cryptos. Especially when mass adoption is the wider option.

The kind of the audience that we were seeking answers from knew the hurdles that current crypto exchanges face. And they stepped in to shed some light on what they thought could better the exchanges.

24% thought that while operating in jurisdictions, there still lies a need for exchanges adhering to GDPR standards. Even though we are moving to decentralization there lies a need for exchanges to comply by measures for data protection and a layer of security to integrate such rules into even cryptosystems. “Protocols” is the word on the go. They bridge the world’s greatest blank spaces in terms of creating a default trust environment and is definitely shaping the tech-era where decentralization is the holy grail.

20% of the customers went by third-party security audits that conclude the need for an external agency to run an inspection on any financial bodies. This kind of commitment towards transparency naturally communicates to the users that they are in safe hands.

While the majority 56% of voters opted for innovative solutions that replace hot wallets. This bracket of the voters thinks that their crypto funds are still not secure on exchanges or on the internet in general. Despite big names that aim to deliver trust through expert solutions for security.

Breaking down the basics

A “wallet” is equivalent to a bank account. There are two broad distinguishing factors for kinds of wallets to hold crypto assets: Hot & Cold wallets

Hot wallets are the ones that are held on the exchanges or that are run on internet-connected devices like a computer, mobile phone, or tablet, like Exodus. Your private keys are definitely not a 100% secure for the simple fact that these wallets are connected to the internet. Therefore storing huge amounts of crypto is not a safe practice.

While cold wallets are off the internet or exchanges and are not free of cost. They can be personal hardware wallets, like LedgerX or Trezor. Cold storage (aka cold wallets) means generating and storing the crypto coin’s private keys in an offline environment, away from the internet. Offline or cold wallet vault storages are being rooted for as a secure means of wallet requirements, even though they have to be purchased, but better safe than sorry later. Nobody wants their funds to be stolen or part of a crypto heist.

So here comes a point where exchanges decide to either manage the risk of holding records on their platform or make a complete shift to a decentralised exchange. Where records, transactions, and anonymity are set in stone for no one to fiddle or hack into. On the other hand, centralised exchanges have beefed up with tighter security upgrades like SegWit measures, SOC 2 compliance, web authentication, ISO certifications and what have you. Additionally, traders, users and investors should follow some measures to further secure their funds. Here are a few tips:

-> Generate your private keys in a secure, offline environment.

-> Create backups of your private keys.

-> Encrypt wallets for additional security

So if crypto exchanges are looking at mass adoption then the one distinct roadblock that needs fixing is the kind of security measures that one adopts. This ensures that the users trust the exchange where they deposit their funds. Upcoming and ongoing solutions involve digital custodial protection of such wallets as well.

By the proverbial quote, “precaution is better than cure” the crypto industry. XDAT is currently scouting for new avenues to make our exchange even more secure than it already is.