Market Analysis

After a sharp surge, Bitcoin price cooled off last week, shedding nearly 1500 points. Much of the drop came in the wake of $207 million worth of Longs liquidation on Bitmex. The price action resembled the previous week upward movement. However, the first cryptocurrency quickly gained on the price and seems to be settling around $8000. Whale action has been impressive during with two major whale accounts moving as much as $84 million in Crypto. Twitter handle Whale Alert confirmed the movement of 5,500 BTC worth $44.1 million from one wallet to another over past 24 hours. The same source suggested another movement of some $40 million in BTC.

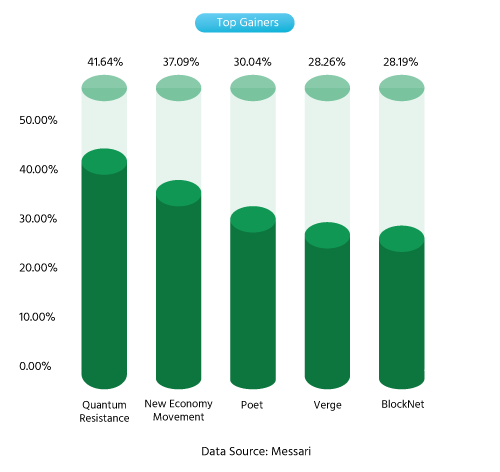

Sentiment around the general cryptocurrency space is positive with altcoins staging massive rally this week. It was one of the biggest monthly gains from the Altcoins against Bitcoin. However, a cautious approach is advised to the investors as market capitalization is increasing and so is BTC dominance. It usually depicts that the money is flowing from the Altcoins to Bitcoin.

On the development front, the week has been positive with Bakkt announcing Bitcoin derivative debut in July. Further, Microsoft also announced building decentralised identity tool on Bitcoin Blockchain. Investors should, however, keep an eye on NVT ratio, a backtested indicator created by Willy Woo. Historically, significant divergence between the price and NVT ratio is followed by a drop in price. Going forward, Bitcoin has not given weekly closing above $8350 for the past two weeks and the level should be watched closely. Any movement above the said resistance would chart the upward course for Bitcoin.

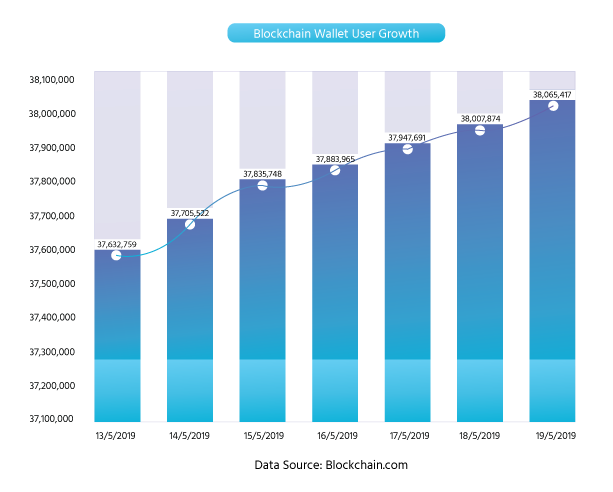

Weekly Growth Blockchain Wallet Users

Weekly Gainers & Losers

-> Bitcoin — The week has been positive with Bakkt announcing Bitcoin derivative debut in July. Further, Microsoft also announced building decentralised identity tool on Bitcoin Blockchain.

-> Ethereum — Ethereum co-founder Joseph Lubin stated that Ethereum could be 1000 times more scalable in the next couple of years on the back of Serenity upgrade. In a separate development, it was revealed that EDF, the world’s fifth largest Electrical company is using an Ethereum Dapp. A rather startling revelation was made by Chainalysis stating that nearly a third of all the circulating supply of Ethereum is held by 376 individuals.

-> Ripple — Börse Stuttgart stated that it has listed two new ETNs out of which one is for XRP. Twitter handle Whale Alert suggested significant transfer of XRP tokens from Bittrex to Upbit.

-> Ethereum Classic — Shane Jonas and Terry Culver of ETC Labs briefed about the latest core developments during Community Ethereum Development Conference.

-> Bitcoin Cash — Bitcoin Cash developers Openbazaar and Bchd full node developer Chris Pacia announced the first 3 of 3 Multi-Sig Schnorr transactions.

-> EOS — Chief Technical Officer Daniel Larimer stated that updates on network code “nearly tripled sustained throughput on large testnets.” Meanwhile, CEO of EOS Brendan Blumer has also appealed the community to consider “1 token: 1 vote” strategy to do away with the Cartel.

-> DASH — Spend Card has added support for Apple Pay further expanding the scope of spending DASH for the purchase. In another news, DASH core group CEO Ryan Taylor stated that DASH is more popular in comparison to Bitcoin and Litecoin in Venezuela.

-> TUSD — According to data from TokenAnalyst, currently there are 15,682 HODLers of TUSD.

Wider Market Update: Weekly News Analysis

-> On the regulation front, Italy became the first country in the EU to regulate Blockchain. Russian Prime Minister, on the other hand, stated that Crypto regulation is not the priority right now for the Russians. The government in Brazil has agreed to pass the ‘instruction 1888’, paving the way for the new rules for Crypto effective from August 1 2019. In separate news, the Bahamas security regulator has drafted a new bill for token regulation.

-> Speaking at CoinDesk’s Consensus 2019 conference in New York, SEC senior advisor of Digital Assets stated that the exchanges that are offering IEO might come under the legal scanner.

-> As per Google Trends Data, search for Bitcoin has hit 14 months high, following the increase in price.

-> Charles Hoskinson of IOHK and Trevor Koverko of Polymath are collaborating to launch Layer 1 security token Blockchain dubbed as Polymesh. In a separate development, startup Blockstream is working on a security token platform on Bitcoin sidechain.

-> Outstanding crypto backed loans are now more than 100 million USD for the first time. In another development, Techstars backed Alkemi has planned to launch liquidity pool deal worth $16 million.

-> Facebook sets up a Fintech company ‘Libra Networks’ in a crypto friendly nation Switzerland (Geneva) aiming to support its cryptocurrency payments. In another development, way ahead of Facebook, Whatsapp enables sending and receiving Bitcoin, Litecoin, Ethereum and ZTX native token of the Zulu Republic platform for transactions, according to Zulu Republic.

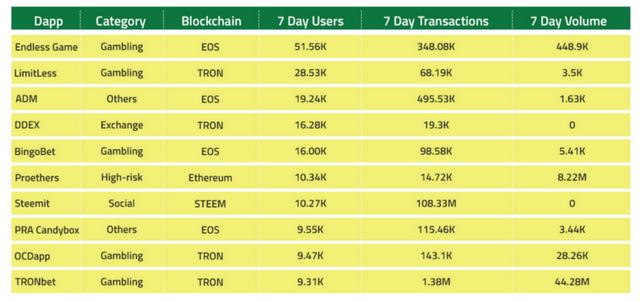

Weekly Dapp Statistics

Fiat to Crypto Trade (in BTC)

Disclaimer

Every effort is made to provide accurate information in this newsletter. However, XDAT cannot guarantee that there will be no errors. XDAT makes no claims, promises or guarantees about the accuracy, completeness or adequacy of contents herein and liabilities for errors and omissions.

Information provided in this correspondence is intended solely for information purposes and is obtained from sources believed to be reliable.

XDAT is not responsible for any losses incurred as a result of using any information contained here. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Any third party opinions, links, news, research, analysis, prices, or other information contained in this newsletter are provided as such as general market commentary and do not constitute as investment advice.

None of the content published in this newsletter constitutes a recommendation that any particular cryptocurrency, portfolio of cryptocurrencies, transaction or investment strategy is suitable for any specific person. The services and content that we provide are solely for informational purposes. The generic market recommendations provided by XDAT are based solely on the judgment of its personnel and should be considered as such. You acknowledge that you shall enter into any transactions relying on your own judgment. Any market recommendations provided by us are generic only and may or may not be consistent with the market positions or intentions of our company and/or our affiliates.