If you're like me, with the recent surge in Bitcoin you may have considered cloud mining as an alternative to buying it at market price. On the surface it makes sense - you pay for a mining contract which allocates a certain amount of GH/s for you and you make the resulting Bitcoin regularly over time. Even better, these contracts are generally lifetime meaning you make a one time investment and then you get paid as long as it's profitable. What's not to like?

Here's the thing though: how do you really know you're getting a good return on your investment, especially if you decide to purchase a contract right now in the current market? Ask yourself seriously, because it's your money you're spending and you should understand the expected returns you might be getting from it. Just because it's a lifetime contract doesn't mean it's guaranteed to pay out forever, particularly in this case because of maintenance costs and other factors which I'll get to below. Before I start though quick note: the following analysis is only for Bitcoin mining and not any other kind of altcoin mining. Also a disclaimer: I do own a small handful of mining contracts, but this analysis is completely and entirely my own thoughts on the subject. This advice is not intended to be any kind of endorsement (which I'm sure will be more apparent further down).

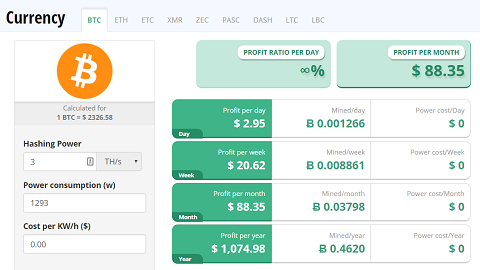

So let's look at one of the more reputable mining sites out there, Hashing24. We could pick any number of mining sites, but I'm going to focus on them since they're among the more well known ones. Just know that this analysis could apply to any site and not just them. Anyway, Hashing24 is fairly popular and well-known mining contractor because they're a legitimate business (always a plus) and generally speaking they have quick payouts, good rates, and low maintenance costs. For the purposes of my example, let's say you want to buy a 3TH/s contract from them. That's going to run you about $510.00 USD, or around 0.22 BTC. If you put in that 3TH/s rate into a mining calculator, you might see something like this (ignore the power requirement for now):

You could also use Hashing24's own mining calculator which is probably a little more accurate in this case:

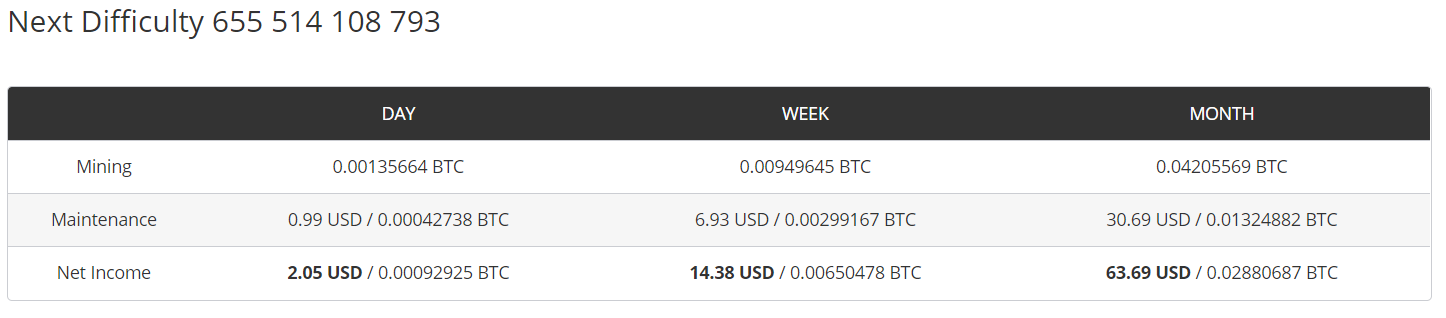

If you want you can even consider the next difficulty increase to see how the next series of payouts will look:

This is assuming a 10% difficulty increase, which is currently on par with the next expected increase according to BitcoinWisdom.

Overall it seems pretty promising right? Even with the difficulty increase you'd still be making about $60/month worth of Bitcoin. The ROI might take a little longer but at least it's still going to be made back within a few months. End of story, right?

But unfortunately it's not, and I'm going to explain my reasoning below.

The problem with these calculators comes down to two factors that we already know about: difficulty and maintenance cost. Specifically, the problem is that these two factors aren't actually correctly accounted for in most mining calculators. See, the thing is that most of them only account for those factors as they currently are, not as how they'll change in the future or impact your return over time.

So how do we understand the impact? Well, we're going to need to figure out what these factors actually look like over time. We will want to know expected difficulty changes over time as well as the maintenance costs. From there we can calculate our expected income and ultimately posit whether or not cloud mining may actually be worth the investment.

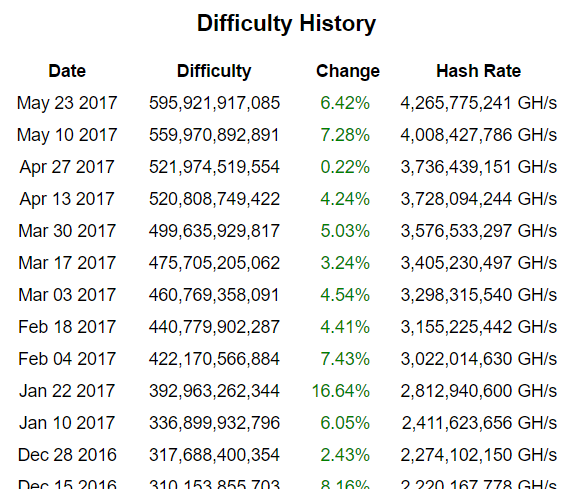

Let's start with block difficulty, since that's easier to calculate. According to BitcoinWisdom, the current difficulty is 595,921,917,085. That's great, but how do we calculate difficulty changes over time? Fortunately BitcoinWisdom provides a handy table of difficulty changes over the past couple years:

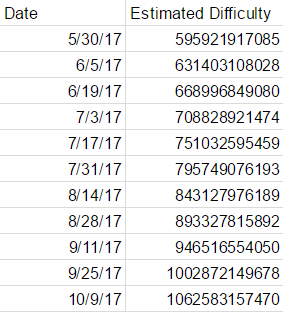

Of course we can't predict what the exact difficulty changes will be, but we can base our calculation on past averages to at least get an idea. Since we want the average increase over time, I calculated the averages for both every entry in the table (goes back to Aug 22 2015) and then just 2017. They are 5.19% and 5.95% respectively. Using the 2017 rate, we get average difficulty increases that look something like this:

Now that we have the average difficulties over time, we can start calculating expected gross BTC earnings, maintenance costs, net BTC income and ultimately total earnings. Unfortunately however here's where things get a little tricky. I based my expected BTC income calculation off the code on BitcoinWisdom, but the problem is that this doesn't match what Hashing24 actually pays out. If you put 3TH/s into Hashing24's mining calculator it claims you'll be mining 0.00149523 BTC per day before maintenance fee deduction, whereas BitcoinWisdom's calculator only says to expect around 0.00106675 BTC per day. This discrepancy only increases as you input higher hash rates.

Hashing24's mining calculation is hidden behind a separate network call so I couldn't just read their code to figure out how they calculate it, and all the other mining calculators I could find more or less calculated earnings in the same way. And, even if I did know how Hashing24 ran their calculations, there's no guarantee I'd be able to replicate it since they could be taking their own historical data into account in some way.

To counteract this, I didn't change the expected BTC calculation but instead tweaked the maintenance deduction to achieve similar net BTC income that Hashing24 reports. This means that the daily gross BTC calculation will be off from what Hashing24 reports, but the net income should still be about the same (in fact it was slightly higher when I did some comparisons, which means my numbers might be more "ideal" than what you'd actually be getting). I know this isn't a great solution, but my goal was to ballpark these estimates anyway so I'm not too concerned about 100% accuracy. It's also worth noting that even if this was accurate my estimates could still be a little off regardless since as per the nature of Bitcoin mining these are only expected returns based on probability, not an actual reflection of what you'll be getting. The point is that it's averaged over time ;)

So if we calculate the expected daily gross BTC income, maintenance fees, and net income we get a table that looks like the following. Note that the maintenance cost column is a reflection of the actual maintenance cost Hashing24 might report. The "cost" I used in my deduction is just calculated as part of the cell formulas.

Don't worry about the "BTC price (est.)" column just yet, I'll get to that in a second.

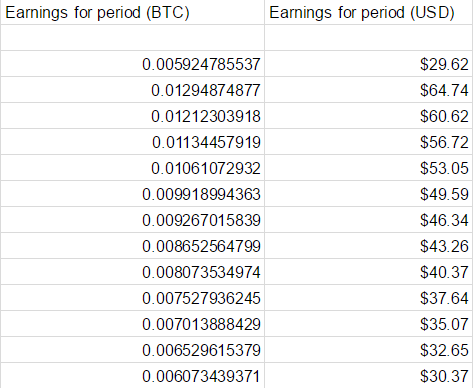

In order to calculate expected earnings at each difficulty, we just multiply by the expected difficulty period which for Bitcoin is 14 days. That will result in something like the following table:

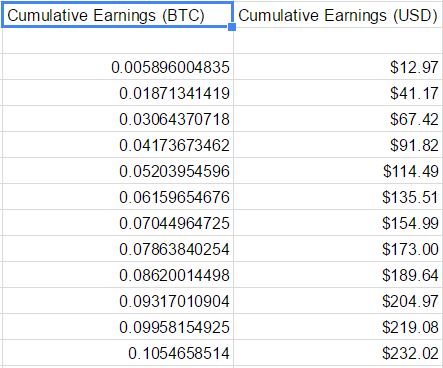

And from there it's just a matter of adding everything up to get a cumulative total:

That last row is the expected earnings by November, which you'll notice is above our initial investment of $510. That's great, right? It means that this mining thing will still pay out after a few months then, yeah?

Well... not exactly. You remember that "BTC price (est.)" column I mentioned earlier? That's an average projected growth of Bitcoin from $2200 to $5000 over the course of ~2 years, and it assumes Bitcoin is just continually going up every mining period. Here's what that same table looks like if you assume Bitcoin stays the same until November:

So you can see that the price of Bitcoin over time will affect how much USD value you earn. Of course that's nothing new, but there's actually something in that data that's a bit more telling. Take another look at the cumulative BTC - it's about 0.1054 BTC. Remember how I mentioned the original cost was 0.22 BTC? If you want to see where you'll break even on BTC, unfortunately you can't. These projections start going into the red around the end of next year, and by then you've only made about 0.177 BTC in total.

Additionally, there's one other characteristic I haven't mentioned yet. See how in the first table the expected BTC earnings is 0.1099 BTC while the expected from the second table is only 0.1054 BTC? That's purposeful. As far as I can tell the maintenance cost is based on USD, not BTC, which means that your maintenance cost differs based on market value. If BTC is down, expect to pay more in maintenance fees (and conversely less when it's up). This is important, because it means you're getting more or less BTC simply by virtue of when it was mined, which affects how much you're able to earn.

So where does this leave us? I started doing this research because I wanted to see if mining would actually be profitable vs investing. And to be honest, I'm having a hard time convincing myself that it is. Of course it's possible that these projections could be wrong. Maybe there will be another massive upward price swing and it'll be worth it. Or maybe the difficulty won't increase as fast or it'll hit a ceiling or even decrease. Or maybe my calculations could just be off. There's a number of assumptions here that could change or potentially be wrong. The point of thise data is mainly just to help get an idea of what an ROI for a mining contract might be in the next couple years.

Either way, I'm not advocating that you don't buy a mining contract. I'm just saying it's a bit more complicated to figure out an ROI than just simply putting a number into a mining calculator, and it's something that's important to consider when investing. If you think cloud mining is still worth it, then by all means go for it :)

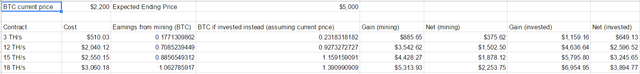

Before you do buy a mining contract though, I have one last piece of information I want to show you. Here's a table showing the expected ROI of mining based on my above calculations vs the expected ROI of investing for various price points:

So is it worth buying a mining contract or do you invest directly into Bitcoin instead? That's something you'll have to decide for yourself, but if any of these projections hold true then my point is that you may not be seeing as much return as you could be getting. As always, it's a risk just like anything else in this space.

Here's a link to my spreadsheet with the analysis, in case you want to check it out for yourself. It has some additional hash rate calculations in addition to the 3TH/s one I talked about here: https://docs.google.com/spreadsheets/d/1bCqcVaiPLEGB6GNR6lYzTVI--ZfFqZq0sFHSwPFh_io/edit?usp=sharing

What do you think? Do you think Bitcoin mining is still worth it? Or do you think my analysis is completely wrong? I'd love to hear your thoughts.

I have some more topics like this I'm considering for future write-ups, so if that's something you'd like to see more of then feel free to follow me and participate in the discussion! Thanks for reading :)

is mining can be profitable depending on TH you are buying. Great analysis you made.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good analysis, although I skimmed through it, it does make sense.

I rather buy bitcoin then purchase hardware for mining or invest in mining.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Yeah that was my conclusion too, but I wanted to see what the numbers might look like hence why I did some more digging.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well written and researched. Thank you for sharing. The other issue is as time goes on, newer mining equipment has a higher ROI/hashrate, so as a result you have another avenue of diminishing returns.

Your $/hashrate may decrease, but so would your yield.

Again, thanks for a clear, well written post! Upvoted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, I appreciate the feedback!

You are absolutely right about diminishing returns of newer equipment. I was focusing primarily on cloud mining but I think it applies to hardware mining as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis. Thanks for sharing it. I was looking into purchasing 1TH through Hashing24 but decided against it for the same reasons you outlined. People should look into mining some of the alt coins that are more profitable than bitcoin. I've been mining Sia coin on my pc and getting about 1.6 to 2k per week currently worth about $13 to $17. The graphics card doesn't even break a sweat mining for them and it easy enough to roll them into bitcoin if desired.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'd heard about Sia coin, though I haven't looked into it yet. Didn't realize it was currently being pc-mined. That seems like the way to go for mining now: find new alts to mine at a reasonable profit then sell (or hold if you believe in it). I think it makes the mining infrastructure slightly less robust since once it become unprofitable people will just move on, but I also feel like many alts will have trouble surviving longer term anyway.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @xerdo! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit