Bitcoin "stumbled" bid farewell to 2017, and in the new year, "open the door". Bitcoin suffered a setback on the first day of 2018, the first since 2015. All along, bitcoin has the leading role in the world of encrypted currency, but now, with the sharp reversal of bitcoin price, while other encryption currencies continue to rise, the status of bitcoin's "boss" is facing the biggest challenge in history.

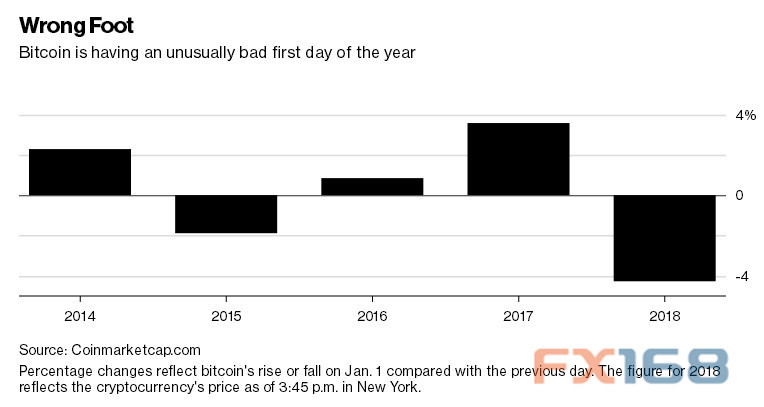

For the whole year of 2017, bitcoin is undoubtedly a "very hot" type of investment, and the price of bitcoin has climbed more than 1300% in the year. But at the end of last year a sell-off that bitcoin bulls feel mad". In 2018, the first trading day of the bitcoin fell, in fact, it was the first time that the first day of the new year came down since 2015. According to Bloomberg data, on Monday, 5 p.m. in New York time, bitcoin was $13624.56 / ounce, down 4.8% on Friday.

(bitcoin's first new year's new year's new year since 2015, Peng Bo, FX168 financial network)

The number one encrypted currency is now bouncing around $15000, but still far below the historic peak of nearly $20000 hit in mid - 12 last year. Analysts say the news from South Korea still holds the price of bitcoin. South Korea's government policy coordination office issued a statement on Thursday, saying that South Korea will assess various measures, including closing the exchange, to curb the speculative behavior of encrypted currencies. According to the statistics, the amount of bitcoin trading on the Korean dollar accounts for 20% of the total volume of global transactions. Once South Korea closes a large number of exchanges, the encrypted currency will undoubtedly suffer a major blow.

According to the South Korean government statement, the government will take appropriate measures to monitor the trend of cipher currency quickly and firmly, and will stipulate the real name system of the encrypted currency, and prohibit the bank from providing the virtual account to the encrypted currency exchange. The Korean government said in a statement: "in South Korea, the speculation of encrypted currency has been in a state of irrational overheating. The government can no longer continue this unusual situation. "

(image source: Peng Bo, FX168 finance and Economics Network)

Choe Heungsik, President of Financial Supervisory Service, said in a forum on Thursday that bitcoin is "invisible", and the bubble of the encrypted currency will eventually burst.

When bitcoin hit the first new year's day since 2015, the other encrypted currencies were still strong. According to CoinDesk, the price of the ether rose 11% after entering the new year, breaking through 900 dollars, refreshing the new high. The market value of the ether is around 87 billion dollars.

Since hitting the 2017 low, bitcoin has soared by more than 1300%, but the increase in the dollar has been more "appalling": up 11000% since early 2017. According to the financial times, the expansion of the ether was largely boosted by the news of the Russian development of the official digital currency.

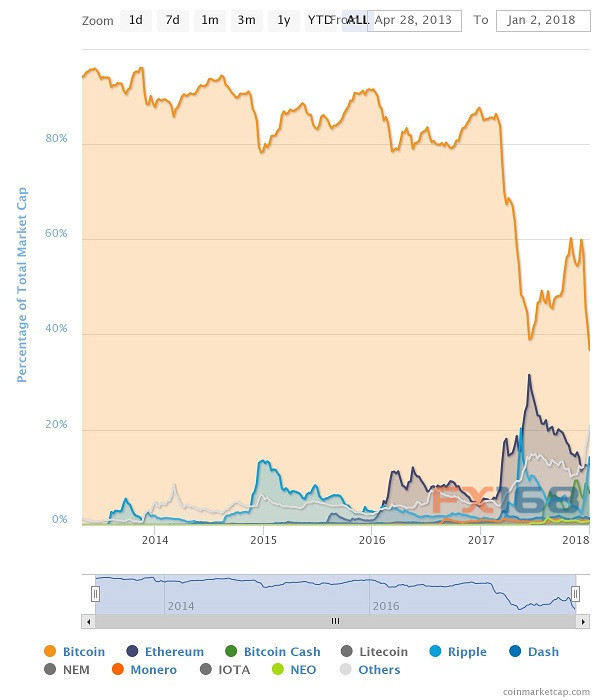

The share of bitcoin has set a new low

According to the website CoinMarketcap.com, bitcoin market value in the whole encryption currency market proportion has dropped to about 36%, a record low, a significant decline compared to December 65% at the beginning of last year.

(bitcoin, such as the share of the encrypted money market share the picture source: CoinMarketcap.com, FX168 financial network)

By Tuesday, the market value of bitcoin was $231 billion 800 million. At the beginning of 2017, the share of bitcoin accounted for more than 80%.

Since the top of $19800 in mid December, bitcoin has lost about 1/3 of its market value.

Indeed, in 2017, bitcoin prices rose to a staggering 1300%. However, in the past month, many other digital currencies increased much more than bitcoin, leading to the reduction of bitcoin share in the market.

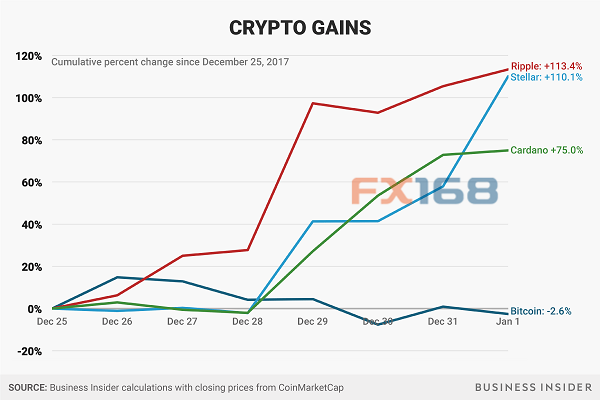

For example, in the past week, Stellar and Cardano, reboxetine currency rose more than 80%, at the same time, bitcoin fell 6% over the same period.

(Business Insider, FX168 financial network)

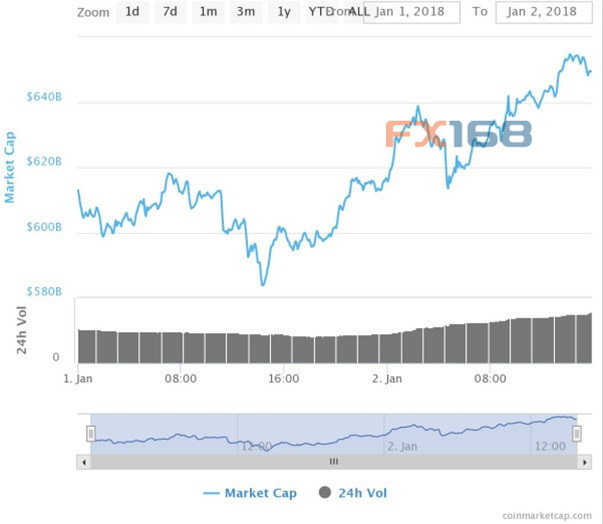

The striking thing is that when the bitcoin fell, the whole market would be hit. However, despite recent setbacks in bitcoin, the total market value of encrypted currency has soared to more than $665 billion, a record high.

(encrypted currency total market value innovation high picture source: picture source: CoinMarketcap.com, FX168 finance and Economics Network)

Some bitcoin put estimates, bitcoin "dominance" will eventually be Ethernet or other digital currency, reboxetine currency currency beyond.

In fact, in the previous round of encryption currency selloff, only reboxetine currency has remained strong. Reboxetine currency the current market value of about $94 billion, is the world's second largest market capitalization of encryption currency. Rui Bo (Ripple) is the name of a San Francisco based start-up company, which uses block chain technology to develop payment networks for banks, digital asset exchanges and other financial institutions. Participants in the network using a method called digital currency reboxetine currency transactions.

Experts believe that the position of the future bitcoin will continue to decline, and the movement of funds in different kinds of encrypted currencies is also a "healthy" performance of the whole market.

Ryan Taylor, chief executive of Dashi, said that as more encrypted currencies entered the market, the market share of bitcoin will continue to decline, "this trend is inevitable."

The sound of warning is all over the ear

In the past year, despite the boom in bitcoin, the criticism and the empty voice in the process have been heard all the time, many of which are Wall Street's "super big guys". Some people think bitcoin is a "deception", and some people think the value of bitcoin will be zero.

J.P. Morgan Chase & Co. (J.P.) Chief Executive Officer (CEO) Jamie Dimon publicly criticized bitcoin as a fraud in an interview last year. Dimon compares the rapid appreciation of bitcoin to the tulip bubble in seventeenth Century.

The tulip bulbs in short supply, soaring prices, but the bubble ended up with a feather, millions of people go bankrupt. Dimon said, "the bitcoin will eventually be disillusioned. It's a scam. It is worse than the tulip bubble, impossible to acquire a peaceful end."

UBS (UBS) said that investors should resist the temptation to buy or sell short bitcoin, because this year the crazy rally of encryption currency has become the "biggest speculative bubble" in history, is also based on a typical example of fear of missing out "for investment. UBS had previously referred to bitcoin as a "speculative bubble". The bank analyst Paul Donovan compares the rise of encrypted currency to the "tulip frenzy" of Holland in seventeenth Century.

Donovan points out that retail investors' interest in investing in encrypted currencies continues to rise and may eventually lead to devastating consequences. He said, "I never like bubbles, because bubbles will absorb most people's money and transfer them to a small number of people. In the long run, they will be very destructive. And, I think it's just one of the problems we have. "

Kuroda Higashihiko, the governor of the Bank of Japan, said that the operation of bitcoin is not like a normal means of payment and is being used for speculation. Kuroda Higashihiko said: "if the question is whether the operation of bitcoin is like currency, as a form of payment or settlement, I don't think bitcoin is used for investment or speculative trading now." When asked whether the bitcoin is a bubble, Kuroda Higashihiko said, "this is not what I should decide, but if we illustrate with charts, bitcoin does show abnormal gains."

Morgan Stanley (Morgan Stanley) analyst James Faucette and his team, in a recent research report, said the real value of bitcoin may be zero. Faucette argues that it is difficult to compare currency valuations because it is not like money or gold. He put forward in the report

Several questions, and give their own answers. Can 1. bitcoins be valued like money? No, no. There is no interest in bitcoin. Are 2. bitcoins like digital gold? Maybe it is. But bitcoin has no internal use and can not be used as gold, and can be used in industry and jewelry. Is 3. bitcoin a payment network? Yes, but it is difficult to form a scale and do not charge a transaction fee.

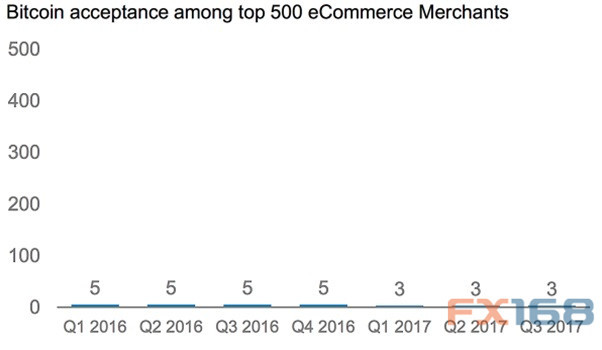

Faucette uses the following chart to support its view, which is the number of online retailers that have accepted bitcoin in the top 500 of the global ecommerce. The following chart shows that almost no online retailer accepts bitcoin, and the degree of acceptance is shrinking. "If nobody accepts this way of payment, the real value of it should be zero," Faucette said.

(Morgan Stanley, FX168 financial network)

Warren Buffett's gold partner - Berkshire Hathaway Inc vice president Charlie Munger (Charlie Munger) for the first time recently talked about his views on encryption currency. In view of bitcoin Munger, speculation is out and out "crazy thing", people should avoid it like the plague

Open bitcoin. "I think, even stop to think bitcoin is very foolish," said a Munger last November 30th at the Ross school at University of Michigan, held on bitcoin is crazy bubble, a bad idea, they used to attract others concept without much insight or work on it easy to get rich."

Regarding the prospect of bitcoin, Gartman, the "king of commodities", made his expectation on Tuesday. He pointed out that the bitcoin bubble will eventually burst, and the importance of block chain will also increase rapidly. Dennis (Gartman) He said: "in fact, if one or more of the central bank to create their own encryption currency, we will not be surprised, like the Bank of England in the UK back in Europe still in an effort to keep the London central position in the European capital markets, we won't surprise."

Billionaire investor Buffett said he was not interested in special currency. Buffett did not hold any bitcoins. "You can't compare special currency, because it's not a value - producing asset," he said. As early as 2014, when the value of bitcoin was far below the current level, Buffett once said: "far away from bitcoin, it is essentially a mirage. In my opinion, the idea that it has a great intrinsic value is a joke. "

The famous investor Jim Cramer mercilessly into bitcoin called gambling, and suggested that people should go to Las Vegas. "What is the difference between bitcoin and trying to know the super bowl?" he said. I mean it's just like gambling. "

Will the bitcoin crash be one of the biggest risks in the 2018 market?

As one of the most hot assets, Wall Street is also concerned about the fate of bitcoin in 2018. Some agencies even believe that bitcoin will collapse in 2018.

In 2017, Saxo Bank, the Danish bank, routindly unveiled some "bizarre" prospects, including bitcoin. The ten big "impossible" forecasts, given by the bank, will greatly subvert the existing market pattern, which is not a formal prediction of the agency.

Saxo Bank said in 2018, bitcoin prices will continue to rise, and peaked at $60000, the December 2017 launch of bitcoin futures leads to more investors in. However, Russia and other countries will act quickly to crack down on encrypted currencies and marginalization of bitcoin. This will trigger the price collapse of bitcoin and cause its basic "production cost" to fall to $1000.

Looking forward to the trend in 2018, Nick Colas, co - founder of DataTrek Research, believes that more volatility will occur in bitcoin. "The price of bitcoin could rise to $22 thousand in 2018, or fall to $6500," Colas said in the report. We expect two prices to be realized in 2018. " Colas has been paying attention to the bitcoin for at least 4 years.

Deutsche Bank (Deutsche Bank) in a report issued before the 2018, lists the major risks facing the market, including bitcoin prices plummet.(the major sources of risk facing the market in 2018: Deutsche Bank, FX168 finance and Economics Network)

In addition, MarketWatch, a well-known overseas financial website, conducted an investigation at the end of last year to sum up the list of risk events that investors should guard against. The MarketWatch survey showed that the "bitcoin crash" was the highest in its Twitter survey.