today btc altcoin price

BTC

$ 6,476

ETH

$ 496

LTC

$ 95

XRP

$ 0.54

EOS

$ 10

17 HOURS AGO

By Darryn Pollock

What is Going On With the Crypto Markets, Experts Share Opinions

What is Going On With the Crypto Markets, Experts Share OpinionsNEWS

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

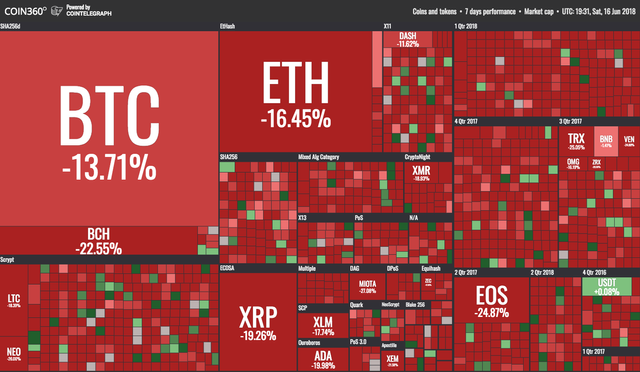

This week has not been too bright for the price of Bitcoin and other major cryptocurrencies, as the markets turned red. The price of Bitcoin started falling from around $7,600 to a low of just over $6,500 at press time.

Although this fall is not as dramatic as some others in the history of the volatile cryptocurrency, the general sentiment around the market has been negative for most of 2018. Still, Bitcoin is a volatile asset with its ups and downs still coming.

From the most recent slump that began on June 10, to a reprieve at the announcement that the SEC won’t consider Ethereum a security, the markets continue to go down, as well as up.

It has led many investors and interested parties to question what is going on in the market, especially in comparison to the highs of December last year.

A few experts in the field of cryptocurrency, investing, and markets spoke to Cointelegraph to give their insight into the current market situation, and why it is dropping.

Naeem Aslam, Emin Gün Sirer, Tom Lee, Miguel Palencia, and Alistair Milne, all discuss their thoughts as to the market is falling.

Naeem Aslam’s concerns with security and regulation

On June 11, it was reported that a small cryptocurrency exchange in South Korea was hacked and many mainstream media outlets tied this catalyst as a reason for the sudden downturn in the market.

However, many commentators have refuted this cause-and-effect link and have sought other reasons for why the price is down. However, regardless of how much effect the hack directly had on the price in Bitcoin, Naeem Aslam, Chief Market Analyst at ThinkMarkets, discusses how this latest hack is another instance of negative press for the cryptocurrency space.

“Exchanges are not utilising the top-notch technology to protect consumers and hackers are taking full advantage of this issue. The question is, is there any limit to these hacks? After every few months, we are seeing the same pattern emerging. This is the result of loose regulatory control and regulators must step in to protect the consumers. Anyone who wants to do with anything with exchanges should be forced to adopt high-grade security and regular security upgrades.”

The effect of these hacks adds a far bigger element of risk to investing in cryptocurrencies, and for the new market of traditional investors, and this is a big turn off.

“Traditional investors would look for riskier assets when the bull market is in full throttle and investors run for the hills when bears are in town. However, smart investors use a slightly different approach. They move their funds from riskier assets to those where they can seek safety.”

“For instance, in a bull market, sectors such as financial, tech and energy are the most favorite sectors. When the market starts to fall off the cliff, portfolio managers and hedge funds start to favour sectors such as consumer staples. They seek stocks with better dividend yield because, even though the general trend in the market could be to the downside, they still get a better yield relative to the overall market.”

Emin Gün Sirer looks at a crack down on manipulation

One of the bigger news stories to come out this week, that has also been tied to the downturn of the market is that research indicates Tether and Bitfinex were at the center of price manipulation, which led to December’s high of nearly $20,000.

Emin Gün Sirer, associate professor at Cornell University, looks not only at this news, but also at the fact that there is a law enforcement crackdown coming on price manipulators as a reason as to why the market is down. He also explains how the cryptocurrency market has not decoupled yet, which only adds to a bigger sentiment of negativity.

“The cryptocurrency markets are in their early stages. We know this from the fact that the coins still have not decoupled — they all move in unison, regardless of the merits of one project over another. This indicates that systemic risks to the area dominate all other concerns,” he told Cointelegraph.

“The current downturn is motivated by one such perceived risk: the law enforcement action on exchanges and their effort to put a stop to price manipulation. This was a long time in the making, and cannot happen soon enough. I suspect that the law enforcement action will be modest in scope and will bring much needed clarity and positivity to markets.”

While this investigation into price manipulation may be having a negative effect on Bitcoin’s current price, it can only be viewed as positive. And for Gün Sirer, it cannot happen soon enough.

“The fact is that these technologies are poised to transform the way we do business. They should not need market manipulation to sustain their value. I'm looking forward to a decoupled world where markets are able to evaluate each coin on its own merits.”

Three reasons from Tom Lee, plus futures effects

Tom Lee, the co-founder and head of research at Fundstrat Global Advisors, who is renowned for his bullish predictions on the Bitcoin price, has given Cointelegraph three reasons why the Bitcoin market is diving, and also mentioned his feeling on futures markets.

“I think there are several factors why cryptos are falling. One, we had a parabolic move at the end of last year, so there is a period of consolidation and price adjustment that is taking place.”

“I also think bigger factors this year have been a lot of government actions that have been taken this year that have scared crypto investors, probably the most notable is the actions taken by the US regulators, like the SEC taking action against ICOs.”

“Lastly, the pace of institutional investor participation in this space has been taking longer than expected, and I think part of that has to do with the slowness of getting some of the onramps established.”

Lee also told Bloomberg that he feels that the expiration of Bitcoin futures contracts has a part to play in the most recent decline in Bitcoin price. He explains this further to Cointelegraph by saying that these volatile movements from futures will not persist indefinitely.

“Futures markets, in normal liquid markets where there is broad participation, don't have an effect on the underlie, the futures itself is adding liquidity, or attracting liquidity, because institutions can use it,” Lee explained.

“In crypto right now, the market has a supply/demand problem, because mining rewards, coupled with tax selling, and other factors have caused more supply versus demand for crypto. The futures markets have been subject to some potential manipulation. I don’t think it will be the case in a few years from now, but even though the futures markets at the moment are only a hundred-million or so contracts, it is enough to affect Bitcoin price.”

Miguel Palencia’s position on ‘whales’

For Miguel Palencia, chief information officer at Qtum, which currently ranked 20th in terms of market cap, this current low has a lot to do with the faux-decentralised nature of cryptocurrencies which are still expanding and distributing.

He talked to Cointelegraph of the effect that ‘whales’ are having on moving the price around, but also makes mention of how these types of players in a relatively small and new market are also helping the ecosystem stay alive.

“Bitcoin, like other assets and technologies, goes through cycles that affect its use, which is often correlated with the asset price. What we see here, is that the cycle was accelerated by situations which can be solved by fully decentralized operations. Eventually, when the blockchain ecosystem becomes fully decentralized and not controlled by big stakeholders and "whales," it will be bringing back trust into the markets and we can see the markets climbing again, on the other hand, these market movers and shakers, supported by true Bitcoin believers, will not let Bitcoin reach zero.”

It is a double-edged sword then, according to Palencia. Whales must surely have a part to play in the supposed market manipulation, but they are also a driving force in keeping the market afloat with their own investment.

Alistair Milne’s view on rapid slowdown

Alistair Milne, CIO of Altana Digital Currency Fund and founder of Cointrader, is examining the entire year’s performance and putting that December rally into perspective. The markets may well be down compared to the highs of $20,000, but $6,000 or $7,000 per BTC is still pretty good.

“It is a combination of a rapid slowdown in adoption, user-growth and profit-taking, as well as hedging,” Milne told Cointelegraph, explaining why he believes the market is where it is currently.

“Altcoins particularly became very over-valued and were overdue a correction. We are now searching for equilibrium again, where demand meets supply. From a macro point of view, it has never been better, so I feel comparisons to 2014/15 are misplaced.”

While many are hoping the bottom has been reached and the downturn is ending, Milne still thinks it is coming, but that it will provide a much more stable base to rebuild upon.

“I think after we eventually bottom, it will be a far more gradual comeback for the price likely accelerating in 2019.”

No need to panic

The sentiment around the markets may be negative and one for concern when it comes to everyday investors, but overall, the experts spoken to do not seem to be raising any cause for alarm.

Gün Sirer is calling for more regulation and policing to try and stamp out the perceived market manipulation, and Palencia raises a good point about the need for Whales at the moment, but in the future, true decentralization will be reached and Bitcoin will be stronger for it.

Milne is also looking ahead, not worried about a bottom still-to-be reached, as it would allow for Bitcoin to gradually come back stronger. Aslam also brings up an important aspect that needs to be sorted out, that of hacks and poor security which are affecting market confidence.

There is a lot that needs to be patched up in the cryptocurrency market, and when these things are sorted out, the price should follow in repairing itself to a more pleasant level.

Follow us on:

Your Email

#Bitcoin News

#Emin Gün Sirer

#Alistair Milne

#Markets

#Volatility

9 Comments

ad-238

JUN 15, 2018

By Stephen O'Neal

What Do We Know About the CFTC Price Manipulation Probe

21962

Total views

188

Total shares

What Do We Know About the CFTC Price Manipulation ProbeANALYSIS

On June 8, it was reported that the U.S. Commodity Futures Trading Commission (CFTC) demanded extensive trading data from several cryptocurrency exchanges in order to investigate whether there has been price manipulation in the crypto market.

Earlier, on May 24, Bloomberg reported that a criminal probe into Bitcoin (BTC) and Ethereum (ETH) price manipulation by crypto traders had been opened by the U.S. Department of Justice (DOJ) in conjunction with the Commodity Futures Trading Commission (CFTC). That information was indirectly confirmed in the recent Wall Street Journal report, although it was made clear that the DOJ was studying potential price manipulation in a separate case. In May, some mainstream players, including former Wall Street executive and billionaire investor Michael Novogratz, and Cameron of Winklevoss twins, president of the Gemini exchange, greeted the probe.

What provoked the CFTC investigation?

According to the Wall Street Journal, the probe followed the launch of BTC futures by CME Group, a major derivatives marketplace, in December 2017. CME generates its BTC futures prices based on data from four major crypto exchanges: Bitstamp, Coinbase, itBit and Kraken, where manipulative trading could potentially have altered the value of BTC futures.

After the settlement of the first contract in January, CME asked the four exchanges to provide trading data. However, several of the exchanges refused to cooperate, saying that the request was intrusive. The crypto exchanges only handed over their data once CME shortened the time window of its request from one day to a few hours, according to the Wall Street Journal’s sources. It was also reported that CME originally sought the information through a third-party — a London-based company that calculates the Bitcoin price to use for its futures contracts. The sources added that the crypto exchanges did not want to hand over data to the undisclosed British firm, which also runs its own trading platform.

CME is regulated by the CFTC, a federal agency dealing with futures and options markets in the U.S. The CFTC views Bitcoin as a commodity and is therefore subject to its direct supervision.

Thus, regulators from the CFTC were allegedly upset that CME does not have agreements which obligate crypto exchanges to share price data that is related to futures contracts. According to the Wall Street Journal’s sources, the quarrel between CME and the crypto exchanges led the CFTC to open an investigation.

Nevertheless, CME spokeswoman Laurie Bischel said that their London-based index provider has a disclosure agreement with all four exchanges:

“All participating exchanges are required to share information, including cooperation with inquiries and investigations.”

Kraken Chief Executive Jesse Powell told the Wall Street Journal that the “newly declared oversight” of how BTC prices form futures prices “has the spot exchanges [Eds: spot markets are non-futures exchanges] questioning the value and cost of their index participation,” while other exchanges declined to comment or didn’t respond at the time.

The Wall Street Journal article also mentions that the CFTC is coordinating their investigation with the U.S. Department of Justice (DOJ). As mentioned above, last month the DOJ opened a similar — but separate — investigation into BTC and ETH price manipulation.

But how can one manipulate BTC price?

The Wall Street Journal’s article mentions ‘spoofing’ as one of the examples of illegal trading schemes that are investigated by CFTC. The May report regarding the separate criminal probe launched by DOJ also listed ‘wash trading’ in a similar context.

Spoofing is a process when a trader (or a group of traders) creates an order for a substantial amount of BTC (or any coin, commodity, etc.) to form the illusion of exchange optimism or pessimism — depending on their goals — and then cancels it, i.e. when someone puts an order to sell 2000 BTC, it might cause some panic among traders, rushing them to sell their stock before the price drops, effectively dropping that price as a result. That’s what an entity named Spoofy would do on Bitfinex, according to a detailed blog on Hackernoon.

Similarly, an article in the Journal of Monetary Economics published by a group of academics in early January, suggests that the price of Bitcoin was artificially bloated in 2013 by a single player operating on the largest exchange at the time, Mt. Gox (which then infamously shut down) and trader Sylvain Ribes published a Medium post in March, arguing that about $3 billion of all crypto-assets’ volume is trumped up.

Wash trading, in turn, is when a trader simultaneously sells and buys the same amount of BTC, essentially trading with himself. First, an investor will place a sell order, then place a buy order to buy from himself, or vice versa. Both activities, spoofing and wash trading, are illegal in the mainstream financial world, but it is worth noting that crypto markets are largely unregulated.

In theory, there are more ways to manipulate the price of BTC: the FICC Markets Standards Board (FMSB), the UK industry body overseeing standards in fixed income, currency and commodity trading, lists about 24 of them besides spoofing and wash trading.

Market and community reaction

On June 10, the day after the Wall Street Journal report, crypto markets saw a sharp drop, as all of the top-100 cryptocurrencies by market capitalization were in the red over 24 hours, while total market capitalization was down by about $20 billion over the same period.

John McAfee, founder of McAfee Antivirus Software and crypto enthusiast who recently announced his bid to run for U.S. president in 2020 as a way to serve the crypto community, urged the community to not panic about the price drop:

“It is an overreaction to the news that Bitstamp, Coinbase, itBit and Kraken are being investigated for price manipulation. This will delay the bull market by no more than 30 days. Don't buy into the fear. Buy the coins.”

While the CFTC probe into four major exchanges is considered to be one of the reasons for the price drop, it might have also been related to the mainstream media reports regarding the security breach of South Korean crypto exchange Coinrail. However, this event is unlikely to have significantly impacted the price action on the markets, with Coinmarketcap data showing that Coinrail is the 99th largest crypto exchange, with a rather modest trading volume of about $2.5 million. The community’s reaction on Bloomberg, the Wall Street Journal, Reuters, the Guardian and others claiming that Coinrail’s hack had crashed markets seemed frustrated.

In late May, BTC fell as much as 4.3 percent to $7,267 shortly after Bloomberg broke news about the DOJ and CFTC investigation on May 24 that the media outlet posted as an update a few hours after the original publication, which also prompted some community members to accuse the publication of FUD.

Follow us on:

Your Email

#Bitcoin Regulation

#CFTC

#Bitcoin Exchanges

#USA

3 Comments

JUN 14, 2018

By Christina Georgacopoulos

Banks and Cryptocurrencies Global Evaluation: The Middle East

13895

Total views

268

Total shares

Banks and Cryptocurrencies Global Evaluation: The Middle EastANALYSIS

Arab markets were flooded with new investors in April after an Islamic scholar announced cryptocurrency is halal under Sharia law. The announcement settled contradicting statements issued by several other Islamic experts, but there are still conflicting interpretations of Sharia’s allowance of virtual currencies among Muslim leaders.

The mufti’s announcement opened crypto markets to potentially 1.6 billion new customers, but it is certain that Middle Eastern governments will play a central role in the development of the crypto industry in order to ensure individuals and institutions adhere to Sharia law.

Sharia law places strict guidelines on economic activity whereby value must be attributed to real, physical assets. The highly contested religious law that governs the Islamic finance sector also prohibits market speculation and collection of interest on loans.

Muslim entrepreneurs, investors, and governments are intent on being leaders in the competitive global marketplace. As many advocate to replace the U.S. dollar as the global reserve currency, Bitcoin and nationalized cryptocurrencies may finally offer Muslim countries economic stability and leeway in Western politics.

It’s an unlikely coincidence that the Islamic Council on Sharia Finance broadly legalized gold ownership for investments around the same time that OPEC and Middle Eastern countries began moving away from the U.S. PetroDollar system in 2016.

Iran, which no longer recognizes or uses the U.S. dollar, and Turkey both announced plans to release government issued digital currencies following the pre-sale of Venezuela’s national, oil-backed currency Petro, earlier this year.

In fact, President Nicolas Maduro of Venezuela called on all 14 OPEC nations to develop a platform for trading oil-backed cryptocurrencies. Just as Venezuela launched its own cryptocurrency to circumvent U.S. sanctions, other oil-producing countries have hinted at abandoning the PetroDollar system that has been operating in the Middle East for over 40 years — threatening the global supremacy of the U.S. dollar.

The following assessment of cryptocurrency regulation in the Middle East is a part of a larger series of pieces evaluating regulation of the flourishing global fintech industry. Part one of the series looks at activity in Asian hotspots like Japan, Hong Kong, Singapore, and Taiwan, and how governments are facilitating or hindering growth. Part two examines crypto regulation and the critical attitudes held by many European leaders. Part three analyzes the varying attitudes of Western leaders on the disruptive new technology, and how regulatory agencies in the Americas are preparing for mainstream adoption of cryptocurrency. Part four assess how African countries are embracing the economically- and politically-liberating force of cryptocurrency and Blockchain.

The list below is based on thorough news research, but should in no way be considered complete. If you have more detailed information on banks and the crypto relationship in your country, we encourage you to share it in the comment section.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, and you should conduct your own research when making a decision.

LEGEND

Saudi Arabia

Saudi Arabia, a key player in the U.S. PetroDollar system, has continuously sold off its foreign exchange reserves ever since the price of oil plummeted in 2014. Saudi regulators are taking a close look at cryptocurrencies, but have yet to propose regulations. Many say an outright ban is unlikely.

The Saudi Ministry of Communications and Information Technology announced the agency completed a three-day “Blockchain bootcamp” in May as part of its plan to create a “digital environment” to leverage the kingdom’s untapped Information and Communications Technology (ICT) potential. The ministry partnered with Blockchain technology company ConsenSys for the event, and focused on Ethereum smart contracts and building decentralized applications.

The Saudi Arabian Monetary Authority also partnered with Ripple in February and launched a

pilot program that will provide cross-border payment technology to banks in the kingdom. The program is the first of its kind to be coordinated by a central bank, and will be accompanied by a regulatory sandbox, program management and training.

Oman

The Omani Blockchain Symposium, held at the end of last year, was the country’s largest business gathering, with nearly every government cabinet member in attendance, as well as 700 attendees from the private sector.

The Central Bank of Oman, as well as the Central Monetary authority, promoted the successful event and indicated that the government will aid in providing the technological infrastructure to promote the implementation of blockchain technology in Oman.

The Blockchain Solutions and Services Company (BSS), a government entity and initiative of the Blockchain Symposium, is reportedly collaborating with the Oman Banks Association, other government agencies and local businesses to develop regulations for the country’s digital transformation.

BankDhofar is the country’s first bank to join BankChain, an international banking community dedicated to the research and development of blockchain solutions. The initiative is part of BankDhofar’s plans to digitize a range of banking services to ensure accuracy, efficiency, and security to customers.

Iran

In January 2017, the governor of Iran’s central bank announced the U.S. dollar would no longer be used in the country in response to President Trump’s temporary travel ban. The country’s first crypto exchange, BTXCapital, stated that Iran had the potential to become a major market in the future due to the exit of the American dollar — although purchasing Bitcoin in the country remained notably difficult at the time.

The Iranian government seemingly held positive views toward Bitcoin when the Iranian cyberspace authority — the High Council of Cyberspace — first announced plans last year to collaborate with the Central Bank of Iran to publish a report on cryptocurrencies. But the central bank has since issued a statement claiming it never recognized Bitcoin as a legal tender, and banned domestic banks and other financial institutions from dealing with cryptocurrencies in April.

However, the Iranian Information and Communications Technology minister stated the ban on cryptocurrencies does not preclude the central bank from developing a domestic cryptocurrency, and that an experimental model of a state-issued digital currency was ready.

The ban on cryptocurrencies preceded U.S. sanctions imposed on Iran in May, and is seen as an attempt to protect the country’s struggling financial institutions and depreciating national currency. Iran’s state-issued digital currency parallels Venezuela’s Petro, which is used to circumvent international sanctions.

Turkey

Turkish authorities have sent mixed signals to the cryptocurrency industry in the past, but are following the lead of other Middle Eastern countries with plans to release a national cryptocurrency.

The Turkish government took a harsh stance on Bitcoin last November, when lawmakers of the Directorate of Religious Affairs stated cryptocurrencies were “not compatible” with Islam because of the speculative nature of the market and lack of government control.

But in February, a report by the deputy chair of Turkey’s Nationalist Movement Party not only proposed regulations for the market, but also mentioned the possibility of a national Bitcoin, called the TurkCoin.

The Turkish Bitcoin exchange BTCTurk, which opened in 2013, terminated operations in 2016 after local banks abruptly discontinued services and closed accounts associated with the exchange. BTCTurk has since reopened, along with the Turkish exchange Paribu.com.

However, domestic exchanges are limited to Bitcoin and Ether, and customers are forced to use English exchanges to access altcoins. BTCTurk’s history is exemplary of the varying responses and divisions between financial institutions and the government's acceptance of Bitcoin. Although cryptocurrencies are far from mainstream adoption, a number of Turkish businesses and real estate companies accept Bitcoin as payment.

On a separate note, various blockchain projects in Turkey have garnered interest from individuals who wish to see cryptocurrency become more accessible. The Blockchain and Bitcoin Conference held in Istanbul in March gathered global leaders to discuss the development and legislative regulation of the sector.

Iraq

The Central Bank of Iraq prevents the use and promotion of Bitcoin, according to a statement by an economic expert last December. Furthermore, those found using Bitcoin may be prosecuted under pre-existing Anti-Money Laundering (AML) laws.

Russia’s Federal Security Service claims to have prevented 25 of 29 terrorist attacks coordinated from Syria and Iraq in 2017, and that “terrorists love cryptocurrency.” The Russian authorities allegedly discovered 100 cases where virtual money was used to financed illicit activities. However, less than 1% of Bitcoin-related transactions between 2013 and 2016 were discovered to be funding illegal activities, according to research by the Center on Sanctions and Illegal Finance (CSIF).

Afghanistan

Code to Inspire, a non-profit organization dedicated to advancing Afghan women’s economic and social standing in the country’s tech industry, is providing resources to women to learn how to code and design mobile apps and software. CIT’s mission will allow women to have a career in IT, participate in the global economy, and become financially independent by using Bitcoin.

However, the lack of domestic exchanges in Afghanistan marks a common issue with Bitcoin’s inability to reach remote, underdeveloped nations. The lack of technological infrastructure, local exchanges and stable wifi connections makes trading and using Bitcoin in Afghanistan difficult.

United Arab Emirates

The Prime Minister of the UAE and ruler of Dubai announced the launch of the UAE Blockchain Strategy 2021 in April, with ambitious plans to be the world’s first blockchain-powered government. The UAE plan will focus on citizen and resident happiness, government efficiency, legislation and global entrepreneurship.

The strategy aims to have 50% of federal transactions being conducted using blockchain technology by 2021, which includes moving to paperless documentation of visa applications, bill payments and license renewals with blockchain technology, which could potentially save $11 billion annually.

The most recent development of the Emirates’ blockchain strategy is Dubai’s partnership with IBM to create a blockchain business registry to ensure businesses operate under its jurisdiction. The government announced the initiative in May, and says it will streamline the process of business operations, digitized documentation of activity and assurance of regulatory compliance.

The technology arm of the government, Smart Dubai, is tasked with facilitating digital implementation in the city and conducts research to determine services that could benefit from blockchain technology. The government entity, which is involved in various initiatives, will propose necessary legislation to ensure Dubai’s “smart transformation,” and aid mega projects developing in the city.

The Dubai Land Department (DLD) launched a blockchain-powered system to record real estate contracts, secure financial transactions and connect tenants and landowners with property-related billers, such as electrical and telecommunications utilities. The government agency, which is tasked with overseeing real estate purchases and approving contracts, says the initiative is exemplary of the country’s blockchain strategy to consolidate government services on a single platform.

In contrast to the government’s embrace of blockchain, the legality of using Bitcoin is not clear because pre-existing regulations do not recognize virtual currencies. However, the government and central bank of the UAE announced earlier this year that regulatory framework for Bitcoin usability and exchanges is coming in the near future.

The central bank previously rejected proposals for licensing trading exchanges, and the UAE Securities and Commodities Authority voiced concern over the high risk of ICOs. But after the announcement of future regulations for the crypto industry, the government and central bank seem adamant on federal oversight to ensure cryptocurrency doesn’t move to underground markets.

Meanwhile, investors in Dubai and the UAE continue to buy, sell and trade cryptocurrencies, despite the lack of local exchanges.

The supposed first-ever Sharia-compliant cryptocurrency, Onegram, launched in Dubai in May 2017 and is backed by actual gold reserves. Because each unit of value is backed by physical gold, speculation and market volatility are tightly controlled.

Notably, a gold investment and trading firm in Dubai is the first company licensed to store virtual currency in the Middle East. The company established a “cold storage vault” for clients to store Bitcoin and Ethereum. The secure vault holds cryptocurrencies in a physical form and are detached from networks in order to address the concerns investors have over online wallet-hacking and malware.

A Dubai-based entrepreneur, Com Mirza, launched the Islam-friendly “Bitcoin of the Middle East,” or Habibi Coin in late 2017. The asset-backed and interest-free Habibi Coin is a monumental advancement for Muslims who previously had difficulty buying homes and investing in other assets. Com Mirza claims to be planning a $100 million USD ICO, and will allow investors to purchase property directly on the Habibi Coin platform.

Kuwait

Kuwait’s Ministry of Finance banned the central bank and financial institutions from trading and dealing with Bitcoin in late 2017, due to market volatility and consumer risk. Other legal authorities in Kuwait indicate that online trading is prohibited by the country’s e-commerce laws, and Kuwaiti law does not recognize Bitcoin as a currency.

Qatar

The central bank of Qatar issued a warning to banks in the country in February, urging others to deny accounts to crypto exchanges and traders, and that failure to comply with the request may result in legal recourse under pre-existing law.

Syria

Cryptocurrency is providing relief to the humanitarian crisis in Syria, where the United Nations World Food Program is using the Ethereum Blockchain to transfer vouchers to refugees. The successful project sent funds to buy food to 10,000 refugees and the U.N. plans to extend the program to 100,000 people in Jordan as well.

#Bitcoin News

#Banks

#Cryptocurrencies

#Saudi Arabia

#Iran

#Turkey

#UAE

#Qatar

#Sy

am zoboq i vote you, vote me back goodfriend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit