The 'stock to flow' multiple for August clocked in at 1.71, which means that at the end of August the price of bitcoin was 1.71 times its theoretical value. End of July it was at 1.80. So, price is still a bit on the high side although not worryingly so. Especially since we have to remember that the theoretical bitcoin price will be at $55k in May 2020 after the halving.

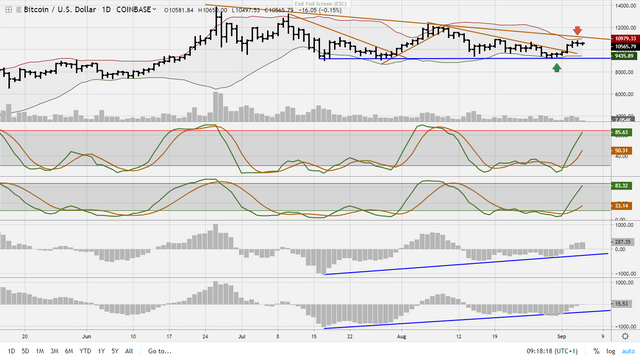

Elliott wave wise we're still correcting. So far, wave 2 proceeds rather disciplined and in an ideal world we should be falling soon towards $7.5k - $8k in order to complete wave c, wave Y and wave 2. However, that's not always the case. What is always the case is that the down sloping brown resistance line controls the correction and a breakout ends it. Breakouts can be fierce though. I have bought a March 2020 call 16k at $9500 for 0.1 BTC and hedged it with an October 2019 put 10k bought around 10.8k for 0.08 BTC. For now, I'm pretty happy with that position.

Indicators

Weekly has some more room to the downside

Daily has some more room to the upside, MACD's are diverging in this triangle which is normal

8 hour looks meaningless to me.

The Renko chart laid another brick down on August 28. Not that the overall picture changed because of that.

Conclusion: boring wave 2 moves along nicely for more than 2 months now, actually in quite a disciplined manner. This is the time when you build or increase your position because when we break prices will move very fast. With a bit of luck we're going to go lower first, so we can buy more bitcoin at lower prices. Medium and long term: to the moon!