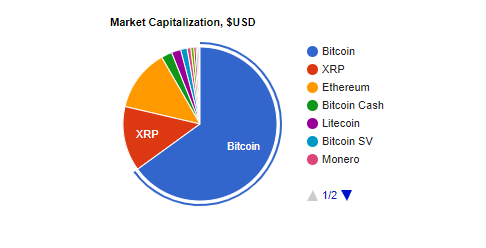

It started when I had a look at coinmarketcap.com. Now I go there all the time. So, I had seen the data many times before. But it never dawned on me. That is the difference in marketcap. BTC has a market capitalization of 65 billion USD. Second and third places are for XRP and ETH, which have both around 13 billion. That is a factor 5 difference; which is huge. Number 4, at the moment, is bitcoin cash (just before EOS) with 2.2 billion; which is even more than a factor 5 less than XRP and ETH. From there market capitalizations start moving down gradually, sinking below 1 billion starting with IOTA currently at place 12.

The picture is clear: bitcoin is everything (65%), ethereum (13%) and ripple (13.5%) are interesting, the rest is for now almost irrelevant. True, bitcoin used to have a much larger market cap relative to the altcoins but that was very much in the beginning when there weren't that many altcoins. It is also true that there are very interesting projects going on, and we all have our favorites. However, many of these projects are experimental, have nothing or not much to show for in terms of a real world working product. All of them are small and some are nonetheless scaringly ambitious: building no less than a new Internet on the blockchain (nexus is going to do that even in satellites orbating space I think), building a giant worldwide supercomputer (Golem), replacing both Google Play store and the Apple store (Lisk), all music and media on the blockchain, real estate on the blockchain, your identity, all identities, just decentralize everything on the blockchain. I mean, even a megalomanic James Bond villain would be terrified by the scale of these undertakings.

Clearly, many are going to fail. Also, for a time there was a reason for bitcoin competitors to pop up as BTC was too slow, too expensive and not willing to scale. However, with the implementation of the Lightning Network these issues are being addressed and possibly to a large extent solved. What is the reason for being for all these bitcoin clones? Some, like litecoin, can stay as a backup should the bitcoin lights go out one day. But why bitcoin gold, bitcoin diamond, bitcoin private, bitcoin cash, bitcoin satoshi version, and these are among the bigger ones. They are all going to go away. Once more privacy has been added to bitcoin, where is the need for privacy coins? They will become even more esoteric than they are now. Why Proof of Stake coins or delegated PoS if bitcoin is quick and cheap enough.

Ethereum is a different animal as it is a platform first and money second. Bitcoin, to the contrary, is money first and all else is second. Ethereum is therefore not in competition with bitcoin. Ethereum is in competition with a series of other platform coins and we'll have to wait and see which ones are going to survive.

Also, let's not forget that it's still very early days. I mean, if you make a comparison with the Internet revolution, many of the larger players came into being after 2002 when the Internet bubble had already popped. Facebook, Google, Netflix and Twitter come to mind. This might very well occur in crypto too. In addition, imagine what will happen when very large companies start allocating serious resources to blockchain development. What will then remain of your little altcoin, painfully trying to create a niche for itself.

Personally I have a weak spot for DAG coins as they provide immediate transactions, virtually for free, with no centralized mining as each node mines itself. Unfortunately, I've learned that they are not decentralized (there is a central authority checking the status of the nodes and the correctness of the history as transactions are not stored centralized as with bitcoin but are distributed). There are some spin-offs of the DAG principle being built with Hashgraph and Radix and they are certainly very interesting, but they're still being built. We'll have to wait and see what will be created.

If the Lightning Network proves to work well, then the issues remaining for bitcoin are first of all the centralization of the miners. The level of efficiency that is required nowadays in order to mine profitably leaves only a dozen or two, very large mining companies to do the job and yes, this is a risk as they are going to meet & greet, have diner together, form an alliance and start making deals together because they have obtained way too much power.

Another problem with bitcoin I can see is that at some point the mining rewards will be so low that mining will only make sense when bitcoin is worth millions of dollars. These prices we'll need to see then. We all know that the mining difficulty adjusts to the network's hashrate, but if bitcoin stays popular, the mining will be done professionally, and only professionally, at an optimum hashrate given the cost of energy used for the latest mining equipment. Bitcoin prices will need to stay in tune with the mining rewards for the ecosystem to work well. In the sense that large whipsaws in price or network hashrate are detrimental to the stability of bitcoin.

But more importantly, once the creation of bitcoins stops in 2140, miners are expected to live of the transaction costs only. Unless they can process an enormous amount of transactions, the cost per transaction will have to increase, seriously obstructing bitcoin's usefulness. So, bitcoin is not perfect. Improvements are still needed. But for the moment, these are all longer term issues. There is time.

To summarize: bitcoin is still the only crypto coin that matters vis à vis all the others with the exception of the platform coins who will go into battle with each other shortly. There are of course many interesting projects going on, but they will first need to establish themselves better in order to be considered as a durable investment. In time, bitcoin itself will probably need to be replaced by another coin because of centralized mining and the disappearance of block rewards towards 2140.

I have decided to exchange all my altcoins for bitcoin during the coming bull market.

Interesting viewpoint, whilst many of your points make sense and are very valid I think about it a little differently.

Competition is good, some people like going against the grain just for the sake of it, people like supporting the underdog, like different names, different people getting behind other projects etc etc so many reasons others will still do very well. of course I agree, many will fail and disappear but that's the same in any market.

Think this way, why does burger king exist McDonalds is successful, offers the same thing and tastes very similar, Coke with Pepsi, Adidas with Nike and it goes on and on.

I realize technology is a bit different from a burger but you get my point, people don't buy on logic they use emotion, logically we only need one Cryptocurrency, Bitcoin can do what we need - we need nothing else but that's logic. Look around, we certainly don't live in a world based only on logic.

For that reason I look forward to seeing some Alts go absolutely crazy again! ;) Of course I also look forward to a 50k BTC, one day :p

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh I completely agree, competition is essential. We need competition to keep a check on the developers to ensure they're not going to get any funny ideas; and while bitcoin may have been the genesis of the crypto revolution, I don't think it's going to be the endpoint. But the main point I'm trying to make is that there is not much competition, that is except ethereum and ripple the competition is mostly irrelevant due to its small size. Projects come and go. Dash was very popular for a while, the PoS coins were, also the privacy coins, but the king remains firmly in control in this game of coins.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit