DEFINITION of 'Initial Coin Offering (ICO)'

An unregulated means by which funds are raised for a new cryptocurrency venture. An Initial Coin Offering (ICO) is used by startups to bypass the rigorous and regulated capital-raising process required by venture capitalists or banks. In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, but usually for Bitcoin.

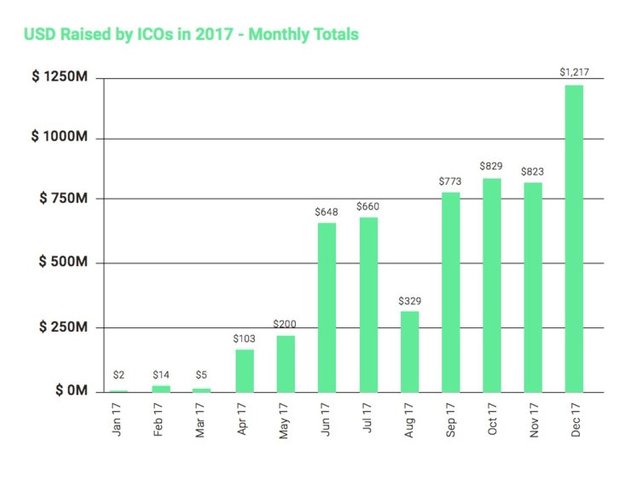

Crypto ICO's Generated $5.6 Billion Through 2017

Although a lot of money was raised, many people were scammed allowing the founders to run off with millions.

1. Poorly Written Whitepaper

This should be the first thing you check prior to making any assumptions about the coin. A whitepaper should be well written and the project should make sense from Start to Finish. It's estimated a proper whitepaper costs between $5-10k. If you see spelling/grammatical errors and you aren't getting the "wow" factor something might be fishy. Although some Scam ICO's pay for a well written white paper this doesn't mean they passed the test. We still have five other steps to get through.

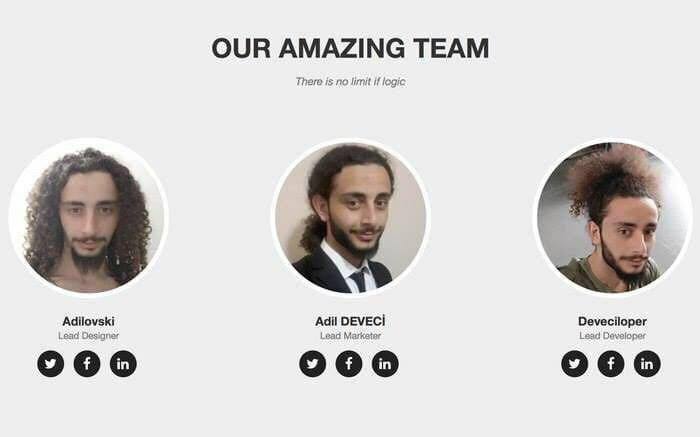

2. Team Lacks Experience

Now a proper ICO should list a majority of their team so they gain some credibility based on past experiences. Although you can use Google, LinkedIn, etc. to find out about these people sometimes little things slip through the cracks like the team below.

It's safe to assume this team doesn't consist of triplets and they're trying to pull your leg. In other news, if the Team seemed to check out its time to move onto Step #3.

3. Roadmap Doesn't Make Sense

Although a roadmap can easily be faked its just another tool for us to understand the intentions and direction of the ICO. This roadmap tends to matter later on after the ICO to keep the team accountable but none the less its something that shows thought. Unless were talking about a very well educated scammer chances are they might have missed this step allowing us a chance to walk away. BUTTTTTT if a roadmap has been provided its time to move onto Step #4.

4. Telegram Chatroom

A well developed community its another tool we add into the checklist to help protect our potential investment. Although these chat groups have been overrun with scammers trying to get your ETH, it's easy enough to judge the group. Do you see people posting? Do the moderators interact with the community? Are spammers being removed? Hopefully you said yes to all of these questions and decide its time to move onto Step #5.

5. Github

Although this step might be a bit more "advanced" its the final straw before making a rational decision. The ICO should have some type of published code to validate its validity.

If you read all the way through this congrats.

At the end of the day theres only one person who can decide whether to make a buy, it's you. Although these guidelines aren't fool proof its enough reasoning to realize theres many layers to ANY new coin. If you learned anything from this, I hope you realize theres a lot of research that should go into any purchase.

Shout-out to the Crypto Coin Trader Facebook Page

UV and RS for you Zach, great assessment :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit