Content adapted from this Zerohedge.com article : Source

A few days ago we first showed a chart of a dramatic divergence between the price of gold and bitcoin...

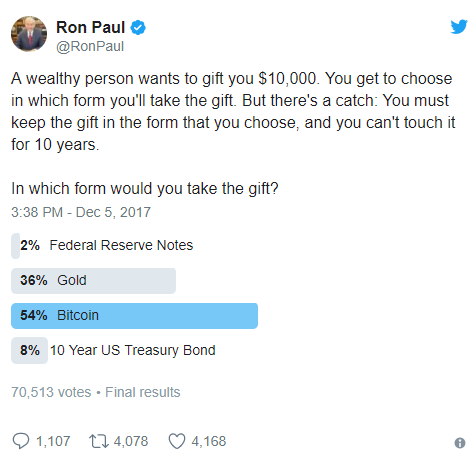

... which together with a recent unscientific poll showing that more Ron Paul followers prefer bitcoin to gold...

A wealthy person wants to gift you $10,000. You get to choose in which form you'll take the gift. But there's a catch: You must keep the gift in the form that you choose, and you can't touch it for 10 years.

In which form would you take the gift?

— Ron Paul (@RonPaul) December 5, 2017

...prompted many to wonder if bitcoin - whether it is a commodity, currency, commodity-equity hybrid as some suggest, or simply a bubble as its opponents claim daily - was stealing demand for gold.

In an overnight note, Goldman's global head of commodities Jeffrey Currie answered this question, arguing that despite bitcoin's "explosive upward trajectory" the answer to whether "bitcoin is taking demand from gold" is no, and gives three reasons why there is a lack of substitution by investors from gold into bitcoin:

First, the investor pools are vastly different. Gold investors who use ETFs, futures or commodity indices are automatically covered by anti-money laundering (AML) and counter-terrorist financing (CTF) regulations which are already "baked in" to processes in these markets. Even physical trading in jewellery, bars, coins etc. has seen a huge increase in regulatory scrutiny, globally, over the last few decades. In the US, professional jewellers and dealers must have an AML program implemented, and significant cash purchases or precious metal sales require additional reporting to the IRS on a transaction by transaction basis. In contrast, there is still very little clarity on how trading in cryptocurrencies could be made to comply with AML and CTF regulations, even in theory. This creates huge regulatory hurdles for professional investors wishing to enter these markets.

Second, as the chart below shows, there has been no discernible outflow of gold from ETFs. Indeed, total known gold ETF holdings recently reached their highest level since mid-2013 (currently up 12% YTD, see Exhibit 8). This is somewhat related to the first point, as mutual funds are the largest holders of gold ETFs, but even accounting for this there is no evidence of a mass exodus from gold.

- Third, and final, the market characteristics of gold and cryptocurrencies are vastly different Currie claims. In this context, th emarket cap of bitcoin is still just under $300 billion, while the total value of gold is a little over $8 trillion. And while bitcoin has a mathematically certain total supply, and gold has a finite (but less certain) supply in the earth's crust, even a cursory examination shows very different market dynamics according to Currie. As a result, Goldman believes that the composition of demand between bitcoin and gold is the key difference in the recent price action, and specifically, bitcoin is attracting more speculative inflows relative to gold.

Putting all this together, Currie concludes that bitcoin has demonstrated much higher volatility and lower liquidity / price discovery compared to gold.

"The market cap of bitcoin is c.$275 billion versus gold at $8.3 trillion. Even all of the cryptocurrencies combined have a market cap less than $500 billion. While the lack of liquidity and increased volatility may keep bitcoin interesting, it is unlikely to convince investors looking for the kind of diversification and hedging benefits which gold has proven to possess over its long history."

Unless it is successful, of course, in which case there is a little under 20x upside for the crypto sector.

Currie does make a good point in his conclusion: "to deal with the AML and CTF uncertainties surrounding bitcoin, and attract a wider investor pool, custody issues must first be resolved beginning with identifying it as a commodity, fund or security." Here Goldman "firmly believes" that bitcoin is commodity, "as bitcoin has no liability that all securities have by definition. Even a dollar bill is ultimately a liability to the US government."

Which is also why demand for bitcoin is so exponentially greater than demand for a dollar bill.

Bitcoin has a mathematically sure general provide, and gold has a finite however much less sure provide within the earth’s crust. Old buyers are quite safe through anti-money laundering and counter-terrorist financing laws but it surely’s nonetheless unclear how cryptocurrencies may agree to those laws.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Everything is in demand and demand, gold has its own safe investors, Bitcoin has the magnetic power to attract new investors because of its rapid growth.

Since gold has a lot of legal and stock regulating in the trade, it's harder to work with it. Bitcoin is easy to trade, making investment investors easier to decide. Otherwise, the solution is to buy gold with Bitcoin :)

Good morning @zerOhedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Playing the devil's advocate here, while I'm certain blockchain is the future,I can't day for sure bitcoin will survive another 10 years given there are far superior tokens with better transfer time and lower transaction costs that could slowly replace it. Physical gold is a time tested entity though.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The dollar is more time tested than Bitcoin yet that is going to get destroyed by cryptocurrencies.

When talking about technology, time means nothing.

We are rapidly moving towards a digital world where value is digitized. People believing that gold will be a store of value, a physical asset, are going to see how misplaced that idea really is.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't disagree completely but why bitcoin specifically ? In the case of disruptive technologies it's always not the early movers who sustain over the long run. Look at the top internet websites today. Google wasn't even around when Netscape and AOL ruled the space.

If a faster better coin gets mas adoption, the digital gold we speak about in 10 years could be something completely different in the cryptocurrency space and not bitcoin itself although right not it has a tremendous first mover advantage

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin will not have the most apps, will not have the most developers, will not have the most traffic.

However it will have the market cap simply because Wall Street deems it so. It has the liquidity and the ROI which is what Wall Street looks for. Sure, you wont be buying a cup of coffee with bitcoin but you might pay your overseas supplier $50K with bitcoin. For transactions like that, it is ideal.

By the time people go about looking for a new "gold" bitcoin will be so entrenched that there will be no point...

Just like gold today, we dont look for another metal to replace it...we just accept it.

Bitcoin will end up doing the stodgy stuff like storing of government records, handling educational materials, etc.... It might still handle the larger transactions but it will never be fast enough to be the everyday currency. But it will have plenty of money invested in it which will keep it propped up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Point taken. Perfectly rational to say by the time people go about looking for a new "gold" bitcoin will be so entrenched that there will be no point, the only exception I see to this case being something that's already well established in the space with a similar use case of bitcoin takes gets adopted by Wall Street - litecoin, for example, which is in the top 5 in marketcap , widely accepted among every other exchange and wallet provider.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Also deeply agree with you @taskmaster4450. Gold will become just another rear commodity among another ones, But digitized value in the form of crypto assets will revolutionize the global economy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At this point, I dont think Bitcoin took anything from the gold market. But that wont be the case in a few years. Gold people are ideologues who firmly believe in the asset despite it under performing.

Gold is still down 33% from its high and that was years ago. People like Schiff have called for $5K gold for 7 years now. How is that working out?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article

Talk about bitcoin gold.!

Real good.!bitcoin is nombwr one to market...but i cant to do

Follow me plzzzz

@medica

Millions thankszzzz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i watch this chart . good sharing @zer0hedge . i like it . now resteemed this post dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The comparison between BTC and gold always arises but BTC has a long way to go before it equals the total value of gold. It will also have to work on the volatility before people leave gold, which has a practical purpose, manufacturing uses, an actual industry to switch teams for BTC.

DAILY DETAILED MARKET ANALYSIS, GIVE IT A READ, MAKE SOME MONEY OR SAVE SOME...

https://steemit.com/bitcoin/@pawsdog/12-12-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/12-9-2017-the-market-view-and-trading-outlook

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your Cryptocurrency news @zer0hedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your update news about cryptocurrency is always informative .keep posting like this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit