Content adapted from this Zerohedge.com article : Source

As technology stocks and securitized mortgages have demonstrated all too recently, just because a bubble pops doesn't mean it's the end of the market. Hell, it doesn't even necessarily preclude that another bubble won't emerge years later.

Wall Street analysts trying to figure out if JP Morgan CEO Jamie Dimon and Bridgewater Associates' Ray Dalio are right about bitcoin - i.e. that digital currencies are frauds doomed to fail - should consider this phenomenon as they try to game out different scenarios for the future of the digital-currency market, said Ethereum co-founder Joe Lubin.

When asked by Quartz about his thoughts on whether digital currencies are in a bubble, Lubin responded with an unequivocal yes.

"Of course it's a bubble. Hopefully it's one in a series of increasingly larger bubbles," Lubin said. "These bubbles bring attention, they bring value into the ecosystem. That value is recognized by software developers and business developers, and they create fundamental value and projects that grow the new architecture."

The popularity of Ethereum's platform, which is widely celebrated for pioneering the development of smart contracts, has helped grow the digital currency's valuation and market capitalization. It has also helped attract a legion of volunteer developers who help maintain and update Ethereum's code, helping to make Ethereum the de facto industry standard for ICOs, many of which are built atop Ethereum's platform.

Lubin says that a Gartner analyst recently pegged Ethereum's developer base at 30 times larger than the IBM-backed Hyperledger project, a competitor in the blockchain space that enjoys all the benefits of having the support of a legacy computing company that has already won the trust of business.

Turning the conversation toward the volatility in digital currencies, Lubin said it will continue to subside as bitcoin becomes more widely used.

Speaking to the volatility of cryptocurrencies, Lubin says that it's just a matter of fewer people using them compared to traditional currency systems, and that it's an addressable problem.

"As they get a larger and larger monetary base, I think the volatility will decrease significantly. There are many state-issued currencies on this planet that are as volatile or more volatile than bitcoin or ether," he said.

As Quartz points out, analysts from Credit-Suisse have found that bitcoin is 11 times more volatile than the post-Brexit exchange rate between the British pound and US dollar, and three times more volatile than the price of oil.

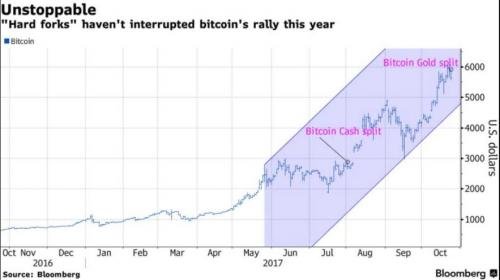

Of course, this hasn't prevented bitcoin from rocketing to a fresh all-time high above $6,000 a coin earlier this week. Even a third hard-fork of the bitcoin blockchain has had only a marginally negative impact on the price.

Ethereum hasn't reclaimed an all-time high reached early in the summer, but has managed to hold on to most of its year-to-date gains.

Blockchain/Cryptos will take over the entire financial system. I have been in this space and watch it evolve for 5 years now. This is going to be big! We are talking 1000's of blockchains and millions of tokens in the future interlooping together forming this giant web of trust. To imagine how big this is going to be just think about concept of trust. There's too many use cases to even begin listing on this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The crypto hype train was always going to cause bubbles, but as we've seen in very recent times, they are now too large to crumble as some naysayers spout. Sure, we may hit some lows but the long term future is looking very bright.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just imagine if all of us that are awake were to listen to the robber barons of Goldman Sachs...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ethereum and smart contracts, a platform that fuels the future. This is a big balloon, I believe that the value of bitcoins and other strong cryptowalts will grow for a long time.

On the one hand, the development of technologies and, in particular, the blockchain technology provides more speed for more data, but on the other hand this is a game that looks like rich bankers, want to exchange money with bitcoin and other currencies.As you stated in a post, behind the corner is a storm, a total control of human lives, I wish it would not be that - this balloon flies in the other direction. Thanks for the excellent post and education @zer0hedge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is hard to be a true bubble when the bubble makers, Wall Street, arent in the game yet. Have no fear, cryptocurrencies, especially Bitcoin will end up in a huge bubble, they will guarantee it.

As for ETH, the challenge with that one is there is no set limit to the number of tokens. It can be expanded. To me, even though I hold some ETH, it is a drawback.

Overall, the entire crypto market is going to explode over the next few years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Money tend toward natural monopolies, I don't think there will ever be a crypto other than bitcoin that will be used as the base unit for pricing all other alts.

BTW I posted this yesterday but thankts to steemit it never went through.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem. I understand how steemit is of late. I have upvoted a ton of people only to have it not go through. Been using busy.org for my commenting and upvoting...it seems to work better.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Of course it is. I feel that most of the original cryptocurrency adopters know that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit