The latest crash in cryptocurrency markets has been well documented. In 2017, bitcoin prices grew by over 1700% to reach an all-time high above $19,000 in December. Soon after that, things turned south as the prices collapsed to $13,000 in January and have since struggled, hitting the latest low of $5,700 in June.

Reports from Mainstream media tells a tale of epic woe as they chronicle the loss incurred by people who invested at the height of BTC prices. But for older cryptocurrency followers, this gloomy tale wouldn’t be the first of its kind; it might actually not be the worst.

Two Similar Scenarios

In 2013, bitcoin prices climbed constantly and reached a high (the ATH) of $1,236 by early December. What followed that spike was a downward trend that spanned more than a year. By the turn of June 2015, BTC was trading at $225.

Similarly, in 2017 bitcoin was on a historic bull ride and reach an ATH just below $20,000. BTC have lost a large part of those gains, now trading just below the $6,000 mark.

Lesser Percentage

A report on bitcoin.com which looked at the percentages shows that the loss in following the crash in 2014 exceeds this current dip.

Those who bought BTC at 2013’s ATH of $1,236 would have suffered losses of 82 percent when the bear run ended in June 2015 (at $225). In contrast, those who bought at 2017’s ATH will have a loss of around 69% but that tells only half the story.

Not Many Bought At Its Peak Price

2013 bear ride happened very quickly compared to 2017; BTC prices soared to the peak in few months. Because prices surged in 2017 slower than it did in 2013, more people bought BTC lower than at the ATH. Investors who bought BTC before mid-October 2015 would still be making a profit while those who bought after then would currently be suffering a loss between 1% and about 65%. The positive point is that not many falls in later part of this range.

Furthermore, bitcoin didn’t last long at its ATH in 2017, trading above $19,000 for less than three days. After less than a week, prices had spiraled down to $13,900 got boosted to $17k before the freefall.

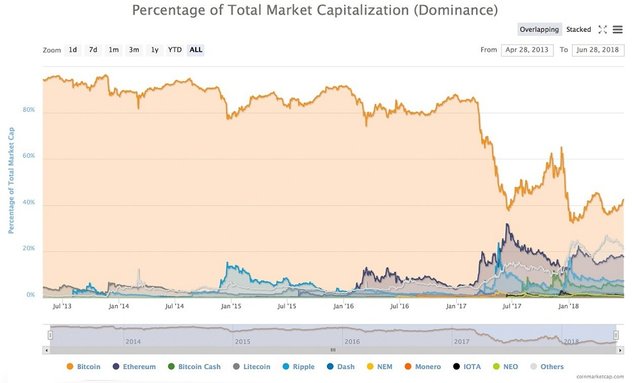

BTC wasn’t as Dominant in 2017 as in 2013

Back in 2013, bitcoin was by far the dominant cryptocurrency accounting for 90% of cryptocurrency volumes but by 2017 when prices peaked, bitcoin has just over 50% dominance. By this time, the cryptocurrency space ware more diversified with over 1600 cryptocurrencies competing for market share.

The loss in value of bitcoin value directly affected a lesser percentage since other coins had their own ATHs separate from bitcoin’s. Bitcoin currently has a market share of 42 percent, up from 38 percent after the crash.

source: CoinMarketCap, Bitcoin.com

It is clear from data that cryptocurrency (bitcoin particularly) have experienced worse downtrend. However, the concern is how long is this bull ride expected to end. Cryptocurrency enthusiasts wonder if the low witnessed earlier this month was the bottom or if the trend will continue for over a tear like it did in 2014.

One thing is for sure, they don’t expect the trend to last forever; many analysts and observers predict a resurgence anytime from. Some are optimistic, BTC prices can surpass the highs of 2017 this year.

Posted from my blog with SteemPress : https://smartereum.com/21465/cryptocurrency-downturn-was-worse-in-2014-than-it-is-in-2018-but-has-the-bull-run-ended-cryptocurrency-report/

This user is on the @buildawhale blacklist for one or more of the following reasons:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit