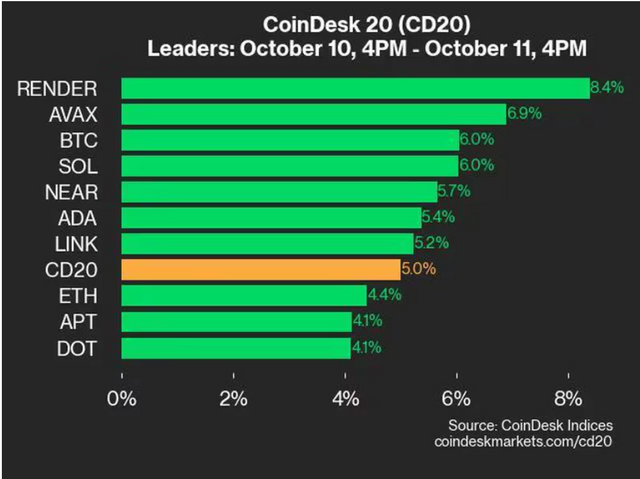

Almost every cryptocurrency on the CoinDesk 20 Index saw rises, but the leaders were Solana (SOL), Avalanche (AVAX), and Render (RNDR).

Bitcoin (BTC) reclaimed $63,000 on Friday, a day after falling to a new low, as investors swiftly put inflation data that were somewhat higher than expected in the past behind them and are now looking forward to Saturday's fiscal policy update from China.

Bitcoin, the most valuable cryptocurrency by market value, defied the trend of losing ground during U.S. trading hours this week by soaring 7% from Thursday's low of $59,000 following the higher U.S. CPI inflation news. The previous day, Bitcoin rose 5.5%, surpassing the 4.7% gain seen by the broad-market CoinDesk 20 Index (CD20).

The cryptocurrency majors were Solana (SOL), Avalanche (AVAX), and Render (RNDR) tokens, with increases ranging from 6% to 8%. Uniswap (UNI) was the sole CD20 index token to post a negative daily return; it lost a little of its gains on Thursday, fueled by the decentralized exchange's intention to create its layer-2 network.

While stocks were rising, cryptocurrency prices surged, sending the Dow and S&P 500 to new all-time highs at week's end. Following vital U.S. jobs data and hotter inflation readings, the dollar index retreated from a week of sharp gains as investors reassessed their expectations of additional interest rate reduction from the Federal Reserve. The index halted below 103.

The optimistic sentiment was also mirrored in crypto-related stocks. U.S. cryptocurrency exchange behemoth Coinbase (COIN) closed the day up 7%, while Bitcoin miners like MARA Holdings (MARA), Riot Platforms (RIOT), and Bitdeer (BTDR) surged 5%-10%.

With around $16 billion in Bitcoin assets, MicroStrategy (MSTR) is the most significant cryptocurrency business holder. Its price climbed 16% to its highest point since March 2000. The premium between the company's share price and its bitcoin holdings widened, which has not happened since 2021.

Changing cryptocurrency prices could be affected by China's fiscal policy update.

Coinbase analysts David Duong and David Han stated in a research release on Friday that the focus on macroeconomic issues impacting cryptocurrency prices has changed from monetary policy to the outcome of the U.S. election.

The impending Chinese finance minister's fiscal policy report, scheduled for early Saturday UTC, might be the primary event that triggers crypto volatility. According to Coinbase research, investors are considering additional financial stimulus measures for the struggling Chinese economy and financial markets, which could impact the digital asset market.

"As most markets will be closed during this next briefing, we expect traders could turn to crypto markets as a way to express their (proxy) views on the size and strength of China’s fiscal announcements," the researchers pointed out.

Markus Thielen, founder of 10x Research, has pointed out that the latest economic data from the United States demonstrate a strong economy and job market, ending previous fears of a recession.

"This sets the stage for risk assets to perform well into year-end, and it may take little to drive crypto prices higher," he added. "A significant move is likely on the horizon, and diligent traders will be well-positioned to capture it."