Immediately after August 1st, some users at Bitcointalk.org were immediately concerned with one particular feature Bitcoin Cash had that Bitcoin does not - EDA, or emergency difficulty adjustment.

The total hash rate of the network determines the difficulty of finding a block in either Bitcoin, and since that is what pays out coins as a reward, it is obviously a key component in mining profitability. Both Bitcoins adjust mining difficulty upward and downward based on current total network hash-rate.

However, Bitcoin Cash has an EDA which allows the network to readjust in cases of massive decreases of hash power. This is exactly what we saw on August 1st, as Bitcoin Cash suddenly had far less hash power behind its network than Bitcoin (Core) did. Had the EDA not functioned as intended, Bitcoin Cash would not be even close to profitable to mine and would probably have already died.

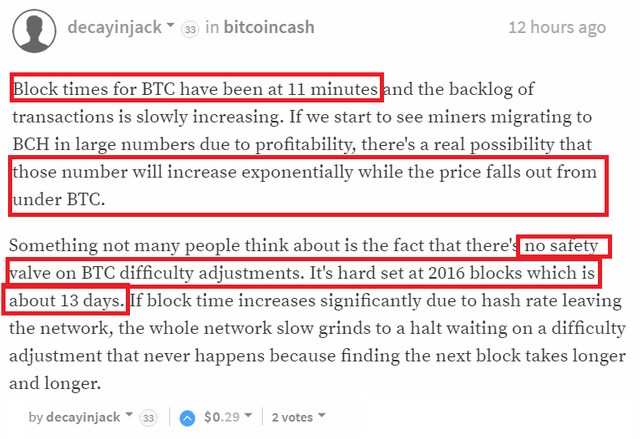

Unfortunately for Bitcoin (Core), it does not have EDA. That means if network hash rate drops substantially, it could take weeks to confirm enough blocks to adjust difficulty downward to compensate. This would result in a huge drop in mining profitability and could lead to a death spiral of miner abandonment. @decayinjack eloquently states the problem below:

It's only 13 days at the current hash rate, if half the network abandons, it's 26 days, if 90% abandon, it's 130 days.

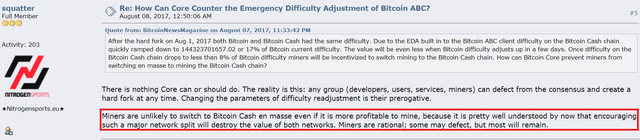

Now that Bitcoin Cash mining profitability (potentially, without allowing for fees) has touched 140%, this is a very real possibility. And nobody wants to be the last one to get off the ride:

There are still switching costs for any mining operation to switch chains, and possibly additional risk (although the market is removing some of that as we speak.) I also am not sure if this data accounts for the current fees miners collect on the main BTC chain, so the 140% number may overestimate profitability by as much as 25%.

Even so, that seems like more than enough arbitrage to tempt miners to start moving. The best argument against this I can find seems hopelessly idealistic:

I've been thinking about this all day. You didn't mentioned the repercussion it would have on the altcoin market but this would be catastrophic.

I try to understand where the markets will go in the most rational manner but I can't wrap my head around what are the rationals here. In hindsight these will be obvious I think but for now they escape me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree.

In the stock market you have the weekend to regroup and think about things. Wrap you head around them.

In crypto there is no true downtime. It can make it more difficult to be rational as we're looking at a potential major change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know what exactly would happen to alt-coins if the Bitcoin (Core) market cap all leaked into Bitcoin Cash. It could really go either way:

Fear in the markets causes consolidation around the perceived safest options, which would probably be whichever Bitcoin was going up at the time and maybe Eth. This could draw capital from alt-coins.

Fear of Bitcoin Core being usurped by Bitcoin Cash causes Bitcoin Core money, much of which is in weak hands having bought on the recent run-up, to diffuse out to alt-coins including Bitcoin Cash.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As you said people could be drawn to altcoin but at the same time if they'd fear Bitcoin Cash rising up then it would make more sense to diversify into BCH than altcoins. We'll see for not Bitcoin is still holding strong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So I guess this explains the big spike in price? How do you feel this btc compares to bitshares or lightcoin? I value your opinion so I'm just wondering how you feel about it all.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think Litecoin is going to have a tough time going forward. Now that Bitcoin (Core) has SegWit, it feels like there's not much point to it.

Bitshares is promising technology, but has no PR and is IMO not very user-friendly. I expect to see it continue to languish, which is unfortunate, as it could certainly solve some problems.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Important to note that as of right now BTC is not pricing in any of this. Markets tend to price in events quickly and Bitcoin is trading above 4K. Be aware but not alarmed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed, it does seem BTC could be susceptible for a dip to replace this sudden BCC market cap.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So do you think there is a danger, that there will be not enouph miners for Bitcoin? And then on 1 time Bitcoin will crash?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it proofreads the comment or else it gets the hose again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post. Thank you for the very valuable information.

STEEM ON!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lexiconical! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This make me nervous lets hope BTC survives.

@rogerblu

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If it doesn't, it appears we will have a pinch hitter ready to go.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit