On the 15th of May the Bcash network will be upgraded through a hardfork. Old Bitcoin op-codes will be re-introduced in Bcash and the block size will be increased from 8 to 32 MB. The price went up a lot in the previous weeks and the upcoming hardfork is appointed to be the main reason. However, I think manipulation was at least partly responsible for the gains and the negative aspects of the hardfork could outweight the positive aspects.

The Bcash hardfork

A hardfork is risky, everyone involved have to update the software or they will be rejected by the network after the fork. When a part of the community decides that the legacy chain is more valuable and refuse to join the hardfork a split will happen. Also a bug could crash the entire network as was the case with Segwit 2x.

If Segwit 2x had happened with full consensus the Bitcoin network would have stopped working for the first time in it’s history! Seen the flawed EDA that was included in Bcash when it forked off from Bitcoin and caused a lot of trouble, I have not enough confident in the Bcash devs to consider them competent. Do you think the code is carefully written and intensively reviewed?

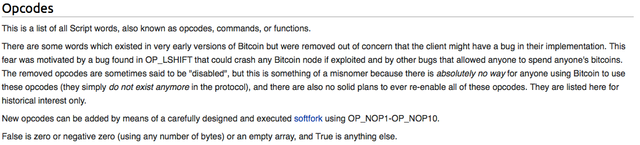

The fork will insert old Bitcoin op-codes in Bcash

The op-codes were removed from Bitcoin in the early years because very serious bugs were found. One bug could cause all Bitcoin nodes to crash and the other one could enable everyone to spend everyones bitcoins.

Both of them are very serious bugs that immediately destroy the fundamental features, and there is a fair chance that there are more bugs that are not found yet because it was so serious that they were removed immediately without further investigation. An unknown bug could crash the entire Bcash network after the hardfork.

https://en.bitcoin.it/wiki/Script

Even Gavin Andresen, the by Satoshi appointed lead developer that time didn't see the removed op-codes to be re-introduced anytime soon back then. He wanted to see a peer reviewed academic style paper that ensures that it is safe to do so. I really doubt if the Bcash devs did do this, but I don't expect so.

I am so happy that I don't have any funds in Bcash while this experiment plays out.

https://bitcointalk.org/index.php?topic=37157.0

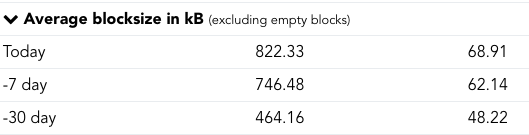

The block size will be increased

The block size will be increased from 8 to 32 MB. This is interesting, because they use not even 50 KB per block over the last 30 days and 68 KB on a day as today with a lot of volume caused by price volatility. 50 KB per block is only 0.626%, so Bcash blocks are not even 1% full yet. I suspect that they will use a tsunami of extremely cheap and low quality transactions to make the network look popular and pump the price, it is really the only use case I can think of.

https://www.fork.lol/ Left is BTC and right is BCH

Why the hell increase blocks that are not even 1% full?!?!

The ease of the hardfork points to centralization

As you see this hardfork will bring huge risk to the Bcash network and it is very discussable whether it is really needed. In a situation like this you would expect heated discussions as took place in the Bitcoin scaling debate, but there is no discussion at all! Bcash folks are following and trusting their leaders blindly!

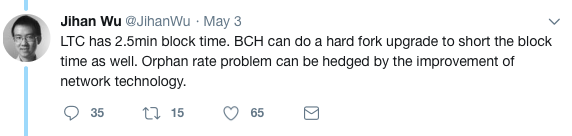

In my opinion this is a HUGE sign that the decentralization is broken. It became so easy to plan and execute a hardfork that there will probably follow multiple additional forks every year and the Bcash sheeps will follow. I saw a tweet from Jihan Wu (biggest miner) that they ‘could’ decrease the block time from ten to 2.5 minutes to compete with Litecoin.

This will quadruple the block rewards miners can earn and a new Federal Reserve is born, because holders will be robbed from their value by the creators of the money. Beside that ‘leaders’ of Bcash can also be compromised to change fundamental features at the will of governments or bankers.

Only talking about this with a coin that does a hardfork so easily would scare me a lot…..

Conclusion:

The upcoming Bcash hardfork is very risky and doesn't bring much extra value. Beside that the ease to execute a fork and absence of discussion is a sign that Bcash is very centralized. I think the rise in price is very overdone and at least partly driven by manipulation.

Especially when you consider that Bcash only have 10% of the security level of BTC, less than 10% transactions (of witch many low value and less efficient because no Segwit and batching), no network effect and no certain future while the current price is 0.166 BTC (16,6%). Bcash now is very risky to own and heavily overvalued. I am happy that I am finished dumping the entire stack I got out of thin air on the 1st of August.

Fair value of Bcash is far below 0.1 BTC in my opinion.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

Is it a hard fork like in Steem, when everyone adopt the new fork, or is it a true fork, like when BCH diverged from BTC?

From ur text it seems more like the former.

In this case, will it be the end of BCH?

I thought it was a decent currency, so why do it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am also confused. Will this result in 2 coins after the fork? Legacy bitcoin cash and new bitcoin cash? If so, any exchanges listing the new coin yet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is upcoming, so how can any exchange have an upcoming currency listed yet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Many exchanges list coins prior to release and allow trading but not withdrawal (as you rightly said, they don’t really exist). I ask as the article doesn’t seem to suggest that 2 coins will exist after the fork.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How can it be done?

How can a nonexistent thing be traded?

For a swap to happen there should be a buyer and a seller.

If it does not exist, how can it be sold?

What happens in such a case if the ICO/HF is postponed or cancelled after people already bought it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don’t the precise mechanics but it has happened regularly. It also happened before bitcoin cash forked from btc. Some exchanges were offering the ability to trade it (or more accurately, a representation of it similar to a future). Possibly the exchange knew it had X btc on deposit, so would receive X bitcoin cash? I don’t know exactly how they manage risk.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Futures or options could have been sold, but remember that this is an upgrade, not an overly contentious fork.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 12.28% upvote from @steembloggers courtesy of @stimialiti!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@youtake pulls you up ! This vote was sent to you by @stimialiti!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 13.33% upvote from @luckyvotes courtesy of @stimialiti!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 10.00% upvote from @sleeplesswhale courtesy of @stimialiti!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@youtake pulls you up ! This vote was sent to you by @stimialiti!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There will not be a significant split. It is merely an upgrade.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So not a fork. In the usual sense unless a lot of miners remain on the old chain!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's the thing though. A fork is simply a change in the software. Any upgrade is a fork.

Whether it's a soft or hard fork, it will always be a certain degree of "contention" either just human or between hashpower that goes along and hashpower that does not.

Regular users will not have to think it over. They use SPVs and just follow the chain with the most PoW by default.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.84 % upvote from @booster thanks to: @stimialiti.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Worded better...is the HF contentious or consensual?

Consent being the important part, as in any relationship.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is always some contention with any fork, because it is a voting scenario where the largest pool of hashpower gets their way. (Even soft forks, as the voting is continuous and will express content or discontent with the soft fork features) But it avoids violence and it is not a traditional democratic or statist event.

The clear majority of the community does seem to support the fork, as judged by activity at meetups and in social media. However social media is fairly easily manipulated and meetups don't represent everyone.

In the end, the complete hashing nodes are the deciders and only cater to users ie consumers when it clearly is in their interest. (So called "full nodes" that don't mine we don't count, as they can be easily sock puppeted as well)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It will not be the end of anything. This article is mostly unnecessary FUD.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That does not seem like a very solid coin.

I am a little active on yours.org, so I do hold some BCash, but only what I earned from writing, but this does really shake my faith in BCash.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This article does not reflect the reality of the situation. It is mostly FUD written by an anti-bitcoin cash guy. it contains nothing specific. I bet this guy can't even read code.

Anyway, the bitcoin cash community is in total agreement with this hard fork and it has been well tested so it should go very smoothly and will make bitcoin cash even better... else why do you think the price would have gone up?

People betting with their money are more serious than a cheap writer ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well you provided no counter arguments to the one he brought up. Like the unneeded blocksize for example.

All you do is shittalking him instead of bringing up reasons why it is wrong what he says.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The blocksize is meant to increase way ahead of demand. Not in panic "when it is needed", but as soon as possible. Satoshi eventually chose to introduce it as a limit against temporary attacks, not for it to be used as a centrally planned quota.

The OP codes there is still some debate in the community about, but most are onboard with re-introducing many (not all) of them. There have been tests run, as there are quite a few knowledgeable developers in the community. (See Bitcoin Unlimited and Bitcoin ABC teams, as well as independent researchers)

I've not seen Gavin Andresen criticize the re-introduction of the specific OP-codes, at least so far. Even if he does, he is not the sole developer. But a lot of people obviously respect his opinion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If you are active on Yours, you could have learn a lot about Bitcoin Cash and your faith would not be affected.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The fork is a planned upgrade. Bitcoin Cash will continue to fork like this, at least one more time if not more to make sure that blocksize increases a long time ahead of demand. (As it used to in Bitcoin in the early days).

("BCash" is a slur introduced by a coordinated diversion campaign that also included a social media spam campaign. It's not a good name, considering the many previous forms of e-cash with similar names and the company with the same name.)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Like you said B cash is centralized. It doesn't hold for a lot of confidence and yes I suspect the upgrade is to enable some form of manipulation. Whatever the case all investors should be very vigilant

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Centralized how exactly. Per the Bitcoin design paper and Satoshis own definitions, it is decentralized because it is a distributed network without a centralized mint or other entity to handle transaction processing.

The Bitcoin design did not rely on 1-IP-1-Vote or users having to run their own nodes. To the contrary, Satoshi avoided both for very good reasons.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a huge block size increase! Are they over doing it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That does look crazy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not at all! Remember this is a MAX BLOCK SIZE parameter. Blocks are still < 1MB in average on that chain so it won't make any difference in the short-term. This increase is purely to avoid potential congestion issues in the future as BCH becomes more and more popular.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin had a 32mb block size originally, did it not? Didn't they reduce the size to prevent spam Tx's, or reduce the attack vectors or something?

Refresh my memory on that...and then tell us whether Bcash has solved the problem which was temporarily solve by reducing the block size to 1mb in the first place.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Initially blockspace was theoretically unlimited, but practically kept at 32mb. The lower limit was later hesitantly introduced by Satoshi at advice from others because of the risk of a poison block "spam" attack that especially existed early on in Bitcoins history. That attack is now unlikely, but even if it was tried a limit at 32MB would be low enough.

The more recent (alleged, as there is no way to identify "intent") spam attacks on Bitcoin before the split and Bitcoin BTC after the split are actually made possible because of the limit being kept so low that it takes very little effort to clog the network. The higher the activity and the more users try to outbid eachother on fees, the easier it is spam it successfully.

Bitcoin Cash will probably move to an algorithm adjusted or other more directly market based block size in the future, in order to avoid central planning of the total amount of available blockspace.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting article about security flaws. I'm shocked on the rise of bitcoin cash. It does seem to get really strong pushes and drops.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is much more genuine interest in Bitcoin Cash than many ticker BTC hodlers would like to admit. It took me some time to see it myself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin cash (BCH) is one coin that attracts all kinds of reactions in the crypto community. On one hand, there are those that swear by it being the real bitcoin. On the other hand, there are those who are fond of calling it a centralized scam. However, even with all the kinds of emotions that it elicits in crypto enthusiasts, one thing is clear, Bitcoin cash is one of the best crypto performers at the moment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At the moment and for the foreseeable future...In my opinion it will pass BTC in the next 12 months in terms of utility...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This guy hates on bch so much he has diapers on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"The ease of the hardfork points to centralization"

Monero also hardforks like twice a year. Does this mean Monero is centralized?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The future will show. Maybe the fork won't be useless

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is already quite useful. We will see how this turns out eventually.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I did not even know there is going to me a hardfork on 15 May. Thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I did not know either until I saw this trending page. Thank you @michiel

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe that Bitcoin Cash has true potential to replace BTC at some point. BTC may become more useful as a storage of value. BCash needs that fork to upgrade its ecosystem and bring more features to everyone.

Don't be that much skeptical, it is what it is. Fork will happen and only future will show how it will adopt.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good analysis! I have 2 concerns. One with the blockchain size and the next with the current ceo and velocity of the cryptocurrency.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is no CEO. You need to research this some more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really respect this breakdown of cryptocurrencies, I have done a similar breakdown but from a slightly more humour based point of view, please feel free to read it, and laugh :-)

https://steemit.com/funny/@georgemason/the-number-1-reason-you-aren-t-getting-rich-from-bitcoin

Upvoted :-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It will be interesting to see if BCH can keep the % of the last weeks after the fork or if it was just a pump/dump.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It will likely drop back down for a bit. Prices usually pump/dump before events and get a little reversal after. Same in most every market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmm yes iv never really been a huge supporter but i think it may be good. Time will tell...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really good news and very nice

The coin betcuin is very distinctive and really very successful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bitcoin is powerful./..its have the power to change our life

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow that is a very interesting and well put together article. Thank you for sharing this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"In my opinion this is a HUGE sign that the decentralization is broken."

It should be no surprise that an alt coin that forked from Bitcoin in order to increase its block size would find quick consensus around increasing the block size again.

"This will quadruple the block rewards miners can earn and a new Federal Reserve is born, because holders will be robbed from their value by the creators of the money."

Its all a matter of the protocol. If the block time is reduced by 75%, then the block reward can be reduced by 75% to offset the increased block time. Net block reward over time remains the same, as does the hard cap at 21million.

Holders are already robbed of their value each block when new coins are created...it is what they consented to when they purchased Bcash, or Bitcoin. Both retain their future hard caps.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Economics 101 - If the blocks aren't full, why are people paying any transaction fee at all? Is there a network minimum?

Price being the metering mechanism, when blocks are full Tx fees serve the function of prioritizing Tx's.

If blocks aren't full, why do people pay a Tx fee at all? Do miners not process Tx's with no fees?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is a network minimum for fee/kb, which can also be decreased over time to satisfy the end user when it becomes necessary. However the network does allow some free transactions, which can be given lower priority.

The concept introduced in the design paper is not that users should outbid each other on fees (as happens when there is a quota on blockspace set below market demand), but that the fee should be minimal so as to enable the use as electronic cash.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The increase in the block size just to increase the rewards to miners temporarily does not make much sense at all though. There much me some long term plan which are not openly declared yet. I am just wondering what's the end game? How are the Bcash people trying to take over BTC volume?.... Mmmm...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The post is mostly FUD frankly. You need to do your own research, because this topic is one of the most divisive in crypto right now. The mania on both sides can be rather similar to the U.S. elections. In the end, what matters is the technology.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@michiel Good points, I addressed a few of them in my article.

Does Bitcoin Cash even have a scalability problem to solve? Warning to investors from Weiss Ratings . Just linked from my article to yours in a comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin has the right balance of pros and cons. That's why it's so popular.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very important update, Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit