Non activation of Segwit2X was intentional, dishonest and a fraud

This half confession and analysis by Two Bit Idiot (Politics Religion and Bitcoin) is an honest and candid appraisal of the mindset and thinking of people on both side of the divide.

Segwit2X was never meant to be activated. It was a ruse to get miners agreement for activating Segwit. They were not told that btc1 had faulty code until the cancellation of Segwit2X. The 93% who were warned took action to prevent activation but the 7% that ran the code got their "surprise".

Big block miners were fooled once, ( Hong Kong Conference ) fooled twice, ( NYA Agreement ) and finally F**#ed over with intentionally buggy code. Coders of Jeff Garzick caliber do not write rookie error buggy code unintentionally. It is a wonder how some seemingly incorrigible people we look up to, are willing to prostitute themselves. This guy no longer has any credibility. He is making another attempt with United Bitcoin. Don't get caught in this scam. Avoid anything he does like the plague.

The Chain Death Spiral hangs over BTC like the "Sword Of Damocles"

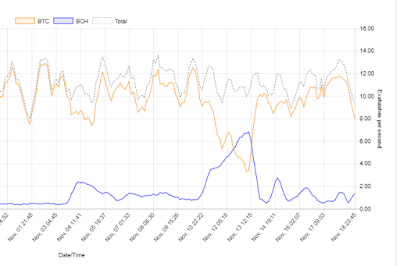

As long as BTC is on the same mining algorithmn as BCH, BTC is always in danger of annihilation.

- Price Action.

The new CBOE and CME futures market increases the likelihood of BTC price being shorted. Such a drop in price for BTC, will lead to miners moving to the BCH chain and putting BTC in danger of the Chan Death Spiral.

- BTC is a Ponzi scheme

BTC is progressively losing users mainly to BCH as fees go higher and confirmation times gets longer. Erosion of existing user base makes it reliant on uninformed new users to prop up its' value. The system will collapse when this flow of new money stops, making it a Ponzi scheme.

BTC have not had a major price correction since the last correction from 8,000 to 5000 when Segwit2X was cancelled. That event very nearly caused the flippening. It is finally correcting now. If it gets caught in the Death Spiral again, this time it will not get out.

- Store Of Value

The proposal that BTC be use only as a store of value and not as a transactional currency does not fly. The first ever recorded use of BTC was the purchase of a pizza. Today the transaction fees are in excess of the price of a pizza. A coin that is not useful cannot maintain a value.

The stated purpose for high fees is to push users towards off chain solutions like the lightning network. However BTC no longer have a monopoly in this space and must compete for users. Gaining adoption is hard, and there are not many users left to use the lightning network if and when it is released. After 5 months Segwit is hardly used. Core has to react to the market and not attempt to drive the market. Governments do that. ( Picking winners and losers)

Is Bitcoin A Bubble

Bitcoin is an asset class that undergoes periodic bubbles. meaning that after each crash it will recover to make higher highs. The last Mt Gox crash took three years to recover its' previous high. Today BTC is in another periodic bubble. However this time things could be different. This time it could really crash to zero and never recover.

Core have turned BTC into a Ponzi scheme and like all ponzi schemes when the participants realise that there is really no economic value produced in the scheme, it will collapse dramatically.

When this BTC bubble burst, Bitcoin Cash will be the new Bitcoin. There will be no other forks of bitcoin because none can compete on the same mining algorithm.

A Generational Wealth Transfer Of Epic Proportions.

What we are witnessing is a transfer of wealth accumulated over generations currently in the hands of a small elite, to a new generation of libertarians, anarchist and crypto savy nerds. Young computer savy kids not even out of their teens are becoming millionaires overnight.

Wall Street is terrified. Never have they seen so much money flow so quickly into a sector that they don't understand, don't control, and are unable to react to effectively.

Scaling - The next big challenge for cryptos

Both BTC and Ethereum networks are clogged up because they are unable to scale to the unexpected demand for transaction. To this extent even Litecoin is being co-opted to fill this demand and as a result the price of Litecoin have increased tremendously over the last week.

It is not inconceivable that even Litecoin will reach its' transaction limit. Bitcoin Cash has shown that with block size of 8MB and increasing to 32MB it can handle the transaction demand now. A massive negative campaign launch against it by the BTC supporters and having to rebuilt its' whole infrastructure means that it is virtually unknown among new crypto investors.

These barriers are quickly coming down. Already OKex and soon CoinEX will be trading BCH based trading pairs. Bitcoin.com will soon offer a Bitcoin Cash Visa debit card. Businesses are changing to Bitcoin Cash for faster and cheaper transaction. These developments in Bitcoin Cash will erode BTC's user base over time. The day is not far off when BTC will succumb to the Chain Death Spiral.

The Shape Of Things To Come.

There will be many token each specialising in different use cases and segments of the industry. This is my analysis on how the crypto market will shape out.

Currency, Store Of value, Smart Contract : Bitcoin Cash ( BTC will go to zero )

Privacy : Zcash ( No Premine )

Tokenisation, ICOs : Ethereum ( Already the best use case )

Data Access, Web Pages : EOS ( Unlimited free transactions )

- Social Media

The future of the World Wide Web is the blockchain. All the web pages on Steemit, is stored on the Steemit blockchain. Steemit already handles more transactions than BTC, Ethereum and BCH combined and it is free to access.

There was a time when I thought that micro transactions was the killer app for cryptos. However I now believe that micro transaction may be suitable for the internet of things, but for social networks, it introduces friction. Facebook could never scale if users had to pay fees to access it.

- Decentralised Marketplace

The future of the market is peer to peer and decentralised. Bitsquare, Open Bazaar, Bitshares. Centralised exchanges will be dominant for years to come but look out for peer to peer to improve and gain dominance in the coming years.

- Collapse of BTC

As BTC's valuation goes higher its' user base actually gets smaller as less people can afford to hold and use it. BTC's position on the same mining algorithm as BCH is unstable. Collapse is inevitable. The risk of putting your money in Bitcoin is high.

People who still support BTC and claim that it will become a reserve currency for international transactions are deceiving themselves. Without the power of the open source development community, it is noting but a FED COIN.