Bitcoin futures exchange-traded funds (BTCF) have become increasingly popular in recent years, providing investors with a way to invest in Bitcoin futures contracts without actually owning the underlying asset. However, as with any cryptocurrency investment, BTCF is subject to government regulation. In this article, we'll explore the latest developments in cryptocurrency regulation and how they impact BTCF.

The Current State of Cryptocurrency Regulation

The regulation of cryptocurrencies varies widely across different jurisdictions. Some countries, such as El Salvador and Ukraine, have fully embraced cryptocurrencies, while others, such as China and India, have banned them outright. In the United States, cryptocurrency regulation is still in its early stages, with different regulatory bodies providing different levels of oversight.

The Securities and Exchange Commission (SEC) is responsible for regulating securities, including BTCF. In the past, the SEC has been hesitant to approve Bitcoin ETFs, citing concerns over market manipulation and investor protection. However, in October 2021, the SEC finally approved the first Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF.

Impact on BTCF

The approval of the ProShares Bitcoin Strategy ETF was a significant milestone for the cryptocurrency industry, as it marked the first time that a Bitcoin ETF was approved in the United States. This approval opened the door for other BTCF to enter the market and provided investors with a new way to invest in Bitcoin futures.

However, the approval of BTCF does not mean that the SEC is no longer concerned about market manipulation and investor protection. In fact, the SEC has stated that it will continue to closely monitor the BTCF market and take action against any misconduct or fraud.

In addition to the SEC, other regulatory bodies are also beginning to pay closer attention to cryptocurrency investments. The Internal Revenue Service (IRS) has issued guidance on the taxation of cryptocurrencies, and the Financial Crimes Enforcement Network (FinCEN) has proposed new regulations for virtual currencies.

These developments have important implications for BTCF investors. For example, the IRS guidance means that BTCF investors will need to report their gains and losses on their tax returns, just like any other investment. The FinCEN regulations, if approved, could require BTCF providers to comply with additional reporting and compliance requirements.

The Future of Cryptocurrency Regulation

The future of cryptocurrency regulation is still uncertain. Some experts predict that more countries will embrace cryptocurrencies and develop regulatory frameworks that promote innovation and investment. Others believe that governments will crack down on cryptocurrencies and impose stricter regulations that stifle growth and adoption.

In the United States, it's likely that the regulatory landscape for cryptocurrencies will continue to evolve. The SEC has signaled that it will be open to approving more Bitcoin ETFs in the future, and other regulatory bodies may also provide additional guidance and oversight.

However, the regulatory landscape for cryptocurrencies is likely to remain complex and fragmented for the foreseeable future. This means that BTCF investors will need to stay up-to-date on the latest regulatory developments and ensure that they comply with all applicable laws and regulations.

BTCF is an innovative investment option that allows investors to participate in the Bitcoin futures market without owning the underlying asset. However, like any cryptocurrency investment, BTCF is subject to government regulation. The recent approval of the ProShares Bitcoin Strategy ETF by the SEC is a positive development for the cryptocurrency industry, but investors should remain aware of the latest regulatory developments and ensure that they comply with all applicable laws and regulations. As the regulatory landscape for cryptocurrencies continues to evolve, BTCF investors will need to stay informed and adapt to changing conditions in order to maximize their returns and minimize their risks.

@BITCOINF_ $BTCF #BitcoinFuture #CoinTiger #Binance #Gems

For More Detailed Informations, visit:-

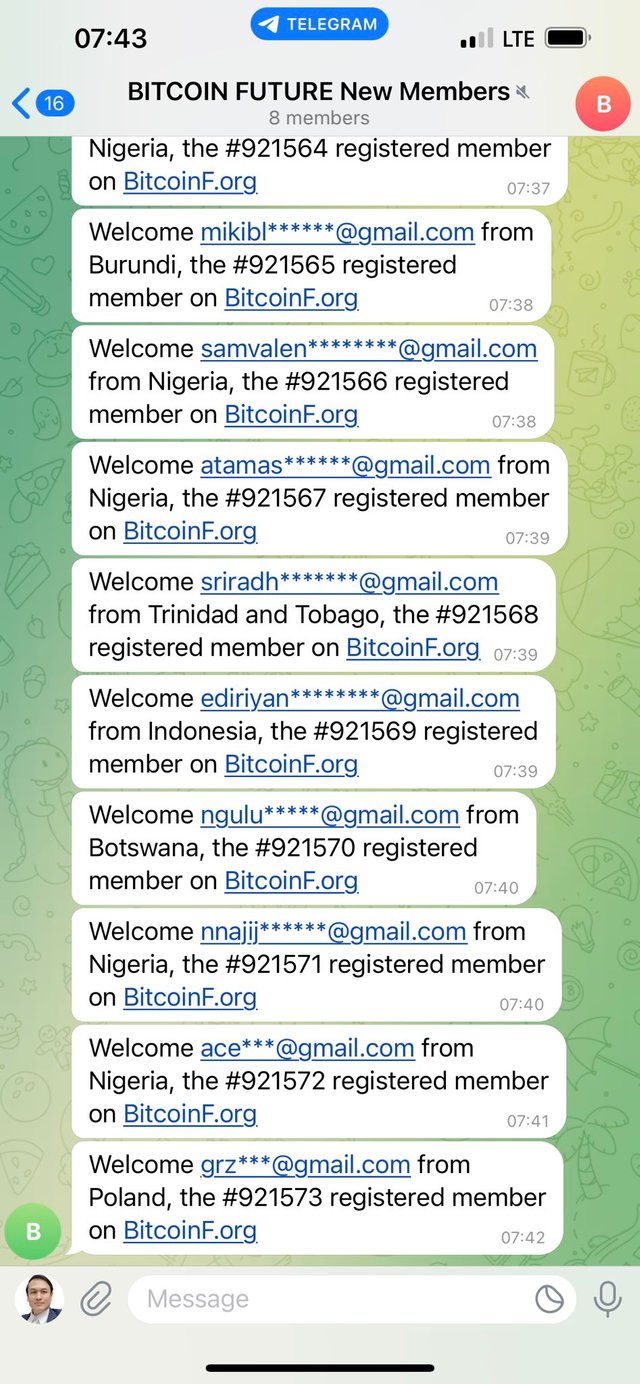

Global Telegram Group: https://t.me/BITCOIN_FUTURE_GLOBAL

Telegram Group 01: https://t.me/BITCOIN_FUTURE_EN01

Telegram Channel: https://t.me/BITCOIN_FUTURE_ANNOUCEMENT

YouTube: YouTube.com/@BITCOIN_FUTURE_GLOBAL

Twitter: https://twitter.com/BITCOINF_

LinkedIn: https://www.linkedin.com/groups/14196582

BTCF Project Website: btcf.info/en

E-Commerce Website: Bitcoinf.net/en

Whitepaper: https://btcf.info/btcfwhitepaper-en.html

Writter

Bitcointalk Username: Lovtiek

https://bitcointalk.org/index.php?action=profile;u=2243938

BSC Wallet Address: 0xc83E325428Ac93069d0230A37905e8B53391c837

Poa Link: https://bitcointalk.org/index.php?topic=5439538.msg61776180#msg61776180