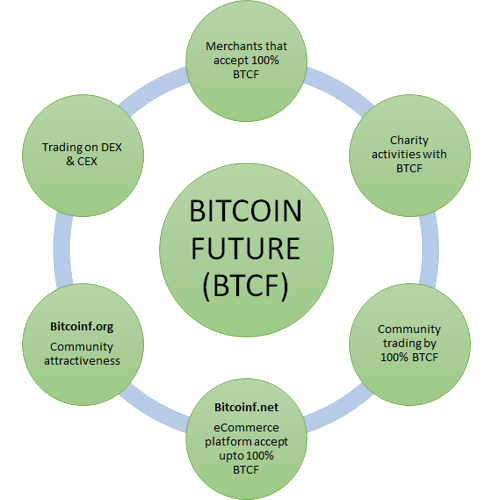

Bitcoin futures exchange-traded funds (BTCF) have gained significant attention and popularity among investors since the launch of the first BTCF in the United States in October 2021. As we move into 2023, it's important to analyze the BTCF market and make predictions for the future of Bitcoin futures ETFs.

Current Market Analysis

As of March 2023, there are currently five Bitcoin futures ETFs available in the United States. These ETFs provide investors with the opportunity to invest in Bitcoin futures contracts, without actually owning Bitcoin. This allows investors to benefit from the potential gains of Bitcoin without the complexity and volatility of owning the underlying asset.

The BTCF market has shown strong growth since its launch in October 2021, with the first BTCF (ProShares Bitcoin Strategy ETF) reaching $1 billion in assets under management within its first week of trading. Since then, the market has continued to grow, with the total assets under management in BTCF reaching over $10 billion by the end of 2022.

Predictions for the Future of BTCF

Continued Growth in Demand

As Bitcoin and other cryptocurrencies continue to gain mainstream acceptance and adoption, the demand for BTCF is expected to continue to grow. The ease of investing in BTCF, as well as the potential for high returns, make it an attractive investment option for both institutional and retail investors.

Increased Competition

As the BTCF market continues to grow, we can expect to see increased competition among ETF providers. More ETF providers may enter the market, offering new and innovative BTCF products to meet the needs of investors.

More Regulatory Clarity

Regulatory clarity is one of the biggest challenges facing the BTCF market. As Bitcoin is a relatively new asset class, regulators are still working to understand how to regulate BTCF. However, as the market continues to grow, we can expect to see more regulatory clarity in the coming years, which will provide a more stable and secure investment environment for BTCF.

Potential for Higher Returns

Bitcoin has been known for its volatility, and BTCF is no exception. However, as more institutional investors enter the market, we can expect to see increased stability in the BTCF market. This could lead to potentially higher returns for investors, as well as a more predictable and stable investment environment.

Increased Mainstream Adoption

As Bitcoin and other cryptocurrencies continue to gain mainstream acceptance, we can expect to see increased adoption of BTCF by institutional investors. As more institutional investors enter the market, we can expect to see increased demand and liquidity in BTCF, which could lead to even more growth in the BTCF market.

The BTCF market has shown strong growth since its launch in October 2021, and the future of Bitcoin futures ETFs looks promising. Continued growth in demand, increased competition, more regulatory clarity, potential for higher returns, and increased mainstream adoption are all positive signs for the BTCF market. As with any investment, it's important to conduct thorough research and consult with a financial advisor before investing in BTCF. However, if you're looking for a way to invest in Bitcoin futures contracts without owning Bitcoin, BTCF may be a viable investment option for you.

@BITCOINF_ $BTCF #BitcoinFuture #CoinTiger #Binance #Gems

For More Detailed Informations

Global Telegram Group: https://t.me/BITCOIN_FUTURE_GLOBAL

Telegram Group 01: https://t.me/BITCOIN_FUTURE_EN01

Telegram Channel: https://t.me/BITCOIN_FUTURE_ANNOUCEMENT

YouTube: YouTube.com/@BITCOIN_FUTURE_GLOBAL

Twitter: https://twitter.com/BITCOINF_

LinkedIn: https://www.linkedin.com/groups/14196582

BTCF Project Website: btcf.info/en

E-Commerce Website: Bitcoinf.net/en

Whitepaper: https://btcf.info/btcfwhitepaper-en.html

Author

Forum Username: roxxy

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=1511275

Telegram Username: @Lenapetrov

BSC Wallet Address: 0x170762eDC9B7068D55CCE71e803b945A83ed45de

My Poa Link: https://bitcointalk.org/index.php?topic=5439538.msg61973714#msg61973714