.png)

There's always an opportunity in every situation no matter how bad it may seem.

Since the market crashed 2 months ago and we are still in a bearish period most of the ICOs that recently completed and are now altcoins available on exchanges are a bargain now!

Why?

Ever since the bear market happened in recent months a lot of good ICOs that have strong potential had a rough time launching their tokens during its ICO phase and if you research some tokens one by one the price coming from their ICO period haven't multiplied a lot as of this point.

I've been contemplating a lot ever since we've hit the 6k level for Bitcoins if:

- if I should stay in FIAT

- if I should stay in Bitcoin during the bear period

- if I should diversify my positions in top 10 altcoins

- if I should invest in new altcoins launched in the market

- if I should find invest in ICO presale

Right now I chose #4 as my strategy, why?

Why is investing after the ICO is better as of the moment?

- The bear market gave the opportunity to slow down the growth of new tokens after their ICO phase

- There are more data available to study the perfomance of the token once it launches

- You can study the volume trades of the token if it's a pump and dump or have market support after ICO launch

- You can cross verify the token on social media since there are more available comments coming all over the world

- You can also verify on Binance if the new token is being voted and if it is gaining traction and popularity

- The risk after the ICO is lower because all of the above data are available rather than investing blindly during ICO period

Data is very important when making a decision and if the token value is almost still the same when it launched during the ICO then I feel it is really a bargain since it lessens the risk of investing blindly in the ICO with no data and you get to feel more the new token during its initial months.

Disclaimer: This is merely for educational purposes only and should not be taken as a financial advice. The tips below are not guaranteed to work and should only serve as an idea and a guide. Do you own due diligence before investing in any crypto currency token.

Here are a few tips on how to research strong new tokens and avoid the possibility of a pump and dump:

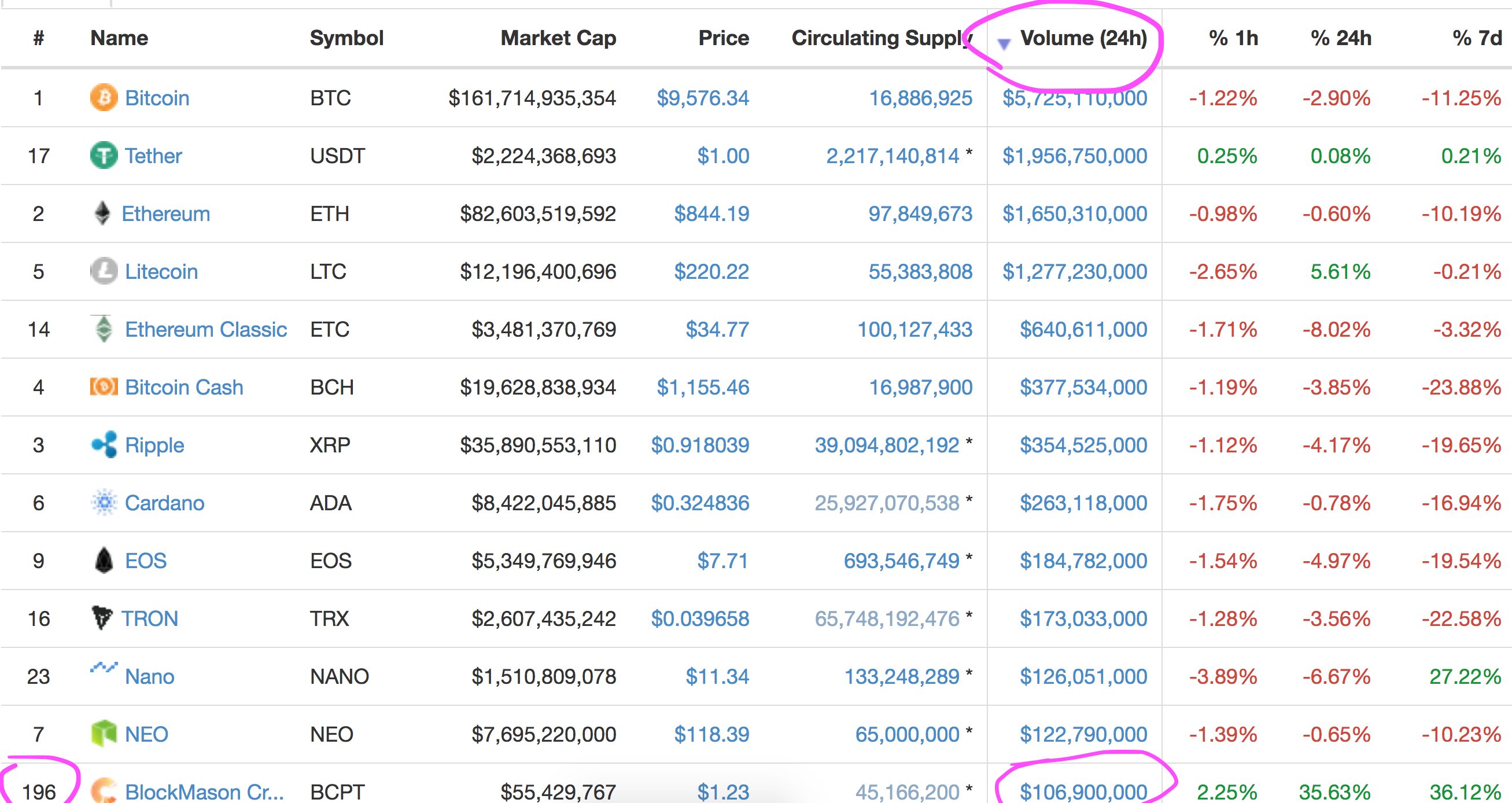

1.) Check coins that have volume and resilient during dips on coinmarketcap, just filter the tokens by 24-hour volume

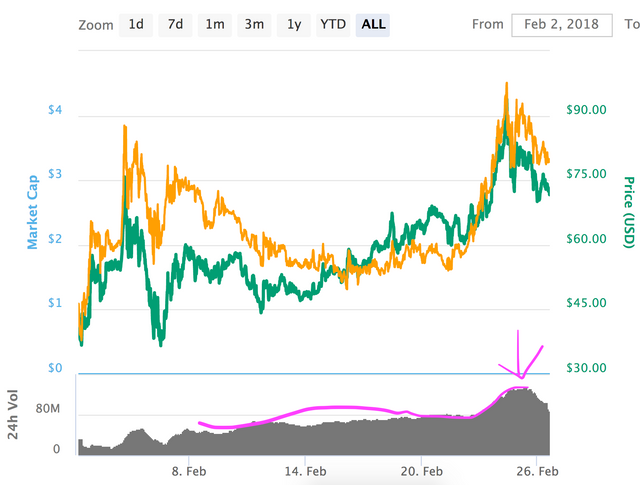

2.)Check lower ranked tokens and see if they just recently launched by checking their first date on the chart

3.)Check also the volume of the coin if they have consistent volume since being launched

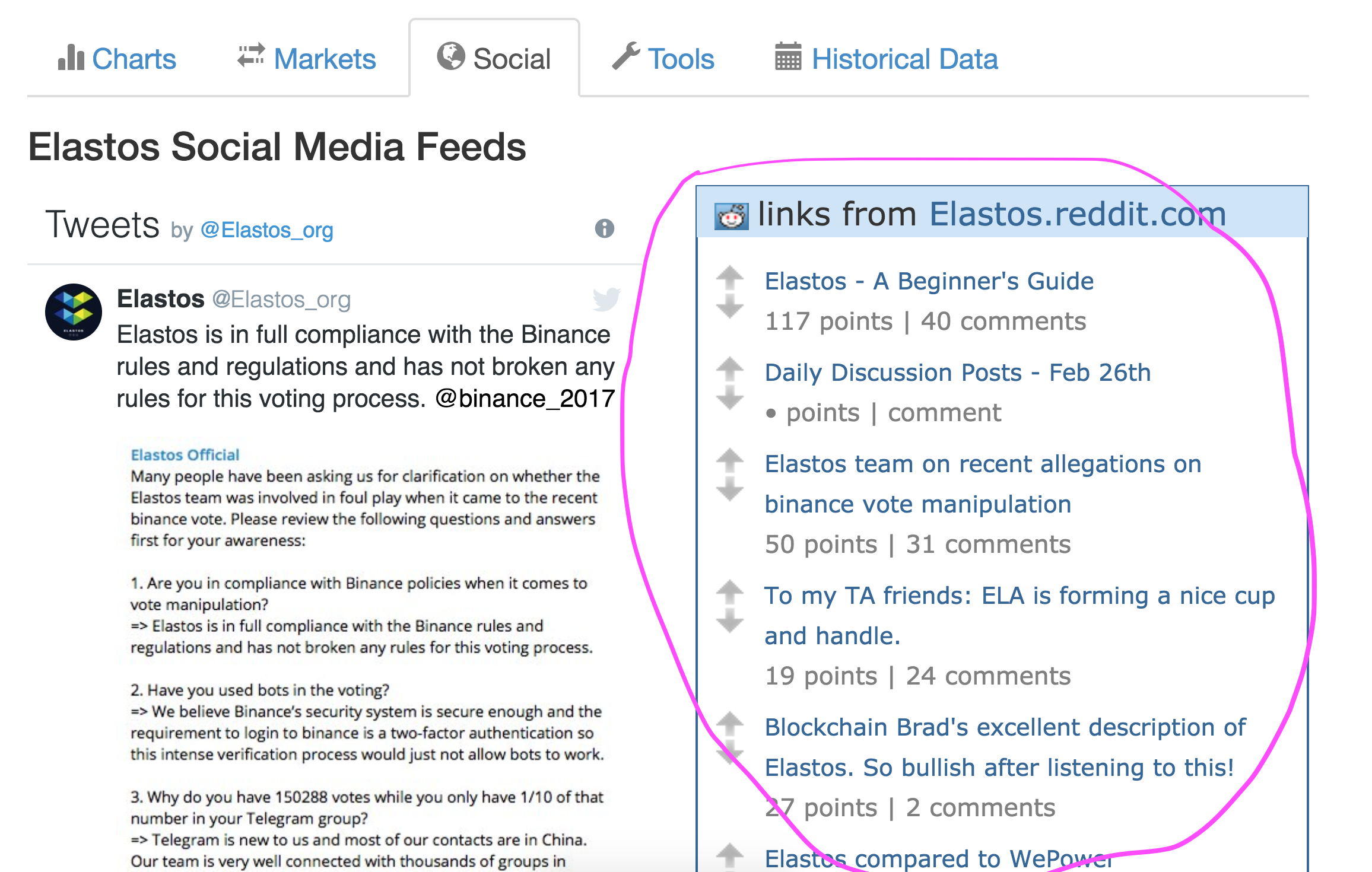

4.) Check social tab and see the buzz going on with that particular and see the comments and discussion of the community

5.) You can also search on youtube or reddit for more reactions and activity from socia media

6.) During market dips, filter out the new tokens that have volume and the ones that are resilient because it is a good indicator to see if the community and market is supporting it even during market dips.

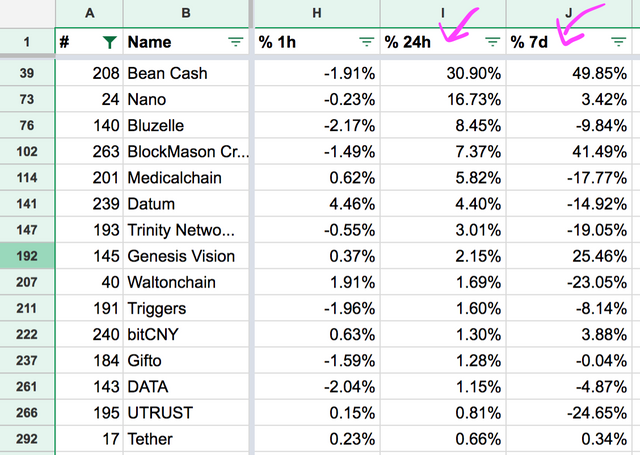

Copy the entire list and post it on excel and filter the resilient tokens based on 7 days and 24-hour volume.

Control A or Command-A and paste as values on excel or google sheets

7.) Check the exchange where they are getting that volume and see if it's a big exchange or not by visiting

https://coinmarketcap.com/exchanges

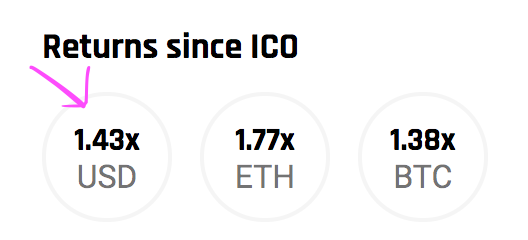

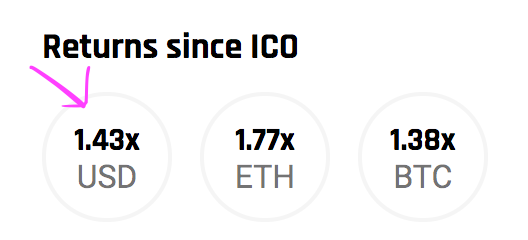

8..) You can also go to icodrops.com and search the token to see how much it multiplied already from ICO price so you would know if it is still a bargain.

9.) Check also from icodrops.com (if available) the fundraising goal because if it's below 30M USD to see if it still has more room to grow.

Pro tip: There's a full list of recently completed ICOs on icodrops.com that you can easily view

https://icodrops.com/ico-stats/

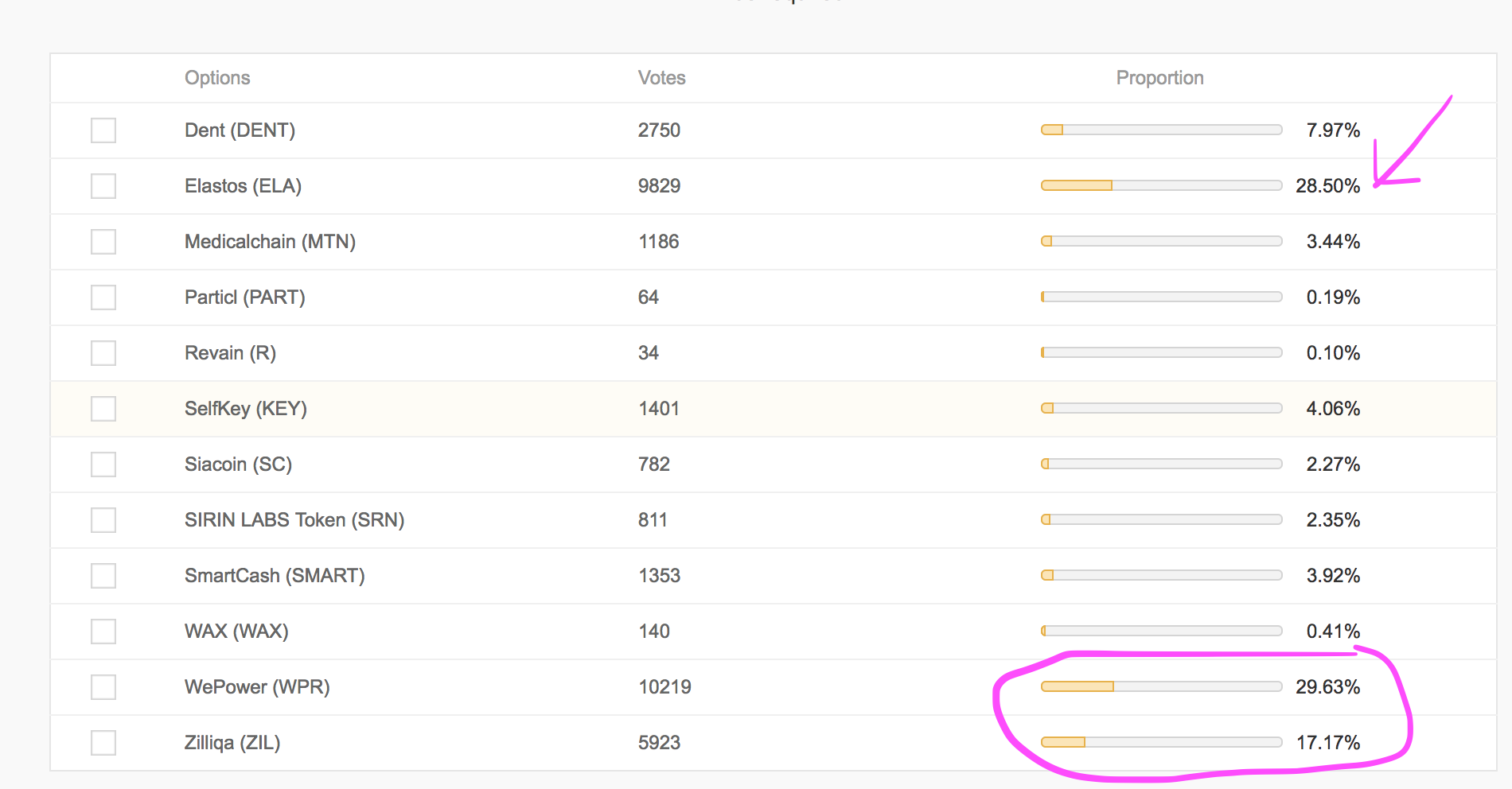

10.) Another idea that has a good community and fan base behind it is through Binance.

If you have an account on binance you can also check the tokens being voted by users to be listed on the exchange. This would give you an idea which tokens have real support from the public and the market

In summary:

- Stay in the game during this bear market period by continuously improving your skill in the overall knowledge of crypto market

- Do not invest blindly in tokens you see on youtube or social media

- Do not invest blindly in the volume of trades happening on coinmarketcap data

- Pump and dump is really happening in this market and make sure you are not caught in one

- ICOs that are overvalued after their ICO period have a strong possibility of being dumped once available on the market already.

- Research carefully if undervalued tokens with a strong volume of trades have a fundamental reason behind it or it is just being pumped by a whale trader.

- Diversify your investment to manage risk

- Invest only what you can afford to lose

- Plan your exit strategy with a stop loss

- Recoup your investment rightaway after making a profit and leave the profit behind for further gains in the future

- Last but not the list, don't forget to read the whitepaper so you can have more conviction on your investment

Final thoughts:

The crypto market game is very tricky and people get into this game because of the possibility of making big wins in investing with new and upcoming tokens in the blockchain sphere.

In this game it is either you are making money from someone else's investment or they are making money from your investment, this is why investing blindly and getting hyped by other people should require due diligence on your part, and having the most number of data that you can access can help you tremendously in navigating this unforgiving and treacherous market.

We will be putting more of our post and tutorial on steemit and you should join us as well to further strengthen your decentralized activity and support.

If you feel this post is helpful please upvote this post and follow us for more helpful tips on how to get started with Bitcoins, altcoins and ICOs.

If you would like to check a unique Bitcoins service in the Philippines that offers a solid competitive rate and can guarantee you 100% safety and security on your transaction visit our website www.bitcoinsmeetup.com.

Disclaimer:

This is for educational and reading purposes only and should not be taken as an investment advice. This is not a financial advice and I am no financial advisor. Consult your own financial advisor or do your own due diligence before making any forms of Bitcoin or cypto investment.

#BitcoinsMeetup

#BitcoinsPhilippines

#BuySellBitcoins

#SafeRealBTC

Before you make any form of investment or When you buy Bitcoins there are four things you should be careful about

- Be careful of scammers

- Buy Real Bitcoins only

- Buy through meetups

- Secure your bitcoins in real wallets with private keys

We cover all topics on our website

- How to safely buy Real Bitcoins

- How to get Real Wallet for Bitcoins with Private Keys

- How to safely store bitcoins for the long-term

- How to sell for profit in the future

Visit bitcoinsmeetup.com

#CheapSafeRealBTC

Upvoted ☝ Have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit