INTRODUCTION

After the success of many token rebases and innovative market developments such as frictionless yield generation, one question remains unanswered. Why doesn't any project combine the advantages of previous projects into one while learning from their pitfalls to get maximum long-term value for DeFi investors?

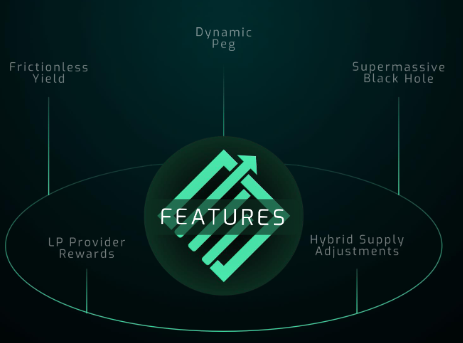

TOKEN FEATURES

Rise Protocol is a decentralized synthetic rebase asset with advanced financial tools that allow it to function as a hedge against any crypto asset class. The starting stake for Ethereum (ETH) was chosen because of its basic importance in DeFi as a whole. This peg is also easy to digest, because investors have to buy RISE using ETH.

Rise Protocol manages price volatility through elastic supply, deflation mechanisms, frictionless results, and industry-leading governance. This combination of technology and human contribution allowed Rise to thrive, but not exceed supply or demand. So, the token symbol is named -RISE.

Token Features in detail

Supply Adjustments

However, if the market price is below 5% of the share price for 3 consecutive days at 20:00 UTC, a "bid adjustment" will be triggered, instantly bringing the market price to the stake while reducing the supply of RISE. Apart from branding that is far removed from the "negative base" Terminology, which in itself has a negative connotation, we will also actively educate our investors and warn if a "supply adjustment" could occur during the 20:00 UTC rebase time of the day. Investors will be aware and notified of upcoming "supply adjustments", preventing much of the panic selling that occurs in other token rebases.

Liquidity Provider Rewards

Liquidity providers will automatically receive the revenue share. Such a frictionless result, but only for some that provide a liquidity-gain-part of each transaction action will be automatically assigned to the liquidity provider.

How did Rise solve this problem on DeFi

- Continuous:

A unique powerful "Supermassive Black Hole" deflation concept that generates and burns tokens via a variety of different methods. Effects scale exponentially over time.

Automatic liquidity generation that permanently locks a portion of each transaction into liquidity, creating an ever-increasing sales floor.

Initial rebase lag 5. This means that if the RISE price when the rebase exceeds 100% of the target price, we will receive a rebase of 20% (100% divided by 5).

"Supply Adjustment" which will increase the RISE price, but reduce supply if the market price is below 5% of the target price for 3 consecutive days during the rebase time.

- Adapt:

Increments have the revolutionary ability to peg into any asset, calculated metric, or asset class. Originally pegged to Ethereum for its importance in DeFi and for ease of understanding, this peg can be changed in the future through governance based on investor / market sentiment.

Smart contracts are coded so that each parameter can be adjusted in the future through governance. Things like sales tax, transaction tax, burn percentage, liquidity provider rewards, rebase lag, etc. All of them have the ability to be customized. This gives RISE the ability to continually adapt and change based on market conditions.

- Fair:

The pre-sale price is 0.01 ETH, which is the same as the launch price of Uniswap.

Seed investors earn Rise at 10% below launch price. However, 80% will be given for 1 month.

The unique smart contract feature allows us to activate Uniswap trading once liquidity is added and the pre-sale token is distributed. This will give everyone their fair share of play once trading starts.

Maximum transaction size of 500 Raised for the first hour after Uniswap trading is activated, preventing sniping bots and creating a fair environment for regular traders / investors.

The sale and purchase tax helps prevent coordinated price manipulation. A portion of this tax is distributed instantaneously via frictionless proceeds to all holders based on ownership.

- Safe:

Rise's contracts have been audited by CTDSec (a professional smart contract auditing firm) and by Shappy of WarOnRugs (a highly respected community owner whose goal is to prevent rug pull and fraud in crypto).

No need to transfer your tokens to the address of the contract at stake to get the prize! Frictionless results allow you to store tokens in your own wallet for maximum security. You can see your balance growing with each transaction.

If you choose to provide liquidity, you will be rewarded through the automatic distribution of liquidity prizes. Again, there's no need to send your LP token into a separate betting contract, just hold your LP token in your own wallet and watch its value increase over time.

Liquidity provided by the initial team will be locked before Uniswap trading is activated.

TOKEN DISTRIBUTION

Initial total supply – 100,000 RISE

Presale – 37,500 RISE

Initial Uniswap Liquidity – 30,000 RISE

Seed investors (vested over 1 month) – 25,000 RISE

Team funds (vested over 2 months) – 5,000 RISE

Development & Marketing – 2,500 RISE

PRESALE DETAILS

Price: 1 ETH = 100 RISE

Whitelist registration will open on February 4th, 2021 20:00 UTC.

Whitelist link will be posted on our official Twitter and Telegram channels.

You must complete all tasks on the whitelist registration form in order to be accepted into the whitelist! The team will be reviewing every application to validate. The whitelist will close once 375 ETH have been pledged.

Make sure to register for the whitelist to guarantee an allocation in the presale! A public presale will not occur if all 375 ETH is pledged, and all whitelisted wallets contribute their pledged amounts.

Minimum pledge = 0.5 ETH, Maximum pledge = 4 ETH

Presale will take place across 2 rounds starting on February 7th, 2021 20:00 UTC, with the first round dedicated to those on the whitelist.

Round 1

(20:00 UTC – 21:00 UTC) – Whitelisted wallets only.

Whitelisted wallets will have 1 hour starting on February 7th, 2021 20:00 UTC to send in their pledges. Once the contribution period ends, transactions and wallets will be validated to ensure wallet addresses and contributed amount matches the whitelist. Any unclaimed RISE from the whitelist will then be available in a first come first served public presale.

Round 2

(22:00 UTC) – Public presale.

Any unclaimed RISE from the whitelist allocations will be made available to a public presale on a first come first served basis.

ROADMAP

Idea and concept

November 2020 – the project idea is born. Plans are drawn up and smart contracts are created.

Beta testing

December 2020 – Extensive testing on Ropsten testnet to ensure everything down to the smallest detail works as designed.

Token presale

January 2021 – Seed investors sale followed by a presale in February 2021 with 37500 Rise on offer.

Code audit and go live

February 2021 – Professional code audit and launch of Rise Protocol on Uniswap.

Q2 enhancements

Q2 2021 – New partnership announced to create additional transactions, generating more tokens for holders of Rise, utilizing frictionless yield. Launch of the governance platform.

Q3 enhancements

Q3 2021 – Implement Chainlink Price Oracles to further enhance the adaptable and dynamic peg function. Further enhance the rebase dashboard to pull in additional feeds.

$RISE #ieo #blockchain #dot #bounty #defi #Rise #RiseProtocol #RebaseToken #FrictionlessYield #Rebases #DynamicPeg #blackhole #AutoLiquidity #AutoRewards

For more information about this project you can see it below:

Website: https://riseprotocol.io

Litepaper: https://riseprotocol.io/rise_litepaper

Twitter: https://twitter.com/RiseProtocol

Medium: https://medium.com/@riseprotocolofficial

Reddit : https://www.reddit.com/user/riseprotocolofficial

Discord: https://discord.com

Telegram: https://t.me/RiseProtocolOfficial

AUTHOR

Username : Shelacans

My Profile Link Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=3136770

ETH ADDRESS : 0xF4F1E40CC4A7f16941c47a5DE71e53a1013c2AF0

Telegram Username : @Selapesekk