The BTC price resets cause Bitcoin addresses to incur widespread losses.

(by Shubham Raina)

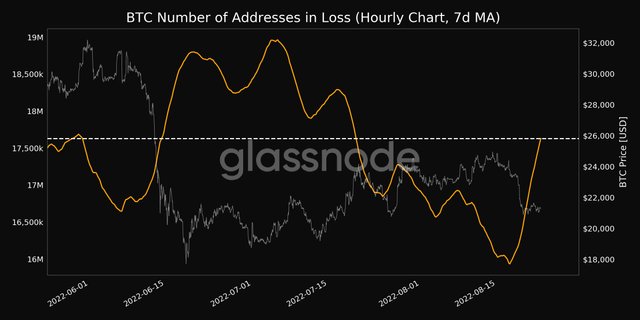

Most recent reports recommend that over 17.5 million Bitcoin wallets are under misfortunes starting around 23 August, more than some other day in the previous month. Bitcoin brokers are under extensive tension as BTC/USD has been beneath $21,000 multiple times since 19 August, as indicated by information from Cointelegraph Markets Pro and TradingView.

With Bitcoin being at its least since the last seven-day stretch of July, individuals who purchased as of late are additionally encountering their wallets bleeding cash, at different degrees. Additionally, the degree to which financial backers added positions to add to the current month's $25,500 highs is presently more clear, with more BTC tending to confront a general misfortune than whenever since 23 July.

GET A FREE $1000 PAYPAL GIFT CARD

Submerged addresses, for example, those that hold resources that were bought over the ongoing cost, have been exceptionally clear since last week's unexpected cost drop. As of composing this article, the seven-day moving normal (MA) of wallets in the red stands at as much as 17.5 million. This depicts an increment of roughly 1.5 million over the most recent few days.

The observing asset, Coinglass, which covers liquidations of positions on subordinates trades additionally shows measurements that demonstrate that most of the misfortunes caused on 1 August, with cost developments across $21,000, are not so significant. In the meantime, 19 August fixed the complete figure of $209.5 million in lengthy position liquidations on trades, which is the most elevated since 13 June. Besides, there were $30 million in short situations too.

Rekt Capital, a merchant, and expert remarked on the circumstance showing Bitcoin's most memorable close beneath the key 200-week MA since July. Others additionally featured that risk resources confronted weighty obstruction in the business sectors while the USD broke higher. The US dollar list (DXY) and Bitcoin have recently shown an opposite connection, to fluctuating degrees. The DXY hit its most noteworthy since 14 July, crossing the 109 imprints and up 4.4 percent since its burdens in August.

excellent

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit