Original post and more see https://news.bitshares.org/

Intro

Ethereum seems to have come into the news lately on account of the highest ever fees and record income levels by the platform. Some hail the price rally, others ask about what this means to smaller businesses and individual traders using DeFi products. When all of a sudden it can cost $22 to send a single token, some are struggling. As it is not possible to make an Ethereum fees comparison directly with BitShares, we'll focus more on the high level topics. For even more context to BitShares, please also see our previous post all about fees here.

High Fees are not a DeFi Success

To better understand importance of the topic before continue to read, take a look at ours last year's article on comparison with Binance chain fees. On one hand we do see sense in collecting huge fee revenues as an indicator of profitable business. This obviously increases the overall market value of the cryptocurrency and provides investors with returns. On the other hand, at the heart of it logic must prevail, as if fees are too high it will also prohibit people from using it. If it's not accessible/affordable to regular people because fees make utility untenable, there won't be much value remaining apart from the corporate one. Fees also cannot keep increasing beyond what a bank would charge - it would defeat one of Crypto's main advantages which beyond privacy or liberty or freedom - should absolutely be limiting the middle-man cost. Further the point here is also sustainability - platform fees must be competitive to sustain usage, or something cheaper will replace it.

Heavy Fuel

It's the popular apps/tokens which are implemented on the ETH network with the ERC-20 smart-contract offerings that take the lion's share of fees. Uniswap and TUSD are the biggest. Below is a table of info thanks to 'ETH Gas Station' website (link below) showing the largest 'gas guzzlers' as of the past 30 days. The purpose is to highlight that vast amounts of business funds have been consumed by these fees alone.

Ethereum Top 25 Leaderboard

| Rank | Name | ETH Spent | Avg. Gwei | USD Value |

|---|---|---|---|---|

| 1 | Uniswap | 19.2K | 89.4 | $24.3M |

| 2 | Tether USD | 12.2K | 94.0 | $15.4M |

| 3 | 1inch Exchange | 3.23K | 95.3 | $4.10M |

| 4 | SushiSwap | 1.95K | 119 | $2.47M |

| 5 | USDC | 1.83K | 102 | $2.31M |

| 6 | 0x0000000000007...e9f56 | 1.43K | 114 | $1.81M |

| 7 | Aave | 1.11K | 97.2 | $1.40M |

| 8 | 0xa57bd00134b28...dd6cf | 1.09K | 218 | $1.37M |

| 9 | 0x | 1.08K | 88.5 | $1.36M |

| 10 | Metamask Swap | 1.07K | 90.9 | $1.36M |

| 11 | ChainLink | 927 | 103 | $1.16M |

| 12 | 0x00c7a37b03690...75446 | 911 | 108 | $1.16M |

| 13 | Synthetix | 832 | 88.4 | $1.04M |

| 14 | 0x860bd2dba9cd4...78f66 | 757 | 117 | $958K |

| 15 | 0x00000063f648c...ff184 | 733 | 123 | $924K |

| 16 | dYdX | 720 | 78.6 | $922K |

| 17 | 0x78a55b9b3bbef...c55e8 | 625 | 123 | $789K |

| 18 | 0xa090e606e30bd...0057e (Scam Reported) | 594 | 73.7 | $750K |

| 19 | SmartWay Forsage (Scam Reported) | 557 | 70.2 | $694K |

| 20 | Bitstamp | 544 | 123 | $691K |

| 21 | 0x0000000000000...10084 | 528 | 1.22K | $665K |

| 22 | DAI | 518 | 94.4 | $652K |

| 23 | 0xf570deefff684...f7419 | 499 | 113 | $637K |

| 24 | 0x03f34be1bf910...59659 | 496 | 97.9 | $633K |

| 25 | 0x00000000cd47a...4374c | 482 | 570 | $610K |

Fees and Benefits

For Ethereum we cannot make direct comparisons to the BitShares fee schedule. This is since Ethereum platform fees are called Gwei or 'gas', and only calculated at the time of execution, and vary at any given moment. They are explained in best detail by looking around websites such as ethgasstation. On BitShares the basic user fees such as a transfer are fixed and remain around a low 0,9 BTS for lifetime members.

The chart above shows the vast amounts of funds collected in fees alone by the Ethereum platform. A good question to ask is with such an increased income, will any of it enable the network to become faster and more widely adopted? Barriers to entry should be at the business/operator level, not the retail end. From what we understand of Ethereum also, fees in 'gas' or Gwei go to miners. On BitShares, fees go the reserve pool in order to pay for more servers and staff, ensuring a sustainable and ever growing and evolving system.

Fees for all actions on the BitShares blockchain are low. This has nothing to do with the traffic or usage being low. Rather, from the outset BitShares is a Proof-of-Stake blockchain, which ETH 2.0 will become. There are no performance concerns with this design. Data from past tests demonstrate even with vastly more congestion, BitShares could simply add more nodes to meet the demand. Congestion is only limited to the number of available terminals (RPC nodes), block confirmations are still 1.5 seconds. On BitShares even though a full tx costs only a few cents, it still takes ~63 seconds for entire round of block producers to validate last block as fully irreversible, and appears almost instantaneously (after 1st block confirmation ~3 sec) anywhere around the world.

How to check BitShares fees

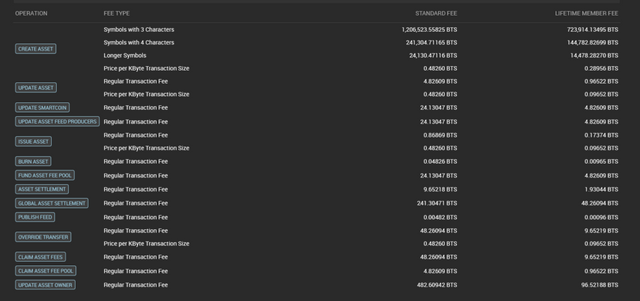

As a heads-up to anyone looking to check the current BTS blockchain fees, they can all be viewed in one place here on the reference UI.

Above: BitShares Wallet Explorer

Fees on BitShares can also be adjusted at anytime by the committee account. This sometimes happens to adjust for the value of the BTS token, ensuring fees remain competitively low for retail use.

High Fees Limit Choice

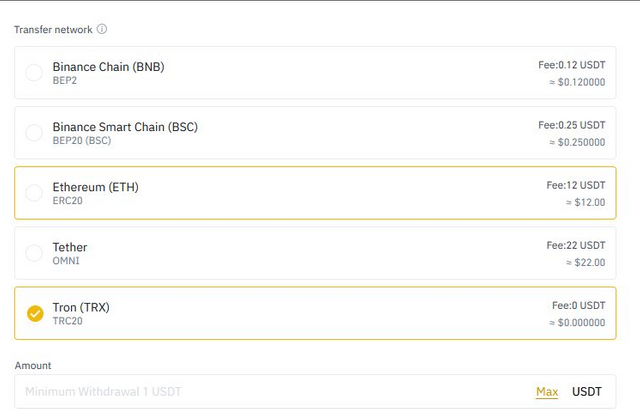

Below for reference, Binance methods of sending USDT, 11th Feb 2021. We can see Ethereum based platform fees run $12 & $22. This is regardless how much USDT is being sent. Tron Network meantime offer zero fees, which may always be always the case (at time of writing, we are yet to explore the economics). Other options depend on you using a Binance chain, at around 12 cents or 25 cents.

In a different scenario with a (revived) bitUSD on BitShares, it would cost a Lifetime member around 0.9 BTS to send any amount around the globe at time of publication (< 6 cents USD).

Binance USDT (ETH token) transfer fees

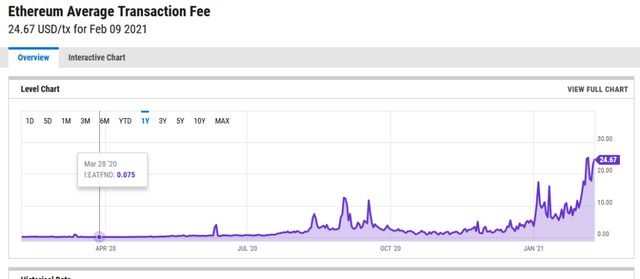

When you pay fees on any blockchain, you are essentially paying for the computational resources of your own actions. Hence the term 'gas' refers to a dynamic calculation on Ethereum, which increases based on network congestion. Below shows a historic view, where it can be seen to have grown quickly in 2021. However, the drastic increase in fees does not come with any increase in overheads, improved infrastructure or performance. In BitShares platform for the sake of this Ethereum fees comparison, increased usage results in increased reserve pool revenues to spend on scaling the network.

Ycharts.com shows avg tx fees on Ethereum at an all time high of over $20 usd

Conclusions

BitShares platform publishes a fixed cost of use, regardless of network load. They can be adjusted when unpredictable events occur. It is surely obvious that fees need to remain low also for sustainability, or if too high they will leave a platform obsolete.

Fees in DeFi do need to cover the network cost, and sustained development on top. Growth or profits should be from increased revenue due to increased usage, not due to increased fees.

BitShares fees have and always will be set via a means of fixed rates via blockchain consensus through committee-account. Programmatic setting of fees based on usage level can lead to unpredictable results.

With great excitement, we are waiting to see what Eth 2.0 will really bring as a hybrid (re)innovation of its original concept from 2015.