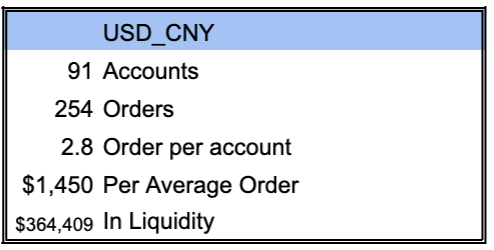

There are 91 account with 254 orders in the market. Understanding what is happening behind the scenes of the BitUSD and BitCNY markets can be very important for traders, investors and other participants.

This DEXbot Liquidity report is brought to you by Cryptick1 who has been deep at work in the numbers, to gain a better understanding of the inner workings of these decentralized markets.

BitShares is a decentralized crypto-currency exchange based on block chain technology where you can buy and sell coins without a centralized trusted party. Two of our most popular smartcoins are BitCNY and BitUSD. Both of these smart coins can be created by locking up BTS in the blockchain. They also can be traded for a variety of coins. This report, shows the inner workings of the market where they are directly traded back and forth.

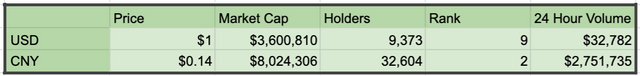

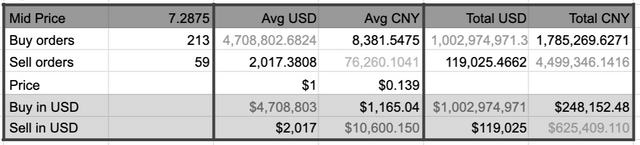

Here is a brief look at the two markets...

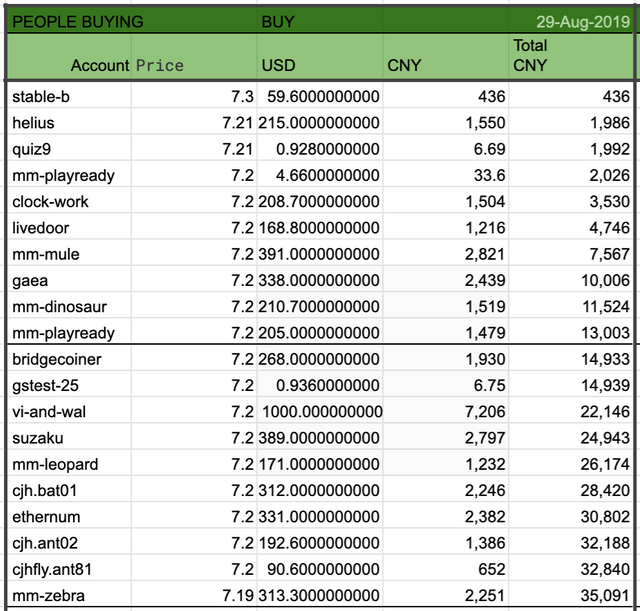

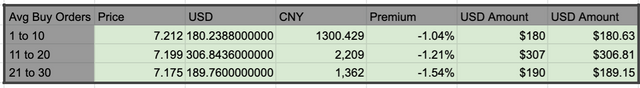

We have raw buy orders...

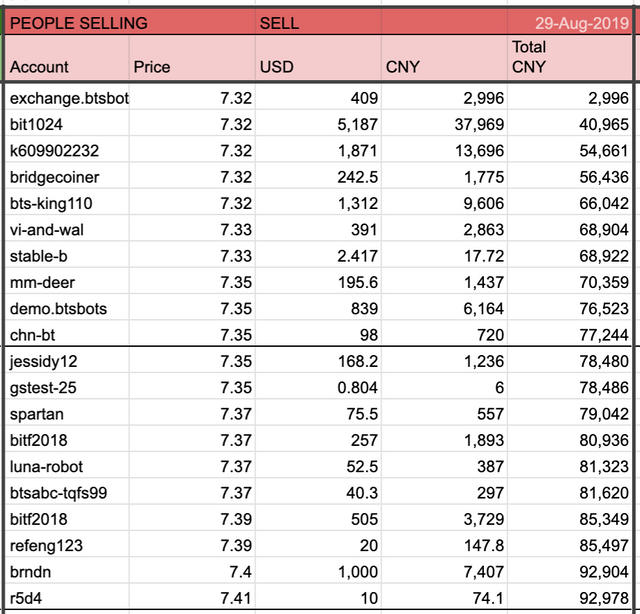

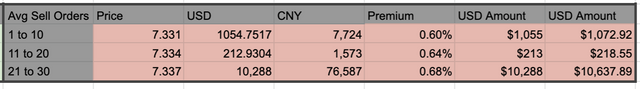

We have raw sell orders...

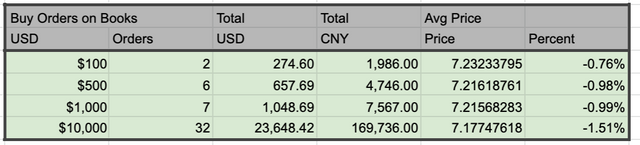

But we are generally concerned about the liquidity, and the liquidity at the money.

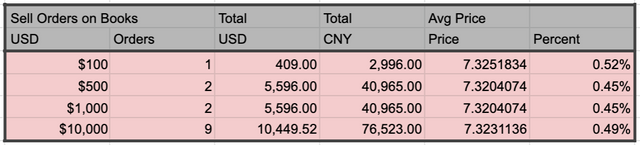

And here is the liquidity on the other side...

Another way that might be clearer to look at this is what if you wanted to buy or sell a set USD amount of money. How close to the middle price would you get? Looking at the data this way...

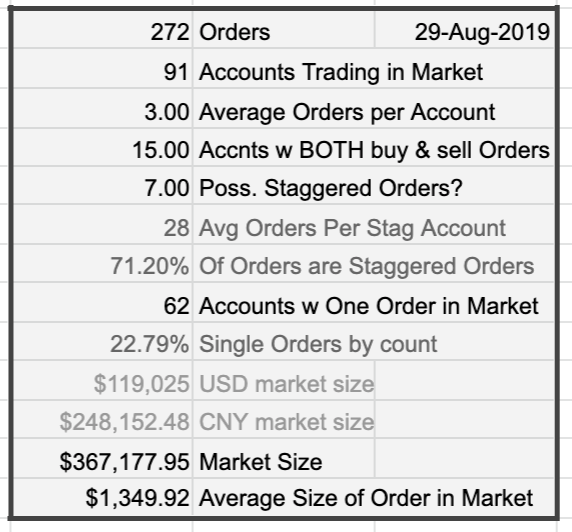

Beyond just Liquidity, there are a few numbers we need to look at to make sure we understand the overall markets.

Here for example we see the average order size in the market is large about 10 times the size of many other markets.

Another nice chart with some breakdowns...

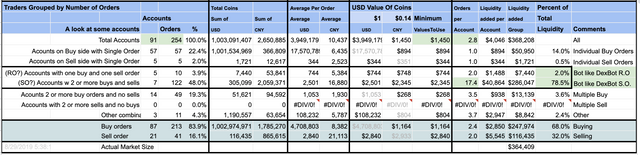

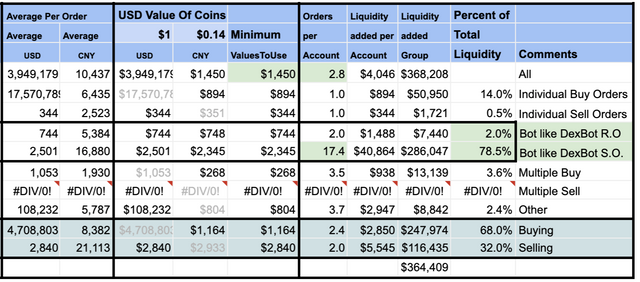

And now this is the chart I have been working on for a long time. One of the things we have really been trying to get to, is to what extent to various bots, or or market makers play in the market. Bots are a huge part of crypto-currency exchanges. Just by looking at the order book it is possible to pick out some bots based on activity. This is not an exact science, and all these numbers need to be taken with a grain of salt. Getting the numbers right has proven hard, as certain data keeps throwing the numbers out of perspective. I think I have fixed most of these bugs, but I am sure somewhere a few have gotten through.

That said, this breaks market participants into groups based on the number of orders they have in the market. This groups bots together and generally separates them from people who might just have a buy or a sell order. This data is a guess and it lumps all accounts with bot like behavior together. It also lumps bots like the Rudex, btsbots, and DEXbot Relative Orders strategy together. The idea and purpose was to see the liquidity, number of orders and amount of orders based on groups.

Yep, there is a lot of data in there. And one can see all sorts of interesting things. Looking at the top line, There are 91 accounts that have 254 coins.

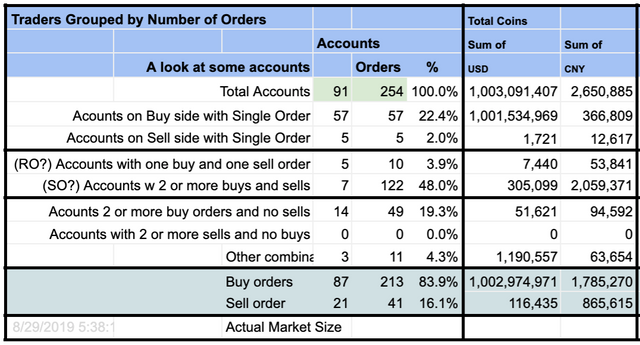

Let's break this in two...

And the second half...

We can then see total coins in the market for all orders, and averages. I convert these coins to USD amounts and take the minimum number to represent average order size. (This seems to be the most accurate way to do so.) Then we what each order adds in liquidity, what each account adds in liquidity, and what the group as a whole adds as liquidity. Finally, a breakdown by percent is given. Due some large market makers in the data set, 72% of market liquidity is provided by market makers using a staggered orders type strategy. (This is exceptionally high in this market.) While normal investors (people with one buy and sell order), represent about 14% of the market.

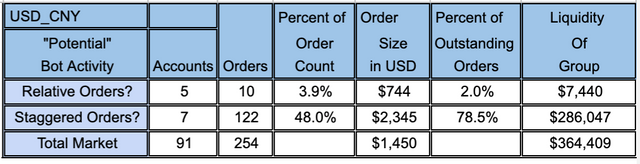

Here is a simpler breakdown

Bots play an important part in liquidity of the BitShares market, and the DEXbot is an open source liquidity bot you can trade with to help liquidity.

Telegram chat room link

https://t.me/DEXBOTbts

Development of DEXbot has been supported by an on Chain Worker Proposal. Download from github today.