BlackRock launches first Ethereum-based tokenization fund. Tokenization is the process of representing real-world assets digitally on a blockchain. BlackRock has consistently said its digital asset strategy involves the launch of ETFs and the tokenization of financial assets.

One of the well-known asset management companies Blackrock has launched its first tokenization fund on the Ethereum blockchain.

This company seeks to bridge the gap between traditional markets and new technology.

As reported by Quartz, the BlackRock USD Institutional Digital Liquidity Fund, also known as BUIDL, is fully collateralized by cash, US debt securities and repurchase agreements. This provides eligible investors with the opportunity to earn returns in US dollars

BlackRock has partnered with Securitize as the transfer agent and tokenization platform, and BNY Mellon as the fund's asset custodian which also includes Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks, which will provide infrastructure for the fund.

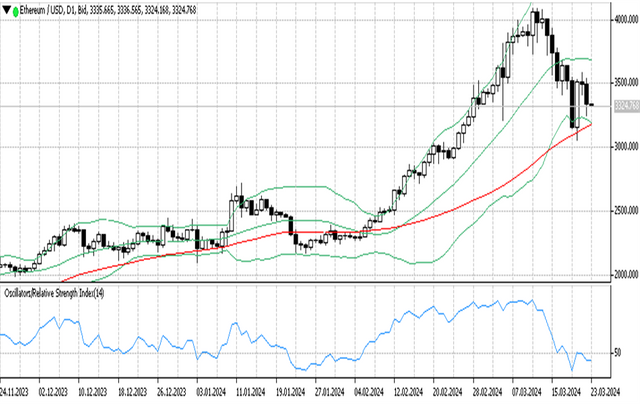

Ethereum/USD Technical analysis today

Ethereum is moving in the red zone today, down 5.07% after forming a Doji indecision candle yesterday. In 24 hours Ethereum price performance formed a Low of $3,254.97 and a High of $3,541.90. Technical indicators of 10 tools give sell signals and 12 moving averages give sell signals.

Ethereum's market capitalization has reached over $398 Billion.

Investing's summary of several technical indicators and moving averages today provides a strong sell signal.

On the Ticktrader daily timeframe chart, the price of Ethereum/USD moved slightly above the lower band line and formed a bearish candlestick.

Bollinger bands appear to be starting to form a horizontal line, an indication of changes in the market which previously tended to be an uptrend into consolidation.

MA 50 near the lower band line is still forming an upward channel indicating an uptrend market.

The RSI indicator shows level 45, which means the price is below the downtrend level.

On the H1 timeframe, the price moves between the middle and lower band lines. Here the Bollinger band appears to be expanding, which means high market volatility.

MA 50 forms a flat channel above the middle band line indicating sideways.

The RSI indicator shows level 41 which means the price is moving below the downtrend level.

Support and resistance.

S3: 3264.31

S2: 3285.93

S1: 3299.96

PP: 3321.58

R1: 3335.62

R2: 3357.23

R3: 3371.27