.

The risk for financial hardship is rising on a daily bases due to several factors like environmental issues, unemployment rate Governmental policy etc. in other to solve the quest for acquiring property and financial asset the mortgage comes come up with idea in rescuing lives from these financial struggles in acquiring property although the mortgage despite their vision, the mortgage industry lacks ideas on how to solve her present challenges .some of the challenges face by the mortgage industry include the following:

Poor communication

Lack of mutual communication is the single most common complaint in the mortgage lending process. Both borrowers AND lending agent want to know that the lines of communication are open. Most communication channel are not communicated to the end users of such loan. from authentic investigation, real estate agents complained that when a loan officer doesn’t communicate well, the real estate agent themselves become the person in the crosshairs of the borrower(s). It’s hard to always be on top of every call and email that comes into the office.

Frequently sending repeated document

Borrow know very well that document are required for them to take loan , which takes a lot of time to gather this document details to the lenders such document as account details, tax returns details which consume most of their time. From borrower point of view is the most tedious deal they are trying to make.

When all processes are done, you may be told that the loan officer either can’t find, or lost, or “never received”, your documents which is definitely one of the most frustrating experiences a borrower can go through.

- The processing speed for loan takes longer

This issue tends to be compounded by the first two common complaints. Sometimes there are roadblocks that can’t be avoided on the path to closing, but what really frustrates borrowers and real estate agents is when this isn’t communicated.

Real estate agents speak to how frustrating it is when a loan officer they’re working with doesn’t bring up issues with the loan until it is no longer salvageable in the original time frame. Even if your intention is to try to fix the issue and get the loan back on track, it’s better to under-promise and over-deliver.

Introduction of Block66

Block66 is a crypto currency platform where lenders can access a market environment vetted by borrowers who are looking for financial loan. This marketplace is for everybody with 100% transparency and is highly automated with low cost and low risks

These loan the borrowers borrow from lender represent a pool of loan called “POL Token” which are repurchase by investor providing with liquidity and empowering a diverse pool of public investors to the block66 platform

Block66 is decentralized application built on the ethereum smart contract.

All mortgage provider in the block66 platform are issued legal license in blockchain and also reflected in the physical world through Digital trust Fund.

Block66 will also provide legal assistance across various geographical locations where borrower will be on defaults by way of a network of partnerships.

Lender in the block66 platform will create their own criteria on lending to borrows, and borrowers will have to choose from the list of thousands of borrowers that suit their needs.

Block66 has put in place a technology that detect fraudster both by the borrowers and the lender by reviewing all legal document authenticity.

When a borrower is match with a lender base on the block66 platform a proof of loan will be generate on the ethereum smart network contract called “POL token” which an audit report of the transaction made on the block66 decentralized App.

The borrowers identity is carried by an API which is done by a third party which does KYC that enable the broker or lender to defect fraud.

Where possible, the system will perform cross-checks of affordability data by querying credit rating agency APIs and, in time, bank feeds to check income and monthly expenditure.

Users of block66 platform both the borrower and the lenders will have an account with cryptocurrency exchange that support and partner with block66. This account will be used for loan repayments by the borrower after the mortgage is issued, and

Will act as a bridge between the conventional fiat banking system and the Ethereum/Block66 ecosystem

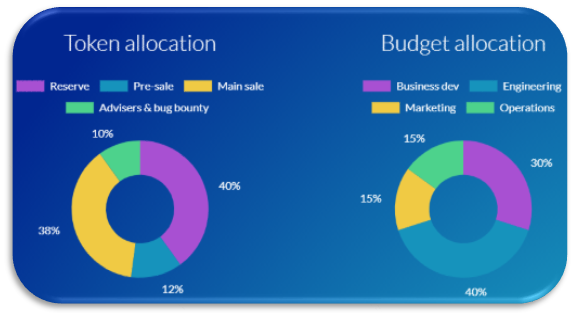

Token Generation and distribution

Total token supply: 305,000,000

Circulating supply: 155,000,000

Breakdown of tokens held by Block66

120,000,000 (40% of supply) held by Block66

30,000,000 (10% of supply) for team, advisors and bug bounty

Public pre-sale

50,000,000 tokens with a 33% discount at $0.10 per token

for a total of $5,000,000

Main sale

105,000,000 tokens at $0.15 per token for a total of $15,750,000

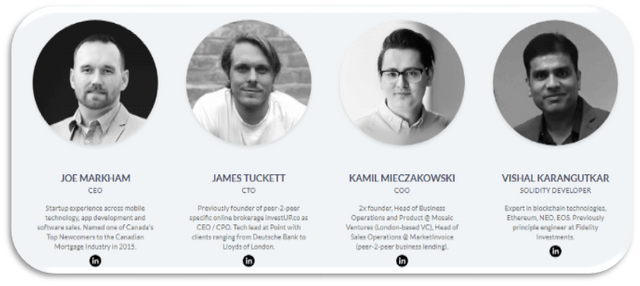

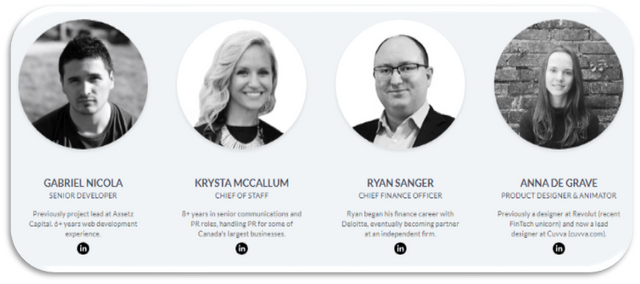

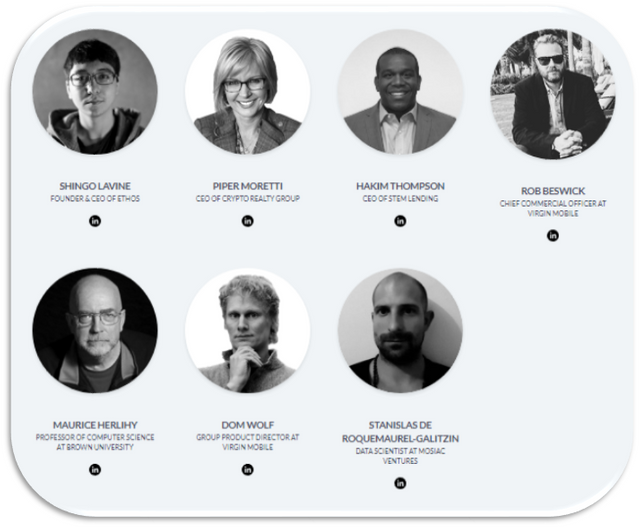

Most Organized Team

block66 Advisors

for more info follow the below link

https://block66.io/

https://www.facebook.com/Block66Official

https://twitter.com/Block66_io

https://www.linkedin.com/company/block66/

https://www.reddit.com/r/Block66/

https://medium.com/@block66

https://t.me/block66_Official

https://www.youtube.com/channel/UCHBDzsJ5aKcYr02lrDVxoag?view_as=subscriber

Writer's Details

Bountyox username: myshawn

Bitcointalk username: wizardcrypto

Bitcointalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=2312222

Thanks for sharing such great information...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you welcome just follow up the link provided because is huge project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

tnx to sharing this information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for shearing this information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome , just follow the link for more info and success of the project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks buddy for this useful information ..keep posting good stuff like this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

more update about the sucess of the project pls follow the link

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good Review dear

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks , this a huge project dont miss it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for sharing the valuable info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome , this a project you cant offer to miss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thnq for giving me this information 🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you are welcome , is good project with lot of benefit for everyone

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing I will check the site for details information on how to purchase

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

dont miss these great project hurry up and buy the ico

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for sharing the information bro. Keep it up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

for more info about the project follow the link mention above

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good effort to make this article. It's really relate with realty .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

is great project , do well to follow via the link provided

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice one. Thx for Sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome , follow the link above for the success of this project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for providing very in-detail information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

is a great project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank for sharing

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you can follow the link l shared for more update about the success of the project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looks great!

Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

welcome bro , you can check the link above for more update this project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

with this new technology by the block66 , the mortgage will be revive again more effective than usual for every one

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this huge project involving a robust technology to remove challenges in the mortgage industry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @sonnyeyakwaire! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Goood info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good review boss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good review boss

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice info

@aggamun

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice bro great idea

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit