I have been reviewing Digital Gold for a while now and i have to say this project keeps getting better by the day, without much intro i would like to give my insights on "why i think every investors should include Digital Gold as an asset in their portfolio"!

Brief History Of Gold

Unlike paper currency, coins or other assets, gold has maintained its value throughout the ages. People see gold as a way to pass on and preserve their wealth from one generation to the next. Since ancient times, people have valued the unique properties of the precious metal. Gold doesn't corrode and can be melted over a common flame, making it easy to work with and stamp as a coin. Moreover, gold has a unique and beautiful color, unlike other elements. The atoms in gold are heavier and the electrons move faster, creating absorption of some light; a process which took Einstein's theory of relativity to figure out.

Gold retains its value not only in times of financial uncertainty, but in times of geopolitical uncertainty. It is often called the "crisis commodity," because people flee to its relative safety when world tensions rise; during such times, it often outperforms other investments. For example, gold prices experienced some major price movements this year in response to the crisis occurring in the European Union. Its price often rises the most when confidence in governments is low.

Why should i invest in Gold?

Increasing Demand:

In previous years, increased wealth of emerging market economies boosted demand for gold. In many of these countries, gold is intertwined into the culture. India is one of the largest gold-consuming nations in the world; it has many uses there, including jewelry. As such, the Indian wedding season in October is traditionally the time of the year that sees the highest global demand for gold (though it has taken a tumble in 2012.) In China, where gold bars are a traditional form of saving, the demand for gold has been steadfast.

Demand for gold has also grown among investors. Many are beginning to see commodities, particularly gold, as an investment class into which funds should be allocated. In fact, SPDR Gold Trust, became one of the largest ETFs in the U.S., as well as one of the world's largest holders of gold bullion in 2008, only four years after its inception.

Portfolio Diversification:

The key to diversification is finding investments that are not closely correlated to one another; gold has historically had a negative correlation to stocks and other financial instruments. Recent history bears this out:

- The 1970s was great for gold, but terrible for stocks.

- The 1980s and 1990s were wonderful for stocks, but horrible for gold.

- 2008 saw stocks drop substantially as consumers migrated to gold.

Properly diversified investors combine gold with stocks and bonds in a portfolio to reduce the overall volatility and risk.

How can i invest in Gold during this period?

Well, so much of the world has been in a state of panic during this pandemic. Financial markets have continued to operate often with spectacular results for investors. Some of the greatest opportunities of our lifetime will unfold in the coming months and years and if we are to survive the effects of the pandemic then this is not a time to shy away from investment ideas. This is the time to embrace them and investigate their potential for our investment portfolios.

If I can point you in the direction of the blockchain technology, is definitely one of the hottest topics out there, but I want to bring you back to the topic of stablecoins, and the topic of stablecoins is never far away from the topic of gold as most stable coins are pegged to it.

But when it comes to investing in gold you now have to decide what form that should take either physical or digital gold. But as times have changed most millennial's are opting to invest in the digital form of gold as opposed to its physical form thanks to the numerous advantages they present. One such project pegging its stablecoin to gold is “Digital Gold”.

When a person buys in Digital Gold, they are not only acquiring Gold, they are guaranteeing the value of their money, where they will not suffer any type of inflation or loss, they will have more security for their person and family, as it is shielded with the safest technology such as of Blockchain, best of all, is that you do not need any intermediary to buy, just go to: https://gold.storage/es/home and follow the simple steps to acquire the gold you need or require.

Review Of Digital Gold

Digital gold works on the ethereum blockchain and every transfer made can be seen transparently on the ethereum blockchain.

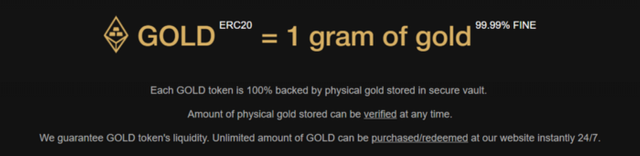

The company, which holds physical gold reserves in Singapore, tokenizes its gold assets and issues 1 GOLD token for every gram of gold stored as reserves.

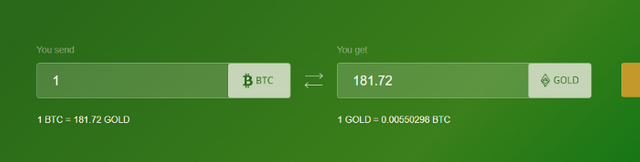

Each 1 GOLD token is worth one gram of gold. GOLD tokens are traded on cryptocurrency exchanges and decentralized DeFi applications. With the development of DeFi, that is, decentralized finance applications, in the

near future, gold-based cryptocurrencies such as Gold Token or gold token or various tokenized assets may be possible in various financial transactions such as collateral and obtaining loans without intermediaries.

The amount of tokens circulating in the market can be questioned at any time thanks to the Ethereum blockchain, which is transparent due to its structure. In this way, users can compare the total circulation of their tokens in the market and the amount of gold held as reserves.

The company, on the other hand, earns an annual revenue of 0.99 percent as a gold storage service.

By clicking here, you can view the number of Digital Gold tokens in total circulation over etherscan.

You can check physical gold reserves with bullionstars live audit reports by clicking here.

Although the Ethereum blockchain is transparent, it can be considered anonymous. Although each of the transfers made is recorded, there is no record of the identity of the wallet owners. During the purchase and sale of

Digital Gold tokens, users can transfer anonymously and hold Digital Gold tokens anonymously, without having to present their identity.

Why should i use Digital Gold?

Easy means for purchasing and investing in Gold: Digital Gold also serves as an anonymous and more efficient means of purchasing and investing gold without losing the monetary features of your investment unlike conventional methods of investing in gold.

Free charges for transfer: The GOLD token being issued on Ethereum can easily be transferred without any payment of transfer fees being required by the platform with only negligible network fees for processing the transaction on the Ethereum network.

Secure capacity of gold: Any financial specialist hoping to put resources or invest into gold must have suitable capacity set up so as to guarantee its security. GOLD token holders need not stress over, for example, the physical gold is safely stored in the DIGITAL GOLD organization's vault, guaranteeing asset security consistently.

Conclusion

In conclusion, Digitizing gold, absolutely, will increase the attractiveness of gold itself worldwide. Digital Gold's initiative to combine gold with blockchain technology will revolutionize today's financial markets. This is inseparable from the value of gold, which increases every day with a period. We need an open mind, due to the fact that the cryptocurrency itself contains a negative rating for some people. Keep in mind that cryptocurrency based on gold itself has the ability to freeze with the "new age" and, most likely, the means to pay for daily transactions in the future.

Related Links:

Website: https://gold.storage

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=5161544

Whitepaper: https://gold.storage/wp.pdf

Telegram: https://t.me/digitalgoldcoin

Twitter: https://twitter.com/gold_erc20

Blog: https://steemit.com/@digitalgoldcoin

Reddit: https://www.reddit.com/r/golderc20/

Author Details:

BTT Username: Gafman

BTT Profile Link: https://bitcointalk.org/index.php?action=profile;u=1903236