The lending space in Fintech is booming in India and around the world, with startups using machine learning and AI to better gauge the credit worthiness of an individual. Information from social media, text messages, and even location specific data from google is used to better understand customers by lending firms. Most lending firms target the middle class or even upper middle class of society, hence they are able to get accurate data through peoples’ mobile phones. Peer to peer lending is growing as an asset class in India with better KYCs enabled through the India stack APIs and Aadhaar number. Most traditional banks as well as emerging fintech players target the so called India-1 and India-2 who are the lower-middle to upper class.

However in India, over 50% of the population live in the rural areas. Most of this population falls in the lowest income group in the country. This does not mean that most of them are poor, but just that everything from groceries to real estate is much cheaper in the rural areas hence people don’t make a whole lot of money, but they don’t spend a lot either.

Microfinance institutions lend to this low income group segment through the grameen bank framework pioneered by Mr.Yunus. This framework uses lending circles and peer groups to loan money and enhance recovery of loans with a majority of loans given to mothers. Microfinance institutions often get their capital from banks. Their margins are on the higher rate of interest given to the low income families. The rate of interest is higher due to higher risk of default and large costs associated with loan recovery, sometimes to the tune of 40% of the interest charged on the loans. In India, microfinance has played an important role in farmers securing financing for their land. However, critics of microfinance show that due to increased pressure to show profits, MFIs give out a large number of loans without a proper credit check and use coercive methods to recover, which has lead to farmer suicides.

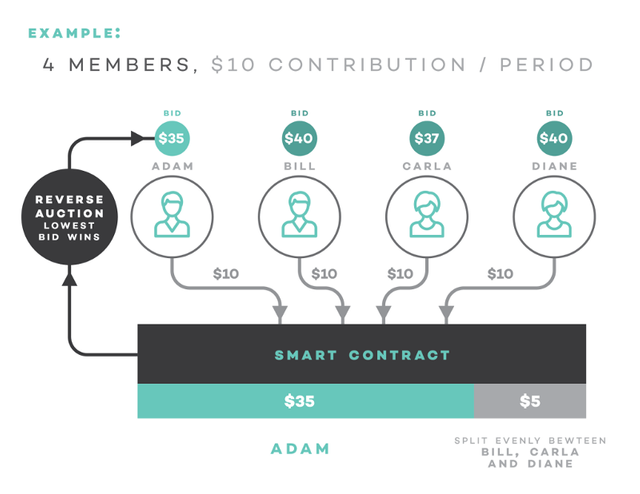

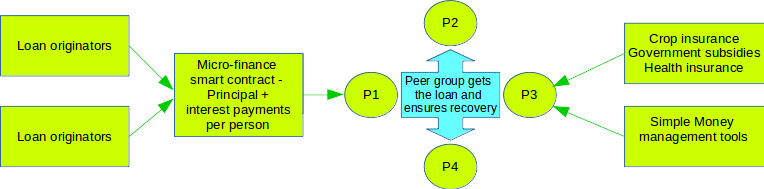

Peer to peer lending with smart contracts for loan disbursal and for interest payments could reduce costs giving out loans and recovering loans. Anyone from the urban areas can lend money to people requiring micro-finance in the rural areas. The Aadhaar could be used as identity, and lending circles could be created in the rural areas to which loans would be given; these lending circles would be groups of people identified by their Aadhaar and smart contracts could automate disbursal of loans as well as interest payments back to the loan originator. Another model could be a smart contract + incentivization program to help better recovery of loans in microfinance institutions.

For example, let’s say a microfinance company ABC wants to give out 100 loans to women in a village. They design a multi-sig + smart contract that acts as a mini-company that gives out loans to each person; the loanees are identified by their Aadhaar numbers. Every person can see how the other has paid back, how much they have taken as a loan. Interest payments would occur back to the company (or DAO in blockchain language) as well as nano peer to peer lending could occur from one woman to another. Another organisation could use this data to determine how much insurance (such as crop insurance) to lend out or suggest to the women as to what they can do with the money given their current employment. This could be a different model of peer pressure that could be used for loan recovery.

Another issue that is faced by people receiving microfinance loans is one of money management. If someone in the rural areas receives a loan of $100 with 20% interest payable semi-annually, how do they manage their money such that they can make enough to pay back the interest payments. Money management is not an easy task, and it is assumed that those who receive the loans are good at money management (statistics have shown that over 30% of the value of loans received is used for purposes other than what was intended for the loan). Organisations could offer money management tools to lending circles and peer groups to solve this problem, although it is not yet clear if money management could be automated through smart contracts.

At WandX, our first product is the decentralized portfolio trading Dapp. Our larger vision is to enable easy digitization of assets and creation of financial products on these assets and cryptocurrencies. Our front-end module would enable creation of this microfinance model on WandX. Although such a model is some distance away in India (Internet connection and smartphone ownership is restricted to less than 50% of the population), WandX will create the platform for such applications to be possible. We see an application of our framework in many real life use cases which we will pilot in the next couple of months. Follow, like, and stay tuned to our blog!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.wandx.co/microfinance-loans-recovery-on-the-blockchain-applications-of-wandx-311355cdd794

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit