CoTrader solves the complexity problem of investment management, and aims to become the world’s largest investment funds marketplace by democratizing the $85 trillion global funds industry. For the first time in history, investors, now powered by CoTrader’s blockchain platform, can have their investments managed with complete transparency, control of assets, and proof of a fund’s past returns-on-investments (ROI). CoTrader’s MVP already supports cryptos, and is live on the Ethereum mainnet at mainnet.cotrader.com

Transparent investment funds marketplace on the blockchain. Offers complete liquidity, asset control, security, privacy, and proven ROI. Supports cryptos, ICOs, stocks, shorts, derivatives and all tradable assets via its super-DEX hybrid exchange tokenization infrastructure and anonymizable smart funds protocol.

There is no other platform that has your privacy and security at heart. In technical terms: CoTrader's patent-pending technology involves a custom zk-SNARKs protocol that extends privacy-preserving co-trading to cross-blockchain decentralized exchange mechanisms.

Because of CoTrader’s powerful network effects, loyalty rewards, real working demonstrated MVP, and first-mover-advantage with the solution to a widespread problem, it’s positioned to be a dominant protocol and novel ledger technology upon which all decentralized trading dApps could offer private trading and cotrading.

CoTrader SuperDEX Infrastructure

Fund managers can trade assets on decentralized exchanges (DEXs). CoTrader provides a SuperDEX infrastructure that pools other DEXs together for maximum the liquidity and power. The initial integrations into the CoTrader platform will use Bancor, Kyber and 0x exchanges .

Further DEXs will be added over time as well as a native CoTrader DEX. This will be done on the fund manager dashboard which will also provide tooling and charts to make the best decisions for the fund

Privacy Preserving Anonymous Funds Protocol

CoTrader's unique and patent-pending anonymous funds protocol extends it's smart funds protocol to prove fund managers' ROIs, but without revealing their valuable trading strategies. Anon funds can be implemented using any underlying privacy preserving smart contract mechanisms, such as zero-knowledge proofs and ring signatures

Mission

Our goal is to help people realize greater financial freedom by maximizing investment returns in minimal time. We connect investors from both sides of the expertise spectrum for their mutual benefit. We're democratizing investment funds for a creative world with fewer boundaries.

Token

Token Symbol: COT

Public ICO: End of Q2 2018

Max HC: $10M or 20k ETH

Total supply: 100B tokens

Type: ERC20

1eth = 500k cot

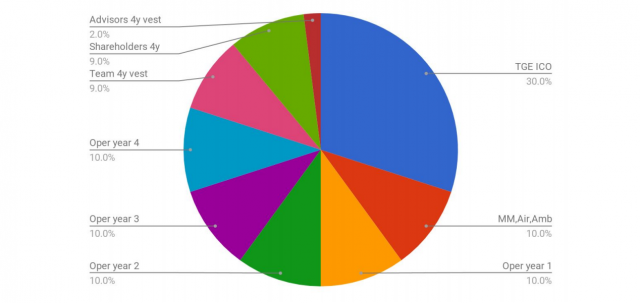

Locked tokens aren’t usable until unlocked. For example, the Company’s tokens are unlocked over 4 years to fund long term expansion operations of the company. Each year, starting one year after the end of the TGE, 12.5% of the tokens would become unlocked to fund the project further.

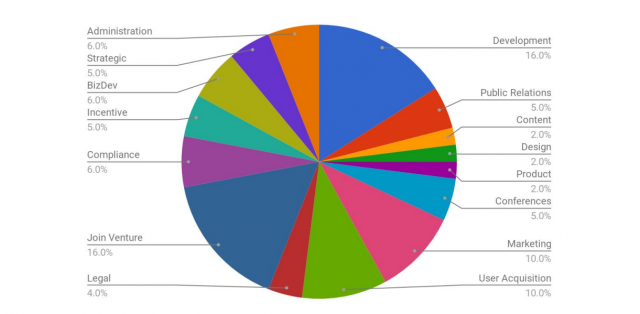

Projected Use of Token Sales

CoTrader tokens are needed to hide trading strategy, as tokens will interact with our unique privacy-preserving smart-contract algorithms. All platform profits may be used to buy back CoTrader COT tokens. A DAO would hold all these tokens until a vote would allocate their sale towards progressing the platform further. One utility the DAO holding profits in COT is future proofing as multiple platforms will be supported (e.g. EOS, NEO, Hashgraph, etc).

ICO

CoTrader is the world’s first trustless “ICO futures” marketplace, driven by smart-contracts. Fund managers are empowered to enter ICOs as part of their portfolios to take advantage of early group-buy discounts that many ICOs offer. This is possible because CoTrader Smart Funds that are, by smart-contract, to receive future unlocked ICO tokens are themselves tradable. CoTrader’s own DEX supports trading these Smart Fund shares since each fund has its own tradable tokens. This means that if a fund manager takes investors into an ICO position and some investors want to liquidate their shar

Detail Information

Whitepaper: https://cotrader.com/cotrader-whitepaper-en.pdf

Facebook: https://www.facebook.com/cotrader

Telegram: https://t.me/cotrader

Twitter: https://twitter.com/cotrader_com

Bitcointalk: https://bitcointalk.org/index.php?topic=4378695.0

Author - asyifa

My Bitcointalk profile link - https://bitcointalk.org/index.php?action=profile

My ETH : 0x31E1baB2A252C6096343F7E1F92590CE91BD4024