My re-entry to the crypto world has been brief admittedly. I got in with Bitcoin about '09-'10 and did that thing where you lose your wallet thinking that $100 you "invested" was gone forever. If I remember right it was something like 1000 BTC I got for this trade. This leaves a bad taste but I'm over it. Yeah, totally over it. What's Bitcoin up to anyway? If you haven't heard, don't lose your wallet or your private key.

Anyway, I re-upped in March following news of this thing I'd just then heard about called "Ethereum". What a thrilling ride. Needless to say, I'm up... A bunch. When the climb started I got determined to find out what the hell was happening. Since that point I've been sinking my teeth into this monster. Gobbling up every little shred of knowledge I can glean. I'm joining the rest of you down the rabbit hole. Here's where I'm at now.

Maybe it's because I'm new but I just don't see Bitcoin as the cornerstone so many people seem to think it is. It could also be related to my proximity to the tech industry, I'm impressed by function not the status quo. Unlike professional traders, my instincts align me to new and innovative solutions to problems because I professionally problem solve every day. In that respect, the world of trading based on candles and movement is largely alien to me. However, I do understand the need for things like abstraction layers in software, development kits, redundancy, governance. In my personal experience those kinds of things generally come packaged with better products and better products make money.

It's for these reasons and maybe others I was generally not super impressed with Ronnie Moaz's predictions on BadCryptoPodcast #70. http://badcryptopodcast.com/2018/01/10/ronnie-moas-70/

Mr. Moaz seems like a sharp investor. Many of the things he said made sense from the perspective he seemed to be viewing them from. That is, one of a very established stock investor. A man with instincts that come from years trading established markets. He has uncanny intuition about a group of investor's behavior when this candle or that candle moves one way or another. The point is, I can see why he's been successful. From about 2014 to early 2017 the crypto world hasn't changed much, either in market cap or innovation. In that world Ronnie's predictions make complete sense to me. It was a speculative market driven by some utility, yes, but for the most part driven by the waxing and waning in people's opinions about Bitcoin and cryptocurrency. But that changed this year.

In early 2017 Ethereum was already 2 years post release. It's crowdfunding campaign was interesting but nothing special by today's standards. It brought with it this exciting idea of a smart contract realized. Smart contracts are an old idea actually, Nick Szabo talked about them in 1996, only Ethereum seemed to be a interesting way of realizing their promise. I suspect, and this is speculation, that around the same time in 2016-2017 the computer nerd underground was starting to realize there was something new about blockchain. The early adopters (and eventually beneficiaries) of smart contracts had already started work on their projects and the rest of us were hearing the buzz. When Bitcoin started its movement and started to make headlines anyone in my industry who had even read about Bitcoin in the past took another look. And those of us that dug a little found Ethereum, Bitshares, steemit, and others. Innovative newcomers that held the potential to actually solve a problem we related to.

Since then I've been watching for a time when Ethereum would lead the market. It seems obvious to me that this is the way boots-on-the-ground innovators will go. Be damned with the "investors", programmers use Ethereum or Bitshares, or EOS or, something with the utility they need. Why would they use Bitcoin? There's 100s of Bitcoin knock-off that do something better than Bitcoin and everything else at least equally as well. I can't, for the life of me, find any programmatic utility in Bitcoin that Ethereum doesn't do better for example. For that matter, there are other altcoins that you can apply the same simplistic maneuver to. So, I keep asking myself what am I missing? Why are established and intelligent investors so bullish on Bitcoin despite this?

Discussions like this come up from time to time and people make some points. Bitcoin is better established. It's immutable. It has tested security. But those don't hold weight in the long term for me. Bitcoin is better established by only 9 hurky years. In 10 years no one will care what's been around longer, will they? Many blockchains are immutable, and is that really as important as people make it out to be? The majority of Ethereum holders seem to agree that allowing people to steal money is not something they want to be all in favor of. Newer systems like EOS, which is still extremely driven to promote the independence and freedom of its users, are planning for governance to specifically address the kinds of problems that come up when you have an immutable chain. And the security thing seems to be grabbing at straws. Time is an illusion as a factor in security. Something is secure, or it's not. You may find out today or 100 years from now but it is so from the moment it's created. Look to linux bugs as proof of that. They seem more egregious because linux is open-source but they make my point. In the linux world, security flaws are found all the time that have been included in production code for sometimes decades.

But more than the rebuttals, most important in my opinion, is that Bitcoin seems developmentally lost. The developers can't reach any consensus about how to address compelling features threatening Bitcoin but being offered by its competitors. From that perspective Bitcoin starting to embody all the hallmarks of an established company fattened up to be eaten alive by a disruptive technology. The reason EOS, Ethereum, and many others exist is because it was so hard to convince the majority of Bitcoin developers that it was time to change Bitcoin. The lead developers of these tokens are often ex-Bitcoin developers of some capacity. Their story generally goes that they tried to change Bitcoin, but the others wouldn't have it, so they went off and started over on their own.

We can draw parallels from this kind of behavior, but you won't find them in the stock market. You'll find them in the history books that tell us about the early days of burgeoning industries. Electricity, Flight, the Internet, these all have common threads that better correlate to what's happening in blockchain today. An early innovator creates something new. It's seen as revolutionary. It's adopted. This inspires other innovators and they usurp the industry founders and take over market share as the adoption rate soars. Orville and Wilber, Edison, Tesla, and many others all experienced this firsthand. They saw their initial market share (based on technology widely adopted and revolutionary as it may have been) getting destroyed by better organized newcomers overtime. It's really not that hard to find examples of this all throughout history. It can be tempting to ignore these comparisons and focus on the numbers you see streaming from Coin Market Cap but it's important to know how this divination of value is determined at the source.

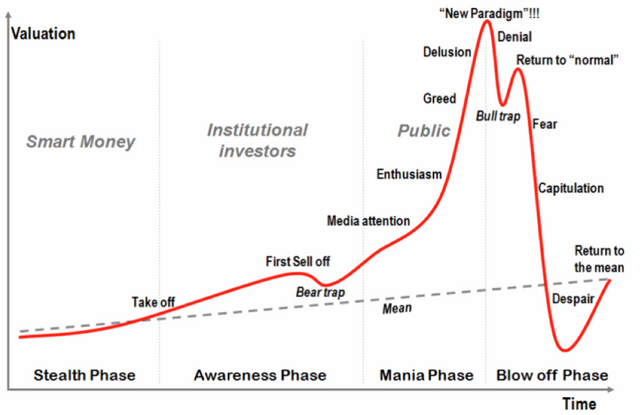

Professional investors and blockchain skeptics love to call Bitcoin (often misassociating the term with all blockchain tech) a "bubble". This is a bubble:

It's a feature of a moving trend and typically it's associated with undue hype. This is based on pure speculation as you're bound to hear over and over. An interesting feature of famous bubbles is that most often they evolve inside of an upward trend. Yes, value is speculated too high, yes there's a sudden realization and fall, but under that is an upward trend overall. After the bubble pops the trend can continue to rise. In fact, most often it does. Gartner likes to zoom out a bit on this concept and show bubbles during an adoption cycle as part of a "hype curve".

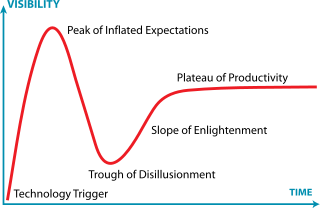

The only difference in this is that it generally follows new technologies. Hype curve is a more specific definition of a bubble. It's a bubble inside of an upward trend only they make allowances for a dip before another climb and eventual plateau when value is fully realized. Hype curves are assumed to occur because of Amara’s Law:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

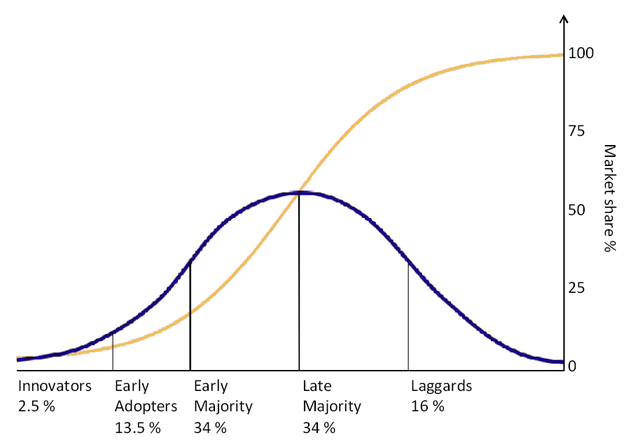

Hype curves are associated as precluding yet another kind of metric, the adoption s-curve.

S-Curves aren't strictly related to value. As you can assume they follow mass adoption rates. You see adoption expressed in market prices as the tail-end of a hype curve.

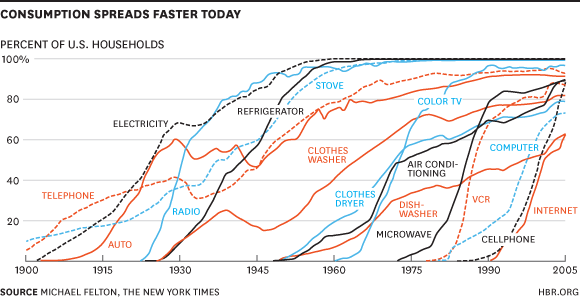

Adoption of every mass-marketed and fully adopted technology in modern times has followed an S-curve. Moreover they seem to be getting steeper in adoption rates. There is one tidbit about adoption rates that's been swallowed and regurgitated as acceptable fact since Facebook took off. If you have a network of people, you have a product. And networks are created by adoption.

In blockchain you can make an assumption based on this that we're still in the very early days. If we're not in a bubble we will be and based on the promise of the technology total blockchain market cap may fully devour any hype bubble severe enough to cause distress. One thing is for sure, once blockchain takes off it's going to see seemingly ridiculously high jumps. Overall, market cap of blockchain will go up and it will stay. This coin or that coin may see incredible failures but none-the-less the blockchain industry as a whole will see monumental movement in the coming years and it will be heralded by mass, world-wide adoption. I think it's not hyperbole to say that this might be something that's actually bigger than the Internet.

Up until very recently the price of Bitcoin was based on a tiny bit of utility but mostly speculation. It has utility for black market economies, it has utility evading government control, and it has utility as an easy way to transact value digitally in a trustworthy way. Outside of specific use cases there was very little adoption and a few light-hearted attempts early on to accept it as payment but obviously nothing truly substantial. Outside of a very small group of people few used Bitcoin for utilitarian reasons and those that did often did this as more of a proof-of-concept test then a fundamental true adoption.

In 2017 that has started to change. I think it's safe to say we're in the midst of a hype curve currently because of that in fact. A slew of applications and ICOs are announced every day that claim to solve any number of problems for us. However, few have released, and fewer still show any signs of changing the world as dramatically as we all expect them to do in time. Either way these are funded via a new utilitarian use for cryptocurrency, the ICO. Strictly speaking you're investing speculatively, but the difference is that money (presumably) is actually being put to use to do something. To build a network, create a company, write more blockchain. This is a milestone event so take note. Because there is a new utilitarian use, it's driven more adoption. But more importantly, the nature of this event (ICO and mass crowdsales) points to the next phase. Exponential adoption. Each ICO is like a mass adoption lottery ticket. If the ICO is successful an entire industry gets disrupted and it's swallowed whole by the blockchain industry. It shouldn't take a rocket scientist to put two and two together. More utilitarian use means more adoption means more use cases means more adoption....

Simply put, there's no question. Blockchain stands to gobble up a significant portion of worldwide value in time. It just will.

The question I'd like to explore is, why do people still assume that amidst all of this adoption that people will flock to boring ol' Bitcoin. We're about to see something similar to the disruption of Usenet. Way back when the Internet wasn't public the Usenet leches all vetched and moaned about regular people getting in on their sweet, sweet network. Heralding the announcement of a public Internet as the end of days they bemoaned having to deal with normal people. There was some disruption to be sure, but the new users mostly avoided usenet altogether. The BBSes and the basic data sharing of the time was occluded quickly by the adoption of the world wide web. I think it will be much the same for long-time crypto investors. Investors that saw altcoins as just another Bitcoin for nearly a decade. We're going to hear them moan about companies and new people in the space, but these new people matter if you're investing. What they buy is what will see the highest adoption, and thus, the highest gain.

It could be the Bitcoin devs get their shit together when they see lost value and decide to come up with some interesting new feature no one else has that saves Bitcoin. It could be that it "stabilizes" magically somehow and people leverage that stability as a feature. I'm not placing high bets on those outcomes because they don't seem incredibly likely. It seems likely that the devs of Bitcoin will be wooed away from it by other crypto markets they side with innately. The lack of visionary leadership will keep a development deadlock on the group and, thus handcuffed, it begins its decline. It seems like if adoption rates soar in a close competitor like Ethereum, EOS, or Ripple and it overtakes Bitcoin in market cap then the Bitcoin advocates will have nothing left to point to as a sign of certain success. If that happens I find it easier to believe that people will openly question why they should trust a protocol that's so slow, so old, and so useless compared to its peers.

I just made a post showing BTC touching the tip of it's triangle after breaking out, along with an example picture of what happens in a symmetric triangle.

and BTC's current standing;

I believe we are at a bottom.

Please check out the post;

https://steemit.com/bitcoin/@louwtjie/btc-update-symmetric-triangle-upwards-break-pulling-back-to-the-tip

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post very well for beginning. My are much more lousy. I completely agree with your view on crypto currencies world. Some will go some new tech will appear in short evolution. We have also to adopt constantly.

Upvote you man and follow.

p.s.

I write TA blogs and analyses and star some projects and initiatives here on Steemit : Bitcoin: #22, #23, #24, #25, #26, Steem: #5, BitShares: #6.

Start movement Upvote Myself no More and series For Better Steemit: #1, #2, #3, #4.

TFDSRE series: #1, #2, #3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @attrezzopox! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit