Escrow or A pledge under warranty is a contractual arrangement in which a third party receives and issues money or documents for a principal operator, with reimbursement according to the terms agreed by the party who performed the transaction, or an account established by the intermediary to hold funds for the principal broker or another person so that the refinement or observation of transactions or trust accounts held in the borrower's name to pay bonds such as excise taxes and premium insurers.This word derives from the essence of the old French,which means paper or photographic paper this shows the deed held by the third party so that the transaction is completed.

Commitment on the Internet escrow has been a manifestation since the beginning of trade and commerce on the Internet.It is one of the many developments that establish trust in the online sector.As a traditional endeavor,the Internet employs work by putting money in a free and flexible third-party control to protect buyers and sellers in transactions.If both parties certify that the transaction has been processed according to the established terms,the money is revoked.If in the event of a dispute between the parties in the commercial affairs,the process moves together to resolve the dispute.The result of the dispute resolution process will determine what will happen to the money under warranty.With the growth of both individual business and individual online trading,the traditional escrow company has been replaced by new technology.

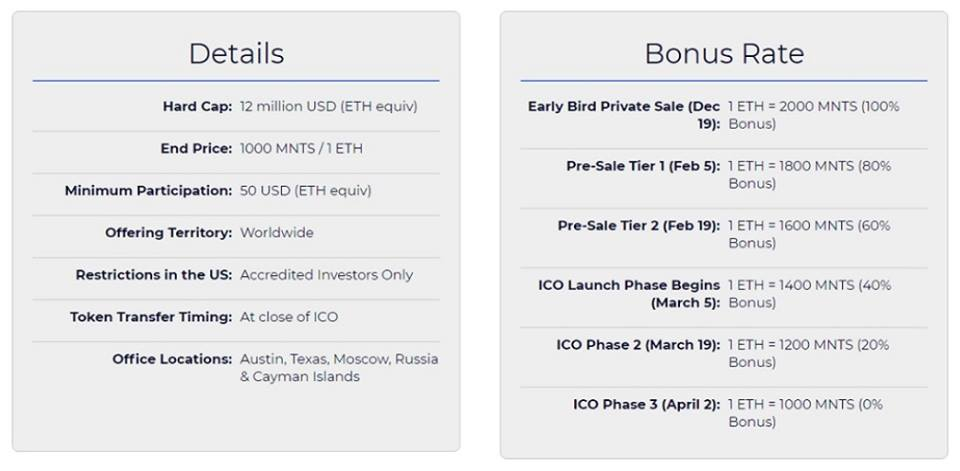

The initial offer of coins (ICO) is the underlying controversy,the crowdfunding focused on cryptocurrency,which may be the source of capital for startups.At ICO,the amount of crowdfunded cryptocurrency is assigned to investors in the form of tokens,in exchange for legal tender currency or other cryptocuments like bitcoin or ethereum.Should be a unit of currency if or when the funding target ICO is satisfied and the project is started. provides a way in which startups avoid the cost of regulatory compliance and intermediaries,such as venture capitalists,banks and stock exchanges,while increasing risk to investors.ICO may fall outside the existing rules or may need to be regulated depending on the type of project.

Incremint and Mint tokens mitigate these risks in a way that embraces the potential of blockchain and works in harmony with the decentralized community.Incremint is an escrow solution.It has key benefits to both issuers and backers.Mint tokens are an integral component of Incremint and will underpin the operations,governance and success of ICOs while offering a compelling value proposition by way of advantageous economic terms to backers,official website https://incremint.io/

ICOs are not regulated and supporters have limited options to reduce risk. Publishers create websites and publish white books for projects that are usually just concepts.They must accept not only the risks associated with the project's profitability but also the risks associated with the integrity and efficiency of the issuer in carrying out the project.Previously the ICO seemed to indicate the lack of protection for supporters and the lack of fiduciary obligations for publishers and the dangers of wrong interest.ICO bad can shake confidence and reduce the demand for derivatives.The bad Ico may invite state regulators to block derivatives as a whole,which will be detrimental to innovation and the blockchain community as a whole.

An escrow solution is needed,existing multiple signature escrow mechanisms rely on the discretion and performance of a person, the impartiality of whom is not always certain,rather than the automated and decentralized collective will of token buyersthis is a serious weakness.Traditional escrow mechanisms are problematic as well in the context of ICOs due to the limited capabilities and unwillingness of banks to deal with cryptocurrencies.

Incremint overcomes these critical deficiencies,it is a hybrid escrow product combining the reliability and trustworthiness of a traditional escrow mechanism,with the automation and enhancements of smart contract voting or smart voting and decentralized blockchain technology.Incremint enables issuers to custom define parameters and escrow a portion of funds raised in their ICO,subject to release when designated milestones have been met and approved by token holders.

Mission Project

Incremint.io Ltd,the entity conducting the ICO,is a wholly owned subsidiary of Blockchain Escrow Technologies Ltd.“BCE Technologies”BCE Technologies’ mission is to support the growth and development of the ICO market by better aligning the interests of issuers and token buyers, mitigating risks and incentivizing openness and transparency.We believe in the potential of ICOs to fund innovation and view effective self-regulation mechanisms as critical to the long-term health of the ICO market and blockchain community.

INCREMINT FEATURES

Incremint escrow solution offers the following features:

- Crypto wallets for holding cryptocurrencies in escrow

- Bank accounts for holding fiat currencies in escrow

- Smart voting infrastructure

- Fund release mechanism

- A dedicated account representative

- Flexibility to deal with unexpected circumstances by calling for extraordinary voting

- Currency volatility risk management capabilities

- Real-time status updates of voting and fund disbursement status for both

issuers and token holders

PRE-ICO

The Issuer and Incremint agree on the parameters tailored to the Issuer’s needs for collecting,escrowing and releasing ICO proceeds to the Issuer.In this case,it is agreed that the ICO proceeds will be released to the Issuer in the following tranches, as per the respective milestones :

- 25% are immediately made available to the Issuer

- 25% are released when the Issuer completes the MVP version of the DAPP

- 25% are released when the DAPP infrastructure integration is complete

- 25% are released when the DAPP goes live in beta

Each milestone has a deadline or pre-agreed completion mechanism. The Issuer requests that 80% of deferred ICO proceeds be exchanged into USD and deposited into an escrow account organized by Incremint with a reputable financial institution.

ICO

The terms of the collective escrow arrangement are detailed in the Issuer’s white paper.The ICO is successful and the Issuer sells coins for ETH worth US$10 million.Simultaneously,ETH worth $2.5 million goes to the Issuer.ETH worth US$7.5 million is escrowed,with 80% of that amount, or US$6.0 million, being converted to fiat and deposited in an escrow account with a third-party bank and 20% of that amount remaining in ETH and held in a virtual wallet.

If you would like to participate in the purchase of MINT Token please visit LINK and follow the instructions as below.

STEPS FOR PURCHASING MINTS :

- Apply for private sale

- Receive an e-mail from Incremint.io with purchase instructions

- Receive secure key for payment

Please begin the purchase process by completing the application form below. The Incremint team will do its best to get you a quick response.Once approved you will receive an e-mail with a secure key to access payment information on our site.https://incremint.io/buytoken.html

Please note that if you are a US person and are not an accredited investor,you are not allowed to participate in this ICO.

Whitepaper : https://incremint.io/pdf/Incremint.pdf

Facebook : https://web.facebook.com/incremint.io/

Twitter : https://twitter.com/incremint_ico

Telegram : https://t.me/incremint_NEWS

Bounty Campaign : https://incremint.io/pdf/Incremint_Bounty_Campaign.pdf

Ann Thread BTT : https://bitcointalk.org/index.php?topic=2845074.0

My Account BTT : https://bitcointalk.org/index.php?action=profile;u=395093