Globalisation has created previously unimaginable opportunities for interactions between investors and businesses across the world. However, those opportunities are very unevenly distributed. The investors that benefit from them are mostly major institutional investors, and the businesses they invest in are usually large corporations that often have little to do with the interests of the societies they come from. This is in many ways an untenable state of affairs, as it encourages unstable, top-down economic models that are both fragile and often resented. It also means that the potential synergy between smaller investors and entrepreneurs across the world remains unfulfilled. Obstacles to its fulfillment include the primitive state of the financial infrastructure in many developing nations, lack of trust on the side of smaller businesses and the difficulty that smaller investors face in acquiring reliable information about foreign markets.

LendingDev, a non-profit organisation, hopes to rectify this through a microeconomic approach. Through its EthicHub blockchain platform, it wishes to facilitate crowdinvestment into smaller-scale agricultural projects in developing nations. Private investors would be able to provide business loans with transparency, reliability and ease through the help of smart contracts and other features. Local agricultural producers would receive much-needed support on more accessible terms, providing a boon to the overall economy and giving developing nations the resources that they need to keep developing.

The EthicHub model for investments

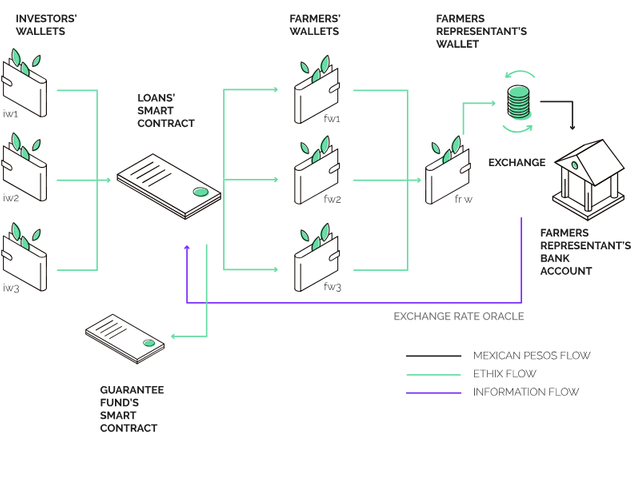

EthicHub will be built as a platform on the Ethereum blockchain. A central role in its function will be played by Local Nodes – users on the ground who will act as recruiters and managers for would-be borrowers in their areas. They would evaluate agricultural projects and help those involved register on the platform and draft their loan requests as smart contracts, setting conditions such as the funding period, the amount of funds needed and repayment terms. Those requests will be available to potential investors on the platform, together with detailed reputation information about the borrowers (assuming they have a credit history on the platform), the Local Nodes' success rate and macroeconomic data about their region, type of produce and local currency.

All lending on the platform will be done with ETHIX tokens. Borrowers will be able to convert them to their local fiat currency through an exchange, though later LendingDev hopes to streamline the conversion process further. The platform will set a maximum interest rate for each request, but investors could bid to lower it, with the requesters accepting funding from those who agree to the lowest rate. If insufficient funds are raised during the funding period, all tokens will be returned to the investors. Otherwise, the loan will go ahead. Borrowers will be reminded about repayments through various channels. Once they make their repayments, the smart contracts will deduct a fee, dividing it between LendingDev and the Local Node, and transfer the rest of the money to the investors.

Each repayment will raise the borrower's and the Local Node's reputations in the system. Conversely, failing to pay back in time will reduce reputations with each delay, and if the preset grace period expires, the loan will automatically default. When that happens, the Local Node's reputation will take a bigger hit, defaulters will be listed on the platform, the principal will be returned to the investors and the debt itself will be handed over to a guarantee fund that will work to secure compensation within certain legal and ethical restrictions. EthicHub's brand ambassadors will work to promote the platform and its ideals, and also carry out decentralised oversight over the Local Nodes, ensuring that they do not violate EthicHub's conditions.

What are the advantages of EthicHub?

EthicHub focuses on delivering economic benefits to both sides of its exchange, while also having a positive economic and social impact on developing nations. It thus combines an idealistic mission with an appeal to profit motives. By enabling local-scale, microeconomic investment with a more forgiving fee structure, it hopes to lower the entry barriers for both private investors and small agricultural producers. It has a coherent economic model that encourages genuine decentralisation by removing intermediaries except for the Local Nodes, who would be both incentivised for their efforts and controlled by members of the ecosystem. The smart contract repayment and default system, augmented by the guarantee fund, will help reassure investors.

The team behind this project has considerable business experience and important connections among small agricultural producers in Mexico, which will help it identify worthwhile projects. EthicHub has a number of partners in the cryptoindustry, including mobilum.com, which is supposed to provide its crypto-to-fiat conversion service as the platform continues to develop. The alpha version of its project has been launched in the first half of 2018, and its lending smart contracts have already been put into use. Seats on the LendingDev board will be divided between the project team, early investors and independent advisors. This board will govern the platform in the early stages, though eventually it is meant to transform into a fully-fledged DAO.

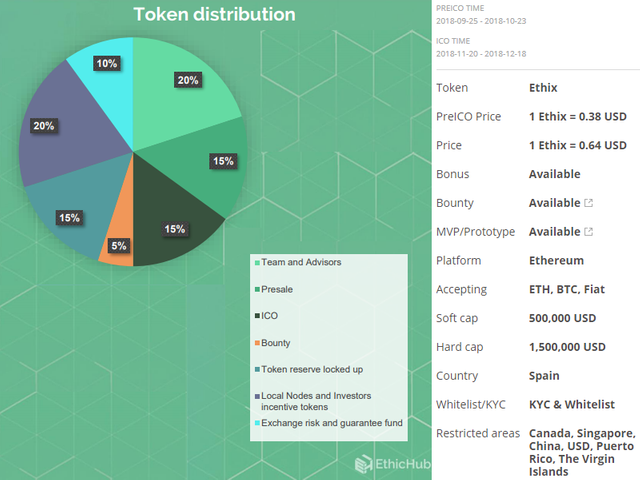

Token sale details

Human-oriented international investment

Microfinance is both a popular social cause and a viable economic model. Both in spirit and in practice, blockchain technology is a good fit for it, as it would enable cheap, transparent and secure microlending transactions around the world. EthicHub is in position to provide a relatively rare service in a market that is large enough for all of its competitors. But covering such a disparate field as small-scale agriculture is going to be a serious challenge.

To meet this challenge, EthicHub will need a truly strong community and team. After all, the long-term success of its services depends on the judgment, competence and good faith participation of Local Nodes, Ambassadors and the team's own experts. Financial incentives and idealism might just be able to give it the human capital it needs to start its ecosystem. Beyond that, it would just need to secure enough borrowers and investors. If LendingDev and many others don't misread the global economic trends, that should be relatively easy. Perhaps the dream of the modern day microfinancing movement and its predecessors will finally come true on the blockchain.

Links:

Website: https://ethichub.com/

WhitePaper: https://bit.ly/2xFiPjJ

Telegram: https://t.me/ethichubeng

Facebook: https://www.facebook.com/ethichubcrowdlending

Twitter: https://twitter.com/EthicHub

Medium: https://medium.com/ethichub

ANN: https://bitcointalk.org/index.php?topic=2779099.msg28427646#msg28427646

Author: https://bitcointalk.org/index.php?action=profile;u=980049

username: the1arty

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

I think it's great that they are innovating and promoting agricultural investment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's right! Thanks for your opinion

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit