Blockchain technology has eliminated the need for intermediaries in the exchange of values and services. No industry has felt this impact more than the financial sectors with its myriads of third-party mediators mediating everything from account verification to transactions. However, while blockchain technology offers a disintermediated and transparent platform for the secure and instantaneous exchange of values, there is growing challenge when it comes to converting cryptocurrency to fiat.

The adoption of blockchain technology has also come up against intense criticism from traditional financial institutions. These bodies see the adoption of the technology a challenging prospect due to technological bottlenecks emanating from fees crypto holders have to pay to exchange platforms, payment processors, and financial institutions. The market’s now infamous volatility and underhanded practices have also contributed to institutional investors reluctant in embracing this emerging market despite praising the underlying technology. ALLSTOCKS Network is a decentralized global stock exchange platform that brings real-world assets to user's fingertip.

An All-encompassing Ecosystem

.jpg)

ALLSTOCKS is set to usher in the future of global market exchange on the blockchain. The platform will transition the traditional financial instruments to Blockchain technology, empowering them through a distributed, decentralized, and tamper-proof ledger system.

Every token issued on ALLSTOCKS will be backed by tangible assets such fiat currencies, bonds, and commodities that can be traded on any crypto exchange for its exact value. The platform bestows on all users the benefits of blockchain technology and cryptocurrencies including; low fees secured transactions and instant transfers. Traditional financial institutions will also be able to benefit from the platform by leveraging its innovative features to navigate the high returns highway of the crypto-economy.

How It Works

.png)

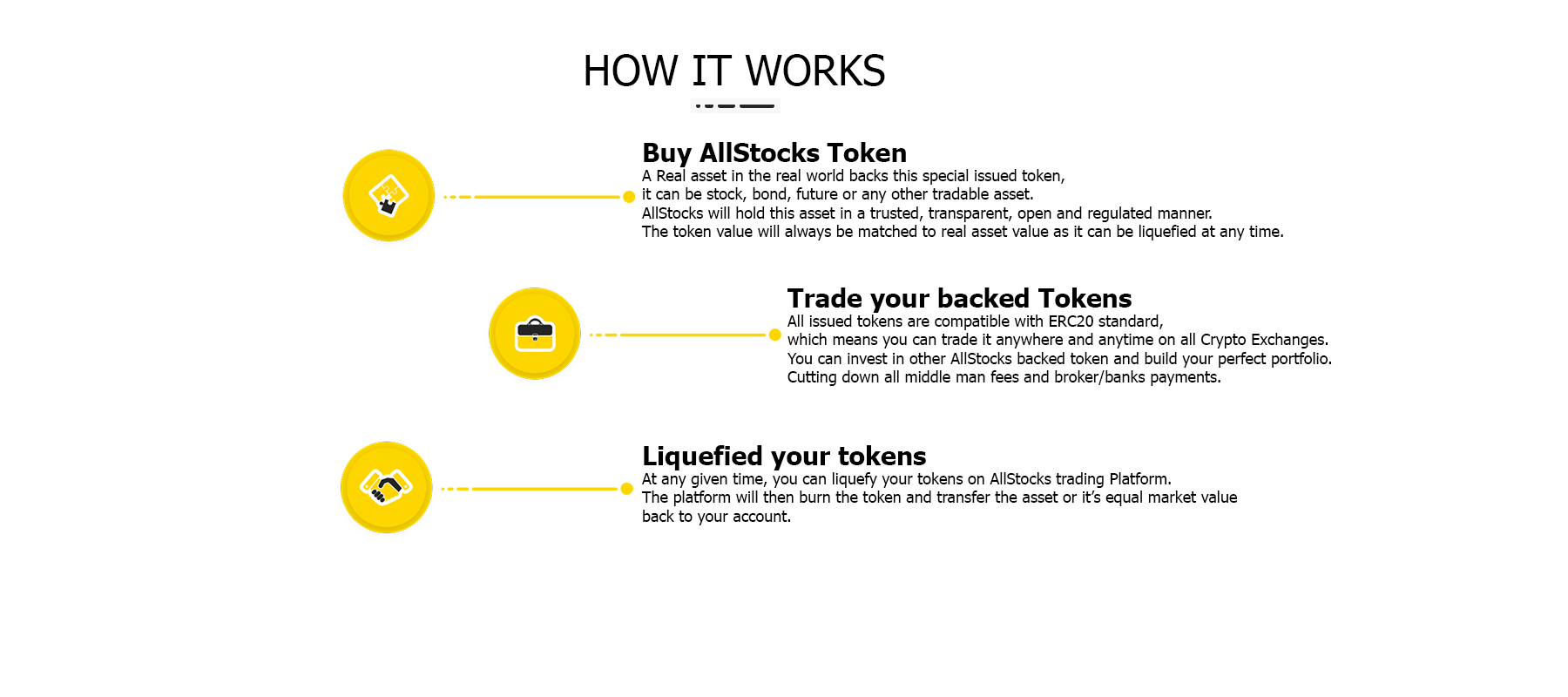

ALLSTOCKS’ ecosystem is based on asset-backed tokens that have been minted with the backing of the real world assets they represent. These assets can now be used as the true representation of physical assets like traditional currencies and commodities and trade across the globe without geo-economical limitations and restrictions. This tokenization of tangible assets drastically lowers the barriers to entry for market participants and eliminates the traditional third-party mediators required for such transactions, reducing the cost for business entities.

Once a real-world financial asset has been identified, a corresponding token is issued for the asset and held in a trustless, decentralized, and legally compliant escrow smart contract. The token value will always be the same as the asset it represents and can be liquefied at any moment notice on any crypto exchange to transfer its real-world value into the owner's account. Once liquefied, the asset irrevocably becomes the property of whoever supplied the funds for liquefaction. Off-chain activities (i.e. The exchange of physical assets) will require the supervision of authorized regulators for full compliance and ensure that all interactions are transparent and properly executed without sacrificing the integrity of the system.

.jpg)

ALLSTOCKS utilities an innovative instrument (“a stamper”) to house the traditional assets that will be developed and issues tokens. All tokens will be issued on Ethereum blockchain protocol, making them ERC-20 compliant. ERC-20 tokens can be traded on any crypto exchange or directly transfer through peer-to-peer channels. This enables counterparties to drastically cut down the fees and commissions of the banks and brokers.

A Global Roadmap

.jpg)

ALLSTOCKS has established a roadmap that will see it initiate partnerships with existing brokerages and exchanges that possess strong geographic reach and influence. These partnerships not only allows the platform to significantly reduce the transfer fees and duration of assets but also helps facilitate a much need liquidity pool, while ensuring due diligence and ownership of non-fiat assets and off-chain exchanges.

Furthermore, ALLSTOCKS will provide developers with access to the SDK (Software Development Kit) of their API to give them an unparalleled capacity to develop their tools and apps for investing, hedging, executing transactions, and interacting with the ecosystem using ALLSTOCKS tokens. These tokens are also the vehicle for settling all network fees and commissions.

ALLSTOCKS development team have reiterated their commitment to the continuous development of the platform to incorporate more financial institutions and support them, creating a unified, global asset market.

For more Information, Visit: https://all-stocks.net/

Read the Whitepaper: https://all-stocks.net/wp-content/uploads/2018/03/Allstocks_whitepaper_rectified.pdf

Join the Community on BitcoinTalk: https://bitcointalk.org/index.php?topic=3210865.0

Join the Conversation on Telegram: https://t.me/all_stocks_ico

Hey @bowtiesarecrypto, the markets are pretty crazy right now. Crypto is back to a weird space but I know long term it's still what we're all hoping it will be! Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah. Long term is what we're all looking forward. The "winter" has been good though. Was able to get in on a few cryptos I missed out on, so you wouldn't hear me complaining

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit