Most times, we have that inner fear of losing a loved one or priced asset. Though it might seem to you foolery for someone to get her leg insured for millions of dollars, such acts are safeguards for future occurrence.

How sad it would be crashing your Bentley beyond repairs and having no back-up in terms of financing its repair or placing order for another. These citations are bedrock for founding insurance.

Insurance had given hope to the literary hopeless individuals who could’ve lost what they’ve labored for in the twinkle of an eye. At the moment, the global insurance industry is having a field day; topping the charts with about 5.7% of the global economy that amounted to €3.7 trillion. The stated figure was for 2016 alone and it is expected to hit €7 trillion in 8 years time (2026) with China and some other Asian countries bringing up the rear.

Don’t get deceived with the figures. The global insurance is facing issues arising from its seeming inefficiency. Though it had succeeded in removing intermediaries and you can interact with your insurers, same can’t be said of its benefits especially in the event of a loss.

Loopholes

The problem doesn’t lie in the industry but on the attitudes of some insuring firms. Signing up for insurance is very easy but when the actual field work of replacing your loss comes up, the company tends to embark on tedious leg work.

Surveys are carried out to determine the extent of the loss/claim after which payment is facilitated. By this time, the customer’s patience might be running out as he ought to have gotten his claim beforehand.

With the current situation, the customers’ perception is the insurance companies’ disregard for their loss. The current price policy seems unmodified and this suggests that customers are getting more claims than they ought to.

With this trend, about 41% claimants might cut-off their business with their providers just as a significant 71% insurance customers are set to discontinue with their insured companies. If this becomes, the possibility of actualizing the €7 trillion al-time value might not be tenable.

A Solution

Socratus is the solution on ground with respect to current issues in the global insurance industry. As posited by its team Socratus aims at win-win insurance. The bottom line is Socratus’ aim at making the insurance viable and viable for both insurers and customers.

Socratus partners both insurance companies and data providers in the facilitation of claims. Its win-win approach cuts across friendly prices instant claim payment and fair and transparent dealing

How it Works

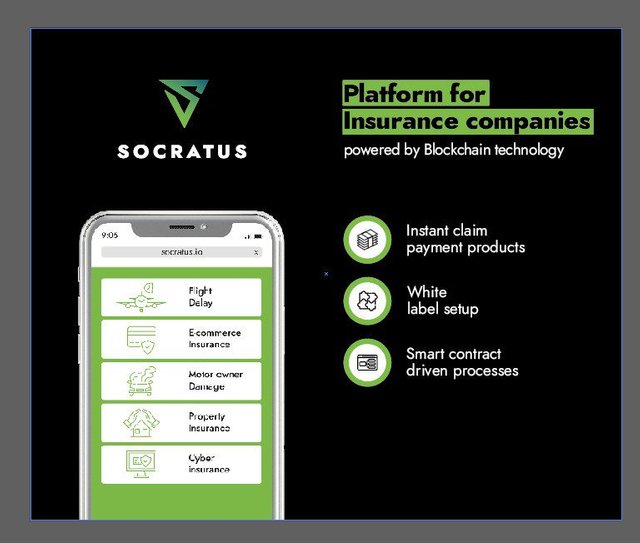

Socratus realized the urgency that claim fulfillment plays in the integrity of the insurance company and the customer. Therefore, it automated its platform by utilizing Smart Contracts and Oracle.

We are familiar with smart contracts. Socratus’ smart contract is one out of the automation tools used by Socratus. It is vested with the power of confirming and executing insurance policies of insurance companies on its blockchain. Oracle on its part was developed as a program code with the authority of pushing verified data to the smart contract technology.

Beforehand you must have signed up with the insurance company with your preferred category such as automobile and house. In the event of an accident with your car for instance, you log in to your profile on the company’s website. By this time, the smart contract is in motion.

Through your profile on the site, you intimate the company of the accident (you can also use the site’s mobile application if you choose). Oracle on its part gets in motion and confirms the truism of your claim. After confirmation, it pushes the data to a verified data provider.

At this point, your claim had been verified. The smart contract authorizes the company on the platform to forward your claim payment to you. Smart contract oversees the payment and at the acceptance of your insurance claim, the smart contract is closed signaling the end of the claim payment.

The bottom line here is you get access to your claim payment faster than you could have gotten it in the traditional insurance setting. In essence, Socratus reduces operational expenses incurred during claim verification by 25%.

Use Cases

Socratus can be applied in multiple digital insurance settings such as personal accident, cyber insurance, logistics, property and e-commerce.

Wrapping Up

With frustrations posed by traditional insurance companies, a platform such as Socratus is better off for customers seeking for maximum insurance benefits. Instances of leg work and claim verifications are lowered to the barest minimum; saving the insurance company costs and facilitating claim payments to the customers.

To learn more about this revolutionary project called Socratus, kindly check the links below:

Website: http://socratus.io

Whitepaper: http://socratus.io/wp

ANN Thread: https://bitcointalk.org/index.php?topic=4134975.new#new

Medium: https://medium.com/@socratus

Twitter: https://twitter.com/socratus_io

Telegram: https://t.me/socratus_official

Writer: Collinberg

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1532780

ETH Address: 0xDdE65B61ebBC4464eD7E313f1811353f99ccd214