One of the serious problems for the companies, involved in operations with cryptocurrencies, is that it's hard for them to pass the so-called Anti Money Laundering / Counter-terrorism Financing (AML/CTF) checks. AML/CTF is a set of procedures put in place in order to prevent money, acquired through illegal activities like drug and human trafficking, from getting into circulation in the financial system. In particular, compliance with AML regulations is a necessary prerequisite for the company to be able to get access to the banking services. The same way as I cannot bring a suitcase filled with cash to the bank and deposit that money without explaining their origins, the businesses need to prove that their money isn't connected to the criminal activities. This is achieved by the companies following a set of regulations commonly known as KYC. (Know Your Customer) For the businesses operating with cryptocurrencies or accepting payments in cryptocurrencies it presents a problem due to the very nature of crypto. While all the financial operations on blockchain are transparent and visible to anybody, the anonymity of participants creates a situation when it's impossible to know, who are the real owners of crypto assets. This way, for example, the company cannot trace the origins of money it receives in the form of payments or investments.

Coinfirm - a UK based startup created a platform, that allows to assess the trustworthiness of Bitcoin/Ethereum/Dash accounts, this way helping the businesses dealing with cryptocurrencies to fulfill the KYC requirements. The Coinfirm platform decrypts and analyzes all the blockchain activity in real-time, revealing suspicious patterns and actors. Also, the system collects the information about the cryptocurrency wallet addresses involved in the operations in the Deep Web to flag the wallets implicated in illegal activities. As well as it uses all the other available resources to gather relevant background data, including information from websites and forums, information accessible through data leaks, etc. The platform's algorithms by analyzing this data allow to evaluate with a high level of accuracy the trustworthiness of cryptocurrency addresses. This analysis and information can help the Coinfirm's clients to follow AML/CTF compliance procedures, ensuring the banking system and authorities that their funds, received in the form of cryptocurrencies, are not related to the criminal or terrorist activities.

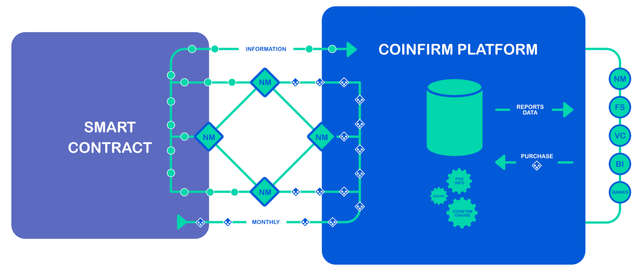

Coinfirm's platform is based on the blockchain architecture and uses AMLT token for all the operations and payments, conducted within the system. Joining the platform, the participants automatically become a part of its ecosystem and data exchange, allowing it to function more efficiently. The Network Members receive rewards in AMLT for providing information useful for identification and verification, like information about the public keys used in their transactions with counterparties. Thus they also become an active component in the platform's identification system.

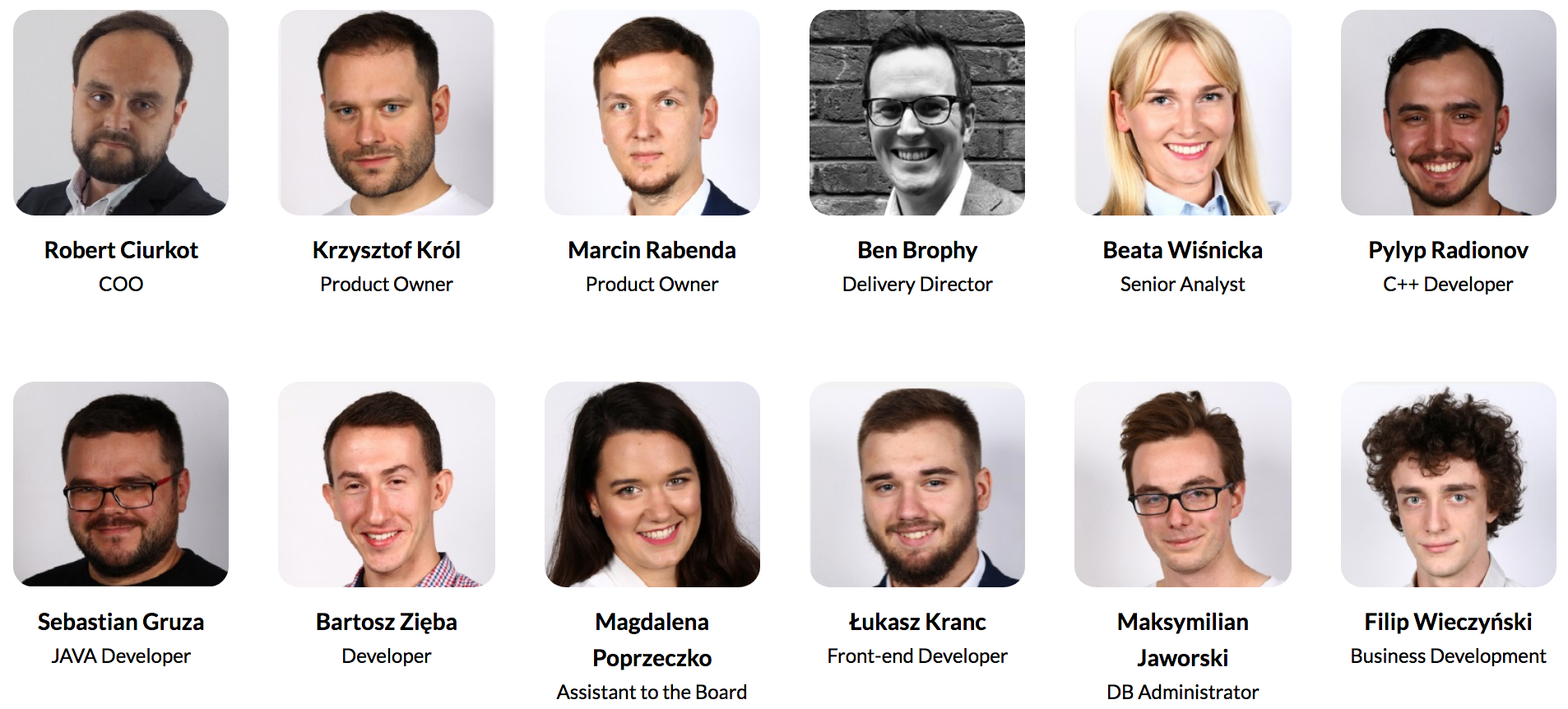

Team

At the present moment, Coinfirm is conducting a token sale aiming to distribute 70,000,000 AMLT tokens.

This is my @originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @cryptotaofficial to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit