2020 has been dubbed magic year by the market. At the beginning of the year, various catastrophic events took place around the world, with fires, viruses, volcanoes, locusts and other disasters dominating the headlines. Among them, novel coronavirus has caused the worst impact, sweeping over hundreds of countries in the world. The number of confirmed cases has reached more than 1,346,000 and the death toll has exceeded 74,000. This is a very terrible figure.

Affected by the epidemic, all kinds of assets in the world have experienced sharp shocks, oil prices have plummeted, gold prices have greatly fluctuated, U.S. stocks have been blown off several times, and so on.

Crude Oil is Cheaper than Water as the Price War Goes On

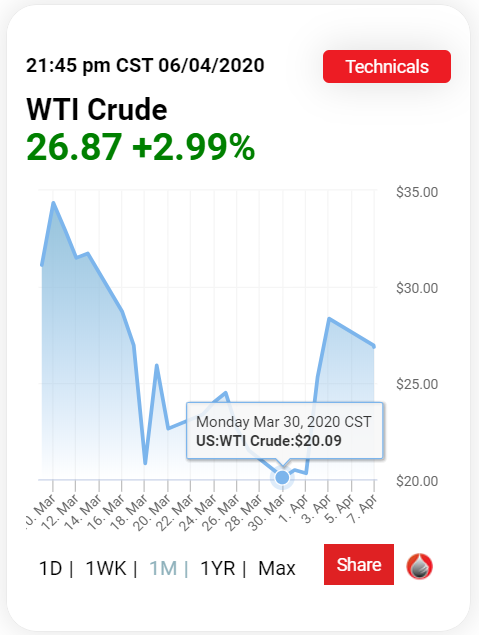

On March 7, Saudi Arabia launched a shocking price war after OPEC+ Saudi Arabia and Russia held talks in Vienna. On the one hand, it was announced that the price of crude oil sold to markets in Europe, the Far East, and the United States would be greatly reduced by 4 to 7 U.S. dollars per barrel, the highest discount rate in nearly 20 years. On the other hand, inform market participants that they will increase production if necessary, even reaching a record level of 12 million barrels per day. The price of crude oil dropped sharply on March 9, with WTI crude oil reaching a low of 27.34 per barrel.

On March 30, crude oil prices fell sharply again, with WTI crude oil falling 7.2% to US$ 20.09 per barrel in a day.

By definition, a barrel of crude oil is about 159 liters. If calculated according to the above capacity, according to the price of 1.5 RMB per liter of ordinary mineral water in China, 159*1.5=34 USD. The result is that crude oil is cheaper than water after a sharp fall.

Stock Markets of European and American Tumbled and China was also affected

The following chart shows the trend of Shanghai and Shenzhen stock 300 Index from Jan to Mar 2020. With the outbreak of the epidemic in China at the beginning of the year, A shares plummeted in a short period, and the stock market began to plummet on Feb 3. As China's prevention and control measures are timely and effective, the epidemic situation is gradually under control, and A shares are gradually starting to strengthen. At the beginning of March, foreign outbreaks suddenly began to kick back, investors' risk aversion increased sharply, and European and American stock markets suffered heavy losses.

Although China resumed work and production in large quantities, as the world's second-largest trading country, the lack of international demand for materials will greatly affect China's export trade and will drag down China's economic development, thus affecting the direction of China's stock market. In other words, the more serious the epidemic in the international community, the greater the drag on China's stock market sentiment and economic expectations.

Gold Plummeted with the Stock Market, What is the haven Attribute?

The market now has a very strong mood of risk aversion. What about the market performance of gold as a traditional investment?

According to the trend chart, we found that at the beginning of March when the epidemic broke out all over the world, gold did not rise significantly, but abnormally fell with U.S. stocks. This phenomenon reminded the market of the scene of the 2008 financial crisis. The reason is also very simple. Due to the sharp drop in the stock market, the demand for liquidity suddenly increased. Cash is urgently needed everywhere in the market to make up for the margin and other investment losses. Therefore, to a large extent, the market actively sells gold to meet the demand for liquidity.

The epidemic spread, U.S. stocks melted and oil prices plunged, since the beginning of this year, many catastrophic events have caused strong shocks in the international financial market. U.S. stocks have been blown four times in 10 days, leaving Buffett, one of the most famous investors in history, not immune. According to media reports, he has lost about 80.2 billion U.S. dollars. However, some people made big profits by laying out their plans ahead of time. A Wall Street company prepared ahead of time for hedging investments, turning US$ 27 million into US$ 2.6 billion.

What should we do for ordinary people under the circumstance that the epidemic affects the global economy?

Behind the Hot Project AK, the Deep Meaning of Soul Mining

Instead of investing in uncertainty, you can focus on AK projects. AK, the full name of Antimatter Kingdom, is a supernode mining platform officially issued by CXC. It is the basic component application of CXC ecology and the cornerstone project of the CXC ecological explosion. We can easily see from white paper and release the plan of AK that the CXC public blockchain hopes to use AK as a springboard to advance ecological value from a post-collision era to an era of hundreds of billions of market values. For every ecological believer and team, joining the starting line-up will be an excellent opportunity.

The background strength of the project is self-evident, and what is more important is to participate with zero risk. Through AK's BTC soul mining, all BTC holders need only sign a soul contract with AK and keep the BTC locked in their wallets (without transferring to the designated address, the BTC bound to the contract is still a completely free and private personal asset) and can obtain AK with a maximum daily currency of 10% starting from D+2. Of course, the original intention of the AK design is to provide a reasonable lock-up mechanism for BTC. BTC that signs the soul contract must be in a lock-up state. Once a transfer or transaction occurs, the contract will become invalid. When the soul contract conditions are met again, D+2 can regain the corresponding AK award. It can be seen that this is an investment mechanism that can easily make profits without investment risks.

For token holders, the market may fall into a liquidity trap with rising global panic, showing a relatively abnormal trend, with risky assets and safe-haven assets showing a downward trend. Although the Federal Reserve cut interest rates by 150BP urgently, it did not save the situation that Dow Jones Industrial Average fell below 19,000 and gold was sold off. At this time, the advantages of AK's BTC soul mining are obvious. Users can easily realize AK's risk-free profit through BTC's warehouse locking and adding mechanism. At the same time, the industrial value of BTC is currently under-estimated. Through soul mining, users are encouraged to voluntarily and consciously participate in the lock-up and add-on of BTC. With the development of the economic cycle and the upcoming halving of production, BTC will return to its fair value. At this time, users will also be able to reap the benefits from BTC appreciation. This is a suitable way for conservative investors, which can steadily obtain the double benefits of AK and BTC.

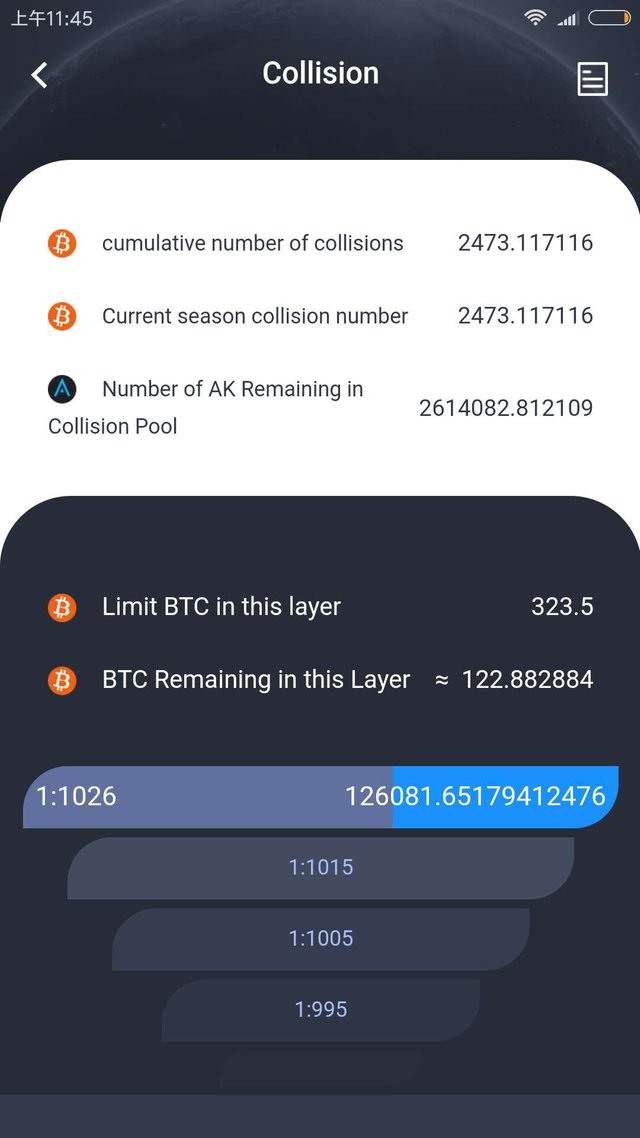

For the blockchain industry, the most scarce thing at present is the innovation power and the attention accompanying the innovation, and AK has successfully achieved this, with 2017 BTCs participating in bit collisions within 2 hours of the launch. Up to now, the total number of collisions has exceeded 2,470 BTCs, and the attention even exceeds several orders of magnitude of BTC. Under the environment of attention and scarcity, the capital and resources will be brought continuously when the users' attention is caught, thus bringing continuous innovation and heat to the development of the industry. The AK soul mining industry is highly worthy of being recorded in history.

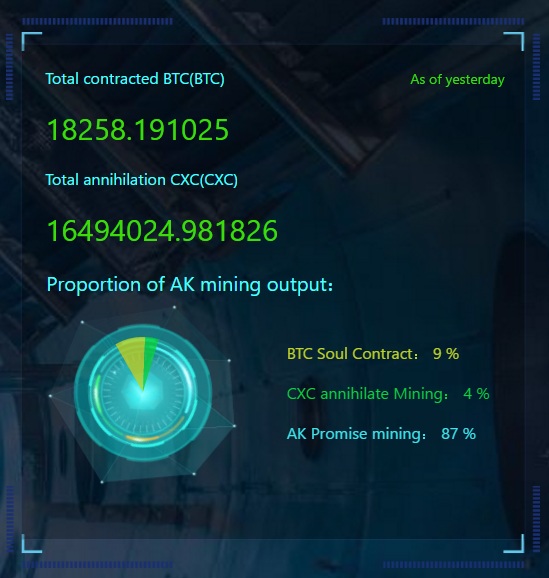

For the AK project itself, soul mining has successfully attracted a large number of high-quality BTC nodes in the world, which is the world's best user group in the blockchain, and this part of the user group plays an important role in promoting the project. As of the early morning of April 3, the number of BTC soul mining contracts reached 18258 BTC. AK takes power from BTC through soul mining to link its cycle with the BTC cycle. Under the driving of potential energy of BTC rising in the later period, AK can continue to rise.

The difficult first quarter has finally passed, with investors all over the world. Compared with the bearish mood of assets such as crude oil, stock market and gold, AK highlights the attribute of high-quality assets and becomes a refuge for global funds, which is required by the current block chain and even the future development. In today's society, whoever is at the top of the information is at the top of the pyramid. Who can understand investment, who can gain wealth first.