Finance is considered to be one of the most seamless industries disrupted by blockchain technology. However due to its many functions and complex systems, there has not been an explosive breakthrough yet. The lending area is ripe for change as customers grapple with challenges to acquire credit solutions.

Recently, the Chain Catcher, a prominent blockchain blog in China, interviewed Stewie Zhu, Founder of DCC, a distributed banking public blockchain employing an infrastructure to interact with banking service providers and create a decentralized ecosystem for the greater financial services industry, and Cipher Tang, CTO of DCC. The two participated in an in-depth interview on the current development, market strategy and product design details of their blockchain project and how it will improve the lending industry.

Changing the Game in the Financial Industry

Chain Catcher:

Please introduce the team and core members.

Stewie Zhu (Founder of DCC):

There are 40 people on our team, 20 of whom are working on technology and the rest are doing marketing and operation. As the founder, I graduated from Yale University and then Oxford University. I once established a Consumer Finance SaaS company called TN Tech.

My partner Dr. Daniel Lu graduated from Yale University and worked for the Deutsche Bank Head Office for many years. Another partner Stone Shi is responsible for leading the quantitative trading market. He served as Vice President at JPMorgan Chase and has extensive experience in derivatives pricing and quantification.

Chain Catcher:

It’s said that DCC is positioned as the “Distributed Bank”. Is it correct?

Stewie Zhu:

We are making a distributed transmission protocol for credit data in the financial sector. Currently, it is mainly for financial lending scenarios.

Generally speaking, the entire lending process takes a long time from pre-lending to post-lending, and it is cumbersome. There can be up to 80 different evaluation metrics to consider when putting together someone’s credit data profile, i.e their online shopping footprint, home loan activity, etc. Therefore, we hope to change the production relationship of the entire financial industry by constructing a transmission protocol that allows users to have control over their data.

Chain Catcher:

It’s known that DCC has moved from the consortium blockchain to the public blockchain, so what are the reasons behind the transition?

Stewie Zhu:

The consortium blockchain is our 1.0 version and was used for over 180 days. The public blockchain is the 2.0 version, which is expected to go live in Q2 2019. There are two primary reasons for implementing the consortium blockchain first. . The first reason is the volume of users, as we hope to accumulate more users and data through the consortium blockchain; the second is to measure the achievability at the technical level.

Cipher Tang (CTO of DCC):

At present, the definitions of the consortium blockchain and the public blockchain are still relatively vague. We believe that if all users can interact directly with the blockchain which can open more ledgering nodes to outside users, then we call it the public blockchain.

Therefore, considering the trade-offs in technology implementation, in the first stage, we adopted an architecture based on Ethereum and the PBFT, a popular consensus algorithm in the underlying layer design to ensure use by users and better support of the smart contract and allow our partners to develop DApps based on our blockchain. This would thereby improve efficiency and common ledgering.

In the second stage, we will use Stellar’s algorithm as reference and use partition consensus to allow all ledgering nodes to enter and exit freely.

The transition from the first stage to the second stage is long because of the underlying implementation of complex development requirements such as message notification, partition consensus establishment, virtual machine definition and other module developments.

For example, we use a streamlined JAVA virtual machine. This is different from Ethereum, which only determines the status without any ledger.

For the architecture in the second stage, we will design a financial ledger with a relatively standard specification, and at the same time, we will customize and match the corresponding template for different upper-level business scenarios. With such a transition, as Stewie said, in the end, through continuous technical optimization, the data will return to the hands of users.

Chain Catcher:

When you started your previous Internet Finance business, what problems did you find in traditional lending?

Stewie Zhu:

I have seen Internet Finance moving from stock financing to P2P and later to consumer finance. We found that all the problems arising in Internet Finance cannot be solved by a non-technical approach.

Take the policy issue of Internet Finance as an example. Why have so many P2P platforms run into problems in June this year? One of the most important reasons behind this is the design of the mechanism.

As early as last November, the “Risk Advice on Internet Small Cash Loan Business” issued by the official website of the National Internet Finance Association of China has indicated that institutions that do not have the ability to lend should stop lending. The effect is clear.

These traditional lending institutions are themselves centralized credit data providers and can hardly be regulated by policies. In order to achieve high profits in business competition, there will inevitably be usury. In addition, the information flow of these P2P companies is not fully disclosed.

One hundred percent of all P2P companies that have run into problems did not disclose their information flow. We know that there would be no mismatches if disclosed, sowhy didn’t they do so? First, there was no way to do due diligence for these assets; second, the underlying assets were faked.

In addition, the mega internet companies are analogous to “central banks.” They are data banks which provide high interest rates for users to earn high profits. Also, there is the danger of releasing users’ privacy. These give small and medium-sized companies nowhere to stand.

Chain Catcher:

So why is blockchain the best solution?

Stewie Zhu:

Blockchain is the only solution. This is what we are doing now, connecting the central nodes of credit data transmission to form a purely distributed structure.

On one hand, users do not need to go to each online lending institution to set up their information. Instead they only need to establish their IDs and send the hash-encrypted information document to each lending institution. Users have control over their own data and privacy is well protected.

On the other hand, in such an ecosystem, all service charges will be paid using DCC tokens, so users not only have control over their data, but also can enjoy very low interest charges.

Small companies can also benefit from the compliance, and can jointly develop on the original user structure, as well as attract more token-holding users through reward incentives to solve the issue of cash realization.

Chain Catcher:

Yuan Dao has recently mentioned “Token Revolution.” Does this provide a chance of rebirth for the P2P companies that find it difficult to survive in traditional Internet Finance?

Stewie Zhu:

First, I think that big companies are afraid to issue tokens.

Second, even if these big companies issue their tokens in disguise, it is difficult to balance the relationship between actual shareholders of the company, vs. token holders who don’t have equity rights to the company.

Third, only small companies can issue tokens. Then we must consider whether the industry itself is suitable for the “Token Revolution” and the technological level needed for its transformation through the blockchain.

Chain Catcher:

The “Token Revolution” can convert more Internet users into token-holding users. If these small companies really manage to enter the blockchain through the “Token Revolution,” will it be a good thing for the whole industry?

Stewie Zhu:

First off, blockchain traffic is not equal to Internet traffic. Second, if we look deeper, the Internet users who invest in tokens and the users who buy coins in the secondary market do not overlap at all. The core reason is that trading of cryptocurrency is not an intuitive process and users may get discouraged by its complexity.

Let me give you an example. If a traditional merchant sends five tokens to a user, called XYZ coin, for non-cryptocurrency users, this is no different from discounts or points. At this time, guidance and education is needed to let the user know the value and tradability of the token.

In the transaction procedure, the user must first download the trading platform software, and open an account. After the transaction, the user needs to exchange it to Fiat currency on the OTC platform. In order to include more non-cryptocurrency users into the transaction, the above steps need to be user-friendly, or the overall market capital can never grow larger.

Giving users control over the data

Chain Catcher:

How is the user’s data information linked to the blockchain?

Cipher Tang:

In the credit field, data is actually divided into external credit data and native lending data. For external credit data, we provide individual users with a standard proof framework that only needs to be verified once and then can be owned by the user to pass to a third at their discretion. This essentially breaks the traditional B2B transfer path that has always left ownership and control in the hands of credit agencies and other third-party authorities.

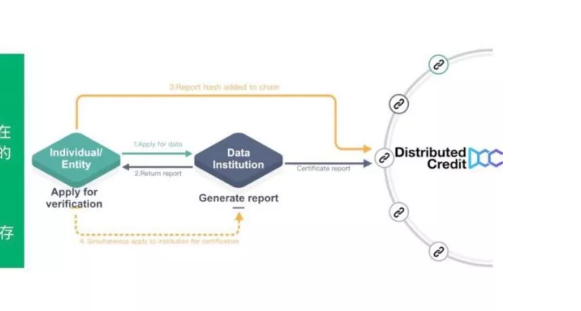

Here’s a step-by-step process on how this works:

- Individual applies for data

- Data institution returns report

- The individual’s report hash is added to the chain

- The individual simultaneously applies to institution for certification

This is an important demonstration of giving users the right of control over their data. There are two mechanisms in the process of user authentication. One mechanism is that the user decides whether the data is linked to the blockchain, and the other mechanism is to apply directly on the chain. The native lending data is the data that directly occurs on the chain.

Chain Catcher:

Risk control is the core of the lending process. How did your team design the risk control system?

Cipher Tang:

In the traditional lending process, each organization’s risk control model is different, which in turn creates different lending standards and lending rates.

In our system, we believe that the risk control system should be diversified. The data is controlled by the borrower itself, and the judgment of the rules and the demand for data are controlled by the lender.

Our logic delivers various types of external evaluations to users. Users can choose to provide data points for institutions to score, and those scores can be cycled back to form more dimensions of certification on the chain.

So in essence, the business process will change. We will connect more data sources to help them provide data authentication on the chain, but we will not touch or retain the original data.

We will have our own risk control system, but only for reference, and will not force users to use it. The data verification and rating we have done on the chain is completely open to the organizations that use the data. So our current role is to provide a reliable relationship platform for data.

Chain Catcher:

What roles are involved in DCC’s lending process?

Stewie Zhu:

According to the lending process, it is divided into pre-lending, lending, and post-lending. During the pre-lending, there are lending advertising platforms like: Rong 360; as well as lending intermediaries like: Qudian, Lexin, Lanling Dai, Shouji Dai, etc. During the lending process, lending institutions are involved such as: banks; lending channels: trust companies, internet small loan companies, etc. During post-lending, there are third-party payment institutions, such as data providers and data analysis parties. These include Tongdun and China Chengxin Credit Rating Group.

Chain Catcher:

So how does your team build cooperation with various institutions?

Cipher Tang:

First of all, for traditional financial institutions, such as licensed banks, the way we work together is that we add a gateway to process data before the system for data collection and on-chain comparison.

Secondly, we cooperate with the internet lending companies during joint development of our DApp. The DApp can reach users very easily, and there are already two that we have established partnerships with.

Thirdly, for the institutions involved in the lending process, such as certification institutions, rating agencies, collection agencies, etc., the data is transmitted in the form of a software development kit, or SDK packages.

At the moment, the confirmation of the status on the chain is less efficient than the original centralized system, so we are working to improve the efficiency and the reliability of status confirmation. At present, because traditional lending is such a slow and arduous process, users have very good acceptance.\

Chain Catcher:

What are the special features of DCC compared to the other projects that do blockchain lending?

Cipher Tang:

First of all, we have to make a distinction between these projects. I think that many of the current lending projects are doing mortgages or collateral based lending on digital assets. This is actually a pawn business. The overall architecture does not use blockchain technology.

The areas they focus on are more towards cryptocurrency, and we are more inclined to changing the structure of the game and the relationship of production. The essence of our system is to transmit the user’s credit on the blockchain. By providing the underlying development standards and DEMO code, institutions can independently develop and interact, and thus our path is not the same as theirs so there is not much to compare.

Secondly, for financial alliances like R3, we have different business focuses. They are more focused on establishing a common ledger that supports multiple business scenarios within banks.

However, we believe that this demand does not form a strong consensus within banks. There are two kinds of things that are very important in the financial underlying system. One is credit and the other is assets. An important issue we see is the monopoly of credit by centralized institutions.

Our starting point is to help users grasp their own data value through blockchain technology, to accumulate their own credit, and finally to change the game and business logic between the C-end and B-end.

The business ledgers launched by Ripple, R3 and IBM are more about changing the game structure between the B-end financial institutions so that they can co-process the business. The change to the underlying overall credit environment is to reconstruct the entire upper-level financial business.

Therefore, we will not give priority to inter-bank common ledger, but we will first serve the C-end users, let the C-end users grasp their own credit value, and thus gradually change the structure of the upper layer.

Trade DCC on Kucoin 📈

Connect with DCC (English):

DCC를 만나보세요 (한국어):

DCC 社群 (中文):

Kênh DCC Việt Nam (Tiếng Việt):

Philippines

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@dcc.finance2018/chain-catcher-blog-interviews-dcc-founder-his-cto-how-user-control-over-data-underlies-changes-859c2e5d23c

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit