What is TokenLend?

TokenLend is a project aimed at creating a platform for P2P loans, in addition to the secondary market for loans using cryptocurrency and the science of applied blockchain. The crew plans to create a primary and secondary market for lending in its personal ecosystem that can function on the premise of fiat and cryptocurrency, in addition to the corresponding Loan Participation Notes that are appropriate for mortgage solicitation (LPN).

The platform scheme utilizes a lending mannequin by means of LPN as a monetary instrument, where corporate financing through mediators is conducted by various buyers in the trade for issued shares. Such a paper has a price sooner or later like every asset, and may flow into the secondary market. By entering cryptocurrency and a reasonable contract into this scheme, one can draw an analogy between TokenLend and this scheme.

The attribute function of the business is to pay attention to a reliable secure loan (for entities and authorized persons), in addition to involving a third event in mortgage-giving techniques to ensure the purity of legitimate transactions and responsible for claiming the money owed. So unlike many of the initiatives in the lending market, the emphasis is positioned on gigantic capital and compliance.

In the phrase of technical structure and innovation, TokenLend creates a centralized platform that utilizes sensible Ethereum contracts to create lending and LPN situations. Secondary markets can also be centralized; transparency is ensured by the Ethereum blockchain as a result of transactional transparency.

From a legitimate point of view, this effort is represented by DT Soft Ltd., registered in Belize. Company mannequins focusing on Eastern Europe: to start with in Estonia and Latvia, 2 most European jurisdictions accept cryptocurrency; Sooner or later, platform action is deliberately developed to combine the different international locations of giants.

This effort was led by a powerful crew led by Sergei Naiden; crew portfolio contains several identifiable initiatives that are comparable to DAEMON Tools. Many consultants from different jurisdictions with specialized expertise are also involved.

ICO TokenLend is being staged in two phases: Presale, and the crowdsale itself. Individual Presale is given a certain low cost, in addition to the unique rights to get into beta platform testing. The TLN token purchased in the center of the ICO is a security token; an important mechanism of value creation inside is the distribution of some of TokenLend's internet revenues among tokenholder.

- Pre-sale

Start: March 1, 2018

End: March 11, 2018

Hard cap: $ 3,010,000

Minimum funding: 1 ETH

- ICO

Starts: March 26, 2018

End: May 10, 2018

Soft Cap: $ 4.3 million

Hard cap: $ 35,000,000

Price: 2500 TLN = 1 ETH

Minimum funding: 0.0004 ETH

Token: TLN, regular ERC-20

Currency received:

Total situation: 130.411.585 TLN

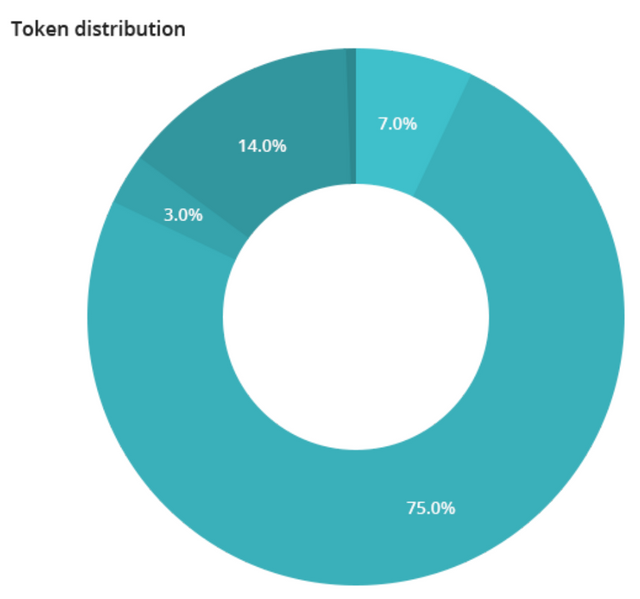

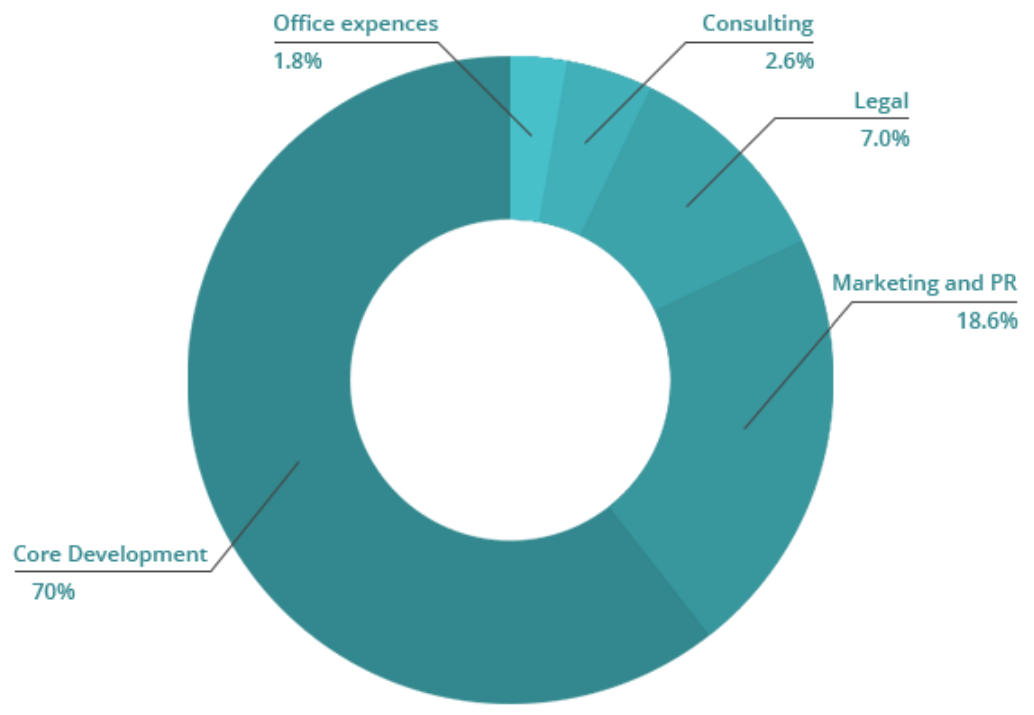

- Budget allocation:

75% - Tokensale

14% - Tim

7% - Pre-sale

1% - Bounty

3% - Adviser

- Sale: 93.750.000 TLN

The TLN token acquired by the contributor is likely to be transferable 7 days after the top of the Initial Coins Bid marketing campaign.

All unsold tokens will likely be burned

The Core Budget is 800 ETH, the amount of funding wants to develop, launch and promote the lending platform.

Partner token is likely to be frozen for 12 months after ICO

50% of crew tokens will likely be locked for 24 months after ICO, the remaining 50% will likely be locked for 48 months.

ICO requires bonus levels to rely on complete acquisitions in addition to sales progress. Depending on the purchase completed, the bonus rate varies from 20% (lower than 5 ETH) to 25% (over 80 ETH). Depending on the sales progress, the bonus rate starts at 10% (tier 1) and decreases to 3% (tier 4).

TokenLend: Service and Scope.

TokenLend is creating a p2p loan platform with three main elements:...

Loan Marketplace - the first loan p2p market where debtors are companies, and lenders (buyers) are platform customers.

Loan Participation Note (LPN) market - a secondary market for p2p that lends customers premises can trade sustainable investments for quick liquidity.

Payment Gateway - a service that allows customers to deposit and withdraw funds from the platform.

It may be prudent to judge all the companies discussed carefully; However, the Loan Market is the premise of TokenLend.

Strictly speaking, the firm's outline of the platform in the documentation should not be significantly complete, but the basic image is given: The market is likely to be crammed with intermediaries (third-party licensed companies who are the originators of mortgages) and debtors (buyers). The lender will take part in the journey solely by the way the mortgage initiator (the official entity and the people who provide the secured loan). According to the business logic, emphasis is positioned on a secured real-estate loan - a reliable mortgage loan. This will enable it to create an ecosystem with a small likelihood of failed borrowers in the first level of platform growth.

The loan initiator is a licensed intermediary who has an official relationship with each borrower and TokenLend. In case of problems with mortgages, mortgage creators harm all the goods on the platform, and they are obliged to compensate for all delays and defaults earlier than any additional debt.

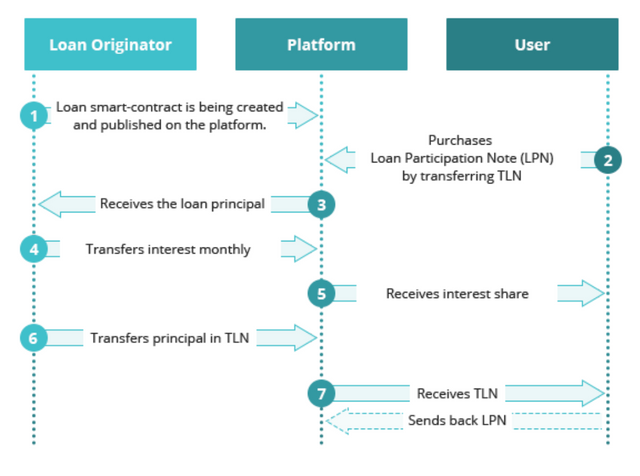

TokenLend illustrates the example of the mortgage life cycle in its white paper; instance using TLN token, but this scheme is valid for any supported forex (fiat and cryptocurrency):

Mortgage advocates provide new mortgages to the system through the Dashboard, fill in all important types and submit documentation. Once the mortgage details are validated and verified efficiently by the system and by TokenLend, a reasonable contract of mortgage is made with all related parameters.

User (buyer) purchases LPN by transferring TLN token to reasonable contract handling. Then a wise contract mortgage generates a LPN contract with a phrase of mortgage compensation and schedule.

Tokens collected from buyers are sent to mortgage initiators, and each LPN is linked to the consumer's ETH grip to shift away from curiosity and principal mortgages.

In accordance with a sensible mortgage contract schedule, the mortgage originator creates curiosity funds and principal payments; funds are transferred to the LPN contract from a reasonable contract mortgage. The LPN contract sends funds to the pockets of investors.

After the last transaction on the mortgage, the mortgage is closed, the bag grip is away from the LPN, and the LPN contract is calculated for full execution.

If there may be delays, defaults or extraordinary events that are different, individual platform mechanisms and actions should not be determined. Given the reference to a purely legal relationship between the top borrower and the mortgage lender, it should be considered that it is the intermediary who may be responsible for the debt restoration or the borrower's chapter. At the same time, it is difficult to predict how this mechanism will likely be executed in reality because the legitimate scheme is ambiguous.

Even based largely on the outline, the monetary flows for lending companies remain unclear to us. Despite the fact that LPN can be issued and purchased in multiple currencies, when utilizing the top TLN borrowers or top lenders must convert funds, which require forex dangers. It should not be clear enough for us to bring this danger as a result of a conversion that should not be detailed; logically, the danger falls on investors, but in this case, they have the possibility to use fiat for platform operations.

There is no way for the creation of the default interest rate or mortgage realization on the platform; this mechanism is likely to be an intermediary task. However, if interest rates conflict with borrower standards do not meet the market, funds will not be raised, which will not benefit the market.

The secondary LPN market will work the same for trade, where customers can make requests to obtain and promote in addition to meeting reply requests. Transactions are likely to be made by transferring an LPN from one Ethereum handle to a different trade for cryptocurrency or fiat. If the platform turns into standard and demand with non-public buyers, this can greatly reduce the lending hazard as it should enable the company to offer liquidity to LPN.

With regard to the company's mannequins, TokenLend does not present approximate calculations at interest rates within the platform, but instead provides the general costs in Latvia and Estonia and justifies the mannequin's usefulness for all events in the ecosystem. According to information from the white paper, loans secured by the real property provided in the market at a cost of 10-14%, and the pull of funding brings the cost of 5-8%. This raises the question, as a result of forex loans should not be determined, however, taking into account that Latvia and Estonia are part of the Euro zone, the cost provided looks unrealistic for this forex. No supply of information was offered for this info.

Regarding the construction of costs, three types of payloads are likely to be established within the ecosystem: The cost of collecting mortgages for the mortgage originator - 0.5% -1% of the mortgage principal; the cost of gross LPN sales to customers - these costs must be collected from customers for every lucrative LPN trade in the secondary market - 1-5% of the market value; and withdrawal fees (for forex fiat alone) of 1% of total transactions.

TokenLend: Team and Stakeholder.

The TokenLend crew is a kind of skilled in the software program market; Founder has got one famous product, DAEMON Tools which is a digital drive and optical disc writing program. Years of experience in the administration of enormous IT initiatives (eg DAEMON Tools) signifies professionalism in the crew, along with its ability to properly manage corporate processes.

The crew members' special skills do not include working with some other blockchain initiatives, but their current expertise should help them apply the technical aspects to an exaggerated stage.

Sergei Naiden, Chief Executive Officer

Robert Morris University, USA

Master of Science, Banking, Corporate, Finance and Securities Law. Entrepreneur glows with more than 25 years of expertise in managing giant corporations and more than 10 years of expertise in the ownership and administration of global IT companies. Developer and vendor of world-renowned software program products, DAEMON Tools.

Ivan Kovtun, Chief Operating Officer,

business analyst and product supervisor with 10 years expertise in managing company operations worldwide and over 5 years of expertise in product ownership of software programs and administration.

Vitaliy Russkih, Chief Technical Officer.

Senior developer with 12 years expertise in creating elaborate techniques and 10-year expertise in the administration of crew software programs.

Alexandr Petrov, Blockchain Architect / Lead Developer

- Senior developers with more than 12 years of expertise in designing and implementing enterprise-level options along with the growth of kernel drivers and the growth of embedded techniques.

- 3+ years of expertise in designing blockchain options for IoT and FinTech.

Maria Viter, Chief Marketing Officer.

Industry skilled with more than eight years of expertise in software product advertising and software expertise over 5 years in the business growth of DAEMON Tools product line.

Tanya Chuh, Chief Communications Officer.

Senior specialist with more than 5 years of expertise in public relations action, specializing in building PR methods and Community administration for companies working in the inventory market and distributors of software programs around the world.

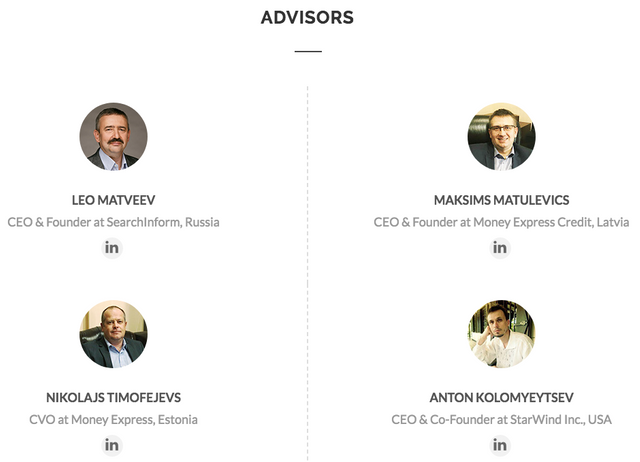

The project has set 4 advisors. Judging by their description, all four are entrepreneurs and have worked efficiently in several sectors of the financial system for several years. It's mentioned, this adviser has not offered the company for different blockchain initiatives before now. We hope their experience will be invaluable for the TokenLend project....

- Leo Matveev: CEO and Founder of SearchInform, Russia

- Maksims Matulevics: CEO and Founder of Money Express Credit, Latvia

- Anton Kolomyeytsev: CEO and Founder of StarWind Inc., USA

- Nikolajs Timofejevs: CVO from MONEY EXPRESS, Estonia

TokenLend: TLN ERC-20 Token.

The TLN Token primarily has safety performance in the company's TokenLend mannequins; Nevertheless, it also brings several utility features, as it can usually be incorporated into the TLN on the platform.

The basic element in TLN value is TokenLend internet income distribution. However, this mechanism is only valid for tokens, ie buyers in the ICO are given a type of "dividend" in exchange for initial participation in the business. According to the info from the documentation, the quantity of prizes from Internet revenues will likely be decided in proportion to the various tokens purchased on ICO.

Mannequin Internet platform revenue details, where ICO buyers get additional also raises some questions. First, the in-depth mechanism, quantity of prizes or monetary outcomes anticipated after the launch of the platform should not be disclosed. At the same time, such mannequins imply the recognition of tokens as security; Here it is important to have a transparent official place close to the regulatory points and to ensure the most achievable liquidity, as a result of buying and selling platforms will seek to keep from supporting tokens.

Another disadvantage to the dividend mechanism is the scarcity of legitimate foundations; investor rights should not be protected by something. And if in the case of utilities, the value of the interior is closely related to the company, and any violation of the rights will occur at the expense of the company, in this case the duty of the crew is impartial to the company and the mechanism is built on conviction. .

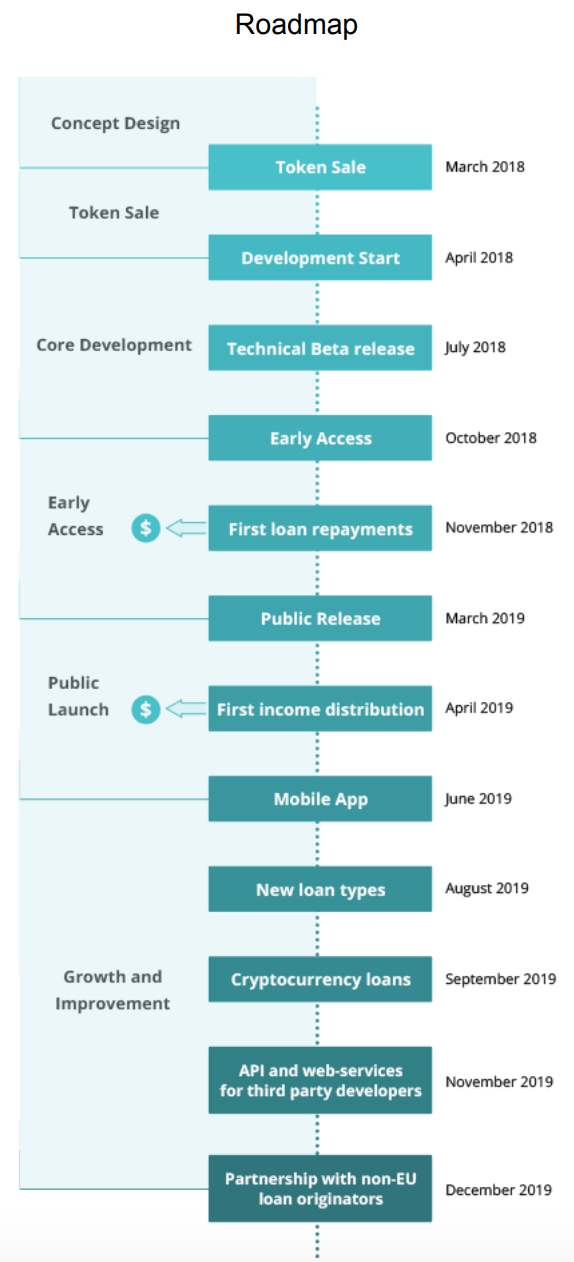

Regardless of official dangers, we positively assess such mechanisms if the crew is ready to make it work and adjust to the obligations. In this case, it is helpful to buy tokens within the ICO itself, and even in the case of extra value discounts, the crew will get the desired funds for growth and can implement the roadmap.

TokenLend: More Information.

- Website: https://tokenlend.io/

- Whitepaper: https://tokenlend.io/tokenlend_whitepaper.pdf

- Facebook: https://www.facebook.com/tokenlend/

- Twitter: https://twitter.com/Tokenlend_news

- Telegram: https://t.me/tokenlend

- Medium: https://medium.com/@tokenlend

- ANN bitcointalk line: https://bitcointalk.org/index.php?topic=2548329

AUTHOR: dean andhika

https://bitcointalk.org/index.php?action=profile;u=1701319

Very well organized and informative post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

WARNING - The message you received from @zamanhuri14 is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post: https://steemit.com/steemit/@arcange/phishing-site-reported-upvoteme-dot-ml

Please consider to upvote this warning if you find my work to protect you and the platform valuable. Your support is welcome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit