This article is part of a scientific paper written by the DECA team. Later sections of this paper will be published on the same channel. This research reveals how the DECA price mechanism works.

Historical Development of Money

1. Development of money

“We have gold because we cannot trust governments.”

President Herbert Hoover to Roosevelt in 1933.

This paper aims to establish the theoretical background to determine a price mechanism for DECA token, the first semi-stable coin based on carbon credits. Firstly, the traditional money such as commodity money and fiat money and its characteristics will be defined. Secondly, the instruments to determine the fiat money supply price will be determined, and thirdly, the price determination of DECA token, a semi-stable coin, is explained.

1.1. Traditional Money

In literature, money is defined as an asset that people use to buy goods and services which has three functions: A medium of exchange, a unit of account and a store of value¹.

There are different types of money such as commodity money, and fiat money.

Commodity money is characterized by having an intrinsic value, which means that the money would have value even if it is not used as money. The most common commodity money examples are gold, silver, or oil. Fiat money has been established by a government decree and was introduced as an alternative to commodity money. Its main characteristic is that it has no intrinsic value, which means that without the government decree it would be worthless.² Fiat money is based on the credit of an economy and its value depends on supply and demand which depends on the economic, industrial, and monetary performance of a country and how it is governed.³

Money has a long history, but China was the first country using fiat money around 1000 AD and people accepted it as they already were familiar with the use of credit notes. For Western Countries, it took them until the 18th century to use fiat money. They started using bills of credit to make payments like taxes. Some regions like New England and Carolina printed a lot of bills of credit which led to devaluation and a hike in commodity prices.⁴

To understand the utility of fiat money, we have to analyze the reasons for its application:

-Consumer-driven economic system

According to the OECD, the final consumer expenditure defined as household consumption to meet their everyday needs such as foods, drinks, clothing, and housing, represents normally 60% of the GDP of a country.⁵ Before the subprime crisis in 2008, the quarterly consumption expenditure accounted for 70%⁶ of the US GDP and dropped steadily until reaching 67% in March 2020.⁷ Consumer spending has become an important part of economic growth and its mostly financed through debt.⁸

The indicator household debt to GDP in the United States showed that it peaked in 2008 at 98% and dropped since then constantly until reaching 76% at the end of 2019.⁹ The results show that most of the spendings are based on credit. One big advantage of fiat money is that governments can print more money and motivate people to spend more which can be traced back to history. For instance, the US monetary history started in 1792 fixing the dollar value to gold and silver. Due to the volatility in the global supply of both metals, the government adjusted the metal values.¹⁰ In 1879, the US adopted the Gold Standard with the US dollar pegged to the gold value until 1933.¹¹

In 1913, the US Dollar wasn’t backed up 100% by gold anymore as the Federal Reserve evolved the system from its founding year. The Federal Reserve backed the US dollar only by 40% with gold and was able to print more money.¹² By doing this, the US government could spend more money and was not so restricted to the availability of gold. Most countries left the Gold Standard during World War I to print more money and finance his participation in the war. The focus on the Gold Standard returned due to the Great Depression in 1929 and the second World War. By the 1950s, the international community decided to replace the Gold Standard and implement the Bretton Wood Agreement, where the USD was pegged to the gold and other currencies fixed their value to the USD. As the United States kept printing money to stimulate its economy, other countries became concerned about the purchasing power of the USD as the exchange rate to gold was fixed. Many countries attempted to exchange their USD against gold.¹³

As a consequence, in 1971, President Richard Nixon announced the end of the gold convertibility unilaterally and the “quasi Gold Standard” fearing a gold run on the United States and hence, devaluing the dollar more. Thus, the US government stopped issuing gold for foreign central banks in exchange for US dollars.¹⁴ Since then, the dollar is based on full faith and credit, which means that the government promises to pay its debt in a timely manner.¹⁵

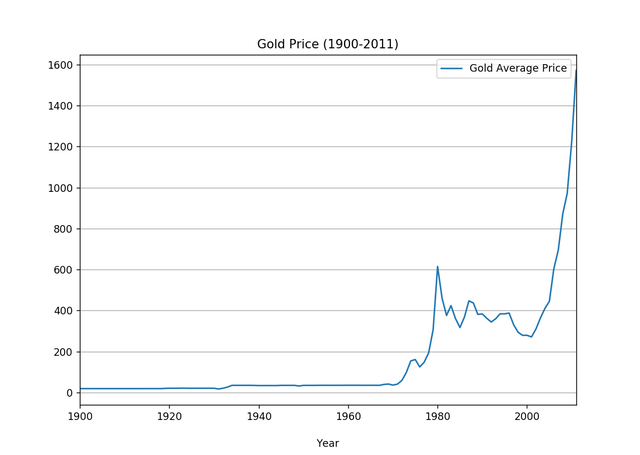

Image 1. Gold Average Price between 1900–2011. Source: Own Development, Data from World Gold Council, London PMI.

Image 1 exhibits the gold price evolution between 1900 and 2011. Up to 1971 the gold price per ounce has been flat, at 20.67 USD until 1933 and jumping in the same year to 35.00 USD as the dollar devalued due to the Great Depression. After the Second World War, the USD has been chosen to be the world reserve currency pegged at a gold price at 35.00 USD. Since decoupling the dollar from the gold, gold could fluctuate freely and the price increased 24 times between 1971 and 1980.

Until today, gold is used as a hedge against fiat money which explains its strong increase over time.

-Fiat Money facilitates usage

The second reason is that it is easier to use fiat currency. Using gold as currency is costly as it takes time to verify the purity and to measure the quantity. To make the usage easier, the government accepted the gold from the public in exchange for gold certificates with the promise that they can redeem them against gold. As people believed this, the certificate was valued as gold itself. Within time, the redemption has been irrelevant as nobody redeemed the certificates for gold. As long as everybody accepts the paper in exchange for value, they will have value.¹⁶

Fiat money became quite popular in the 20th century as governments and banks protected their economy from the busts of the business cycle, where commodity currencies could not help. However, central banks have not been able to prevent a crisis (2008) through the use of fiat money, even if they control the money supply. Thus, there are a lot of critics that argue gold is more stable due to the limited supply than fiat which has an unlimited supply.¹⁷ History proved that the control of money supply can lead to economic ruin. Countries like Germany in 1923, Zimbabwe in 2008, and Venezuela in 2019 got into hyperinflation due to printing money.¹⁸

1.2 Cryptocurrencies

In the history of money, commodity money can be considered as money 1.0, followed by the fiat money (money 2.0). The deficits of the former money types led to the creation of cryptocurrencies which we can define as money 3.0. The first cryptocurrency was developed by Satoshi Nakamoto, who released Bitcoin in 2008. Nakamoto announced this invention as “Peer-to-Peer Electronic Cash System” which is completely decentralized and prevents double-spending. The development of a cryptocurrency, a digital medium of exchange, is the result of the “failures” and deficits of the traditional money mentioned before. It is based on asymmetric cryptography which uses two different keys, the public and the private keys.¹⁹

In contrary to fiat money, cryptocurrencies have a limited token supply and cannot be manipulated by authorities to create more tokens. Furthermore, it is not created by debt as fiat money. A central bank that is creating fiat money to the consumers, is simultaneously issuing a percentage of the consumer's government debt. Cryptocurrencies do not represent debt, only itself.²⁰

In early March 2020, the governor-designate, Andrew Bailey, from the Bank of England, said that Bitcoin doesn’t have any intrinsic value. Other governmental representatives like the United States President, Donald Trump, confirmed the missing intrinsic value. However, crypto investors disagree as intrinsic value is a subjective perception of an investor and depends on the specific situation.²¹

In comparing cryptocurrencies like Bitcoin with traditional money, commodity and fiat, Bitcoin doesn’t have any intrinsic value as it is not based on commodities like gold or silver. The main criticism of cryptocurrencies is the volatility, as the price determination happens through supply and demand. It cannot be influenced by authorities or governments as it is completely decentralized. A reason for the volatility is the missing market liquidity, along with speculation due to its asset characteristics. Eventually, the arguments are the same: People went back to gold as they didn’t trust the government fiat money. Nowadays, people buy cryptocurrencies due to the missing trust in the fiat currency. The cryptocurrency system could be considered as a hedge against fiat currency systems.²²

Cryptocurrencies have not remained since 2008 but are evolving to fix the issues of Bitcoin such as volatility, electricity consumption and the possibility of the 51% attack. Furthermore, methods like proof of stake are getting more decentralized and accessible. New cryptocurrencies with new concepts and technologies emerged, like Ethereum. To tackle the volatility of those cryptocurrencies, stablecoins have been developed based on fiat money, like (TUSD) or commodities like gold (PaxGold), which are 100 % based on the USD or gold price.²³

Other cryptocurrencies like DECA Token will go one step further and develop a semi-stable coin, which is based on a certain percentage of canceled carbon credits. The backup of the token will increase over time, starting from 5% and growing up to 20% over the next few years. Going back in history, the USD was based 40% on Gold in 1913 and today, although not officially, the USD is to a certain degree based on oil due to the Petrodollar.

Sources:

¹ Mankiw, Ball (2010): Macroeconomics and the Financial System

² N. Gregory Mankiw, Economics, p. 607

³ Mankiw, Ball (2010): Macroeconomics and the Financial System

⁴https://corporatefinanceinstitute.com/resources/knowledge/economics/fiat-money-currency/ 2019–05–21

⁵https://data.oecd.org/hha/household-spending.html 2019–05–21

⁶ The Consumer-Driven Economy at a Crossroads ROBERT P. YEREXn, Business Economics

⁷ https://www.ceicdata.com/en/indicator/united-states/private-consumption--of-nominal-gdp 2019–05–21

⁸ The Consumer-Driven Economy at a Crossroads ROBERT P. YEREXn, Business Economics

⁹ https://fred.stlouisfed.org/series/HDTGPDUSQ163N 2019–05–21

¹⁰https://corporatefinanceinstitute.com/resources/knowledge/economics/gold-standard/ 2019–05–21

¹¹ https://fas.org/sgp/crs/misc/R41887.pdf 2019–05–21

¹²https://corporatefinanceinstitute.com/resources/knowledge/economics/gold-standard/ 2019–05–21

¹³ Central Banking Theory and Practice

¹⁴https://www.intereconomics.eu/contents/year/2015/number/5/article/on-the-unilateral-introduction-of-gold-backed-currencies.html 2019–05–21

¹⁵ https://www.investopedia.com/terms/f/full-faith-credit.asp 2019–05–21

¹⁶ Mankiw, Ball (2010): Macroeconomics and the Financial System

¹⁷https://corporatefinanceinstitute.com/resources/knowledge/economics/fiat-money-currency/ 2019–05–21

¹⁸ Mankiw, Ball (2010): Macroeconomics and the Financial System

¹⁹ https://blockgeeks.com/guides/what-is-cryptocurrency/#Understanding_Cryptocurrency_Basics_101 2019–05–21

²⁰ https://www.bitpanda.com/academy/en/lessons/whats-the-difference-between-a-cryptocurrency-like-bitcoin-and-fiat-money/ 2019–05–21

²¹ https://cointelegraph.com/news/does-bitcoin-have-intrinsic-value-or-is-it-based-on-thin-air 2019–05–21

²² https://www.forbes.com/sites/rogerhuang/2019/08/27/bitcoin-and-cryptocurrencies-are-a-hedge-for-bad-government/#6d26b1f12904

21–05–2020

²³ https://www.wsj.com/articles/why-stablecoins-stand-out-in-the-cryptocurrency-world-11560218460 2019–05–21