-First published on Medium in December 2016-

A few months ago I wrote a piece called What Kind of Marketplace Are You Building? It covered the structural differences between the main types of marketplaces.

In this follow-up post, I’d like to address some external factors that could impact the model in the long run.

Online marketplaces still provide one of the best business models out there. They tick all the key boxes including scalability, network effects, no assets ownership, no inventory and fast global growth.

They produced many successful giants that have drastically improved several industries in the past 20 years.

The question is

For how long can this model stay viable? Does it face any potential existential threats?

The most successful marketplaces came to life because they managed to remove middleman entities, that were mostly brick and mortar operations, and replaced them with an automated piece of software accessible over the Internet.

By doing so, they provided a much better user experience with 24/7 access, massive global reach, simple and quick payment mechanisms, transparent reputation rating, realtime services and lower prices by eliminating the need for expensive manual operations.

There’s one important aspect to highlight though. The model is often explained as “removing the middleman” without emphasizing that what actually happens is not a complete removal of the broker in the middle, but rather a replacement of the old broker with a new kind of broker. A much better type of broker, built around a software platform, but still a middleman entity between the supply and demand sides.

That centralized software architecture is how online marketplaces are able to capture value and is the critical building block of their business model.

For almost two decades, nothing seemed to disturb that position. There wasn’t any other technology that could be more efficient than an automated central software to handle the relationship between the supply and demand sides.

Nevertheless, in the past few years, something interesting started to happen, in a totally different domain. Bitcoin, the now famous cryptocurrency, was designed around a distributed architecture that used a public decentralized ledger, called the Blockchain.

The Blockchain architecture allows peer-to-peer Bitcoin transactions to take place in a secure way without the need for any central entities such as banks.

It didn’t take very long before Blockchain type of architecture started to appear as the ideal distributed trust management system the Internet was waiting for. It could be used to solve peer-to-peer trust problems beyond the original Bitcoin transactions and wallets.

“We finally have the conceptual framework for such a system, one in which trust need no longer be invested in a third-party intermediary but managed in a distributed manner across a community of users incentivized to protect a public good.” Oreilly

The Blockchain provides a solution to the trust and data sharing problem without the need for a central database controlled by a third-party.

What it doesn’t directly provide is a system to implement the business rules and logic that online marketplaces need. For example, revenue split agreements, dynamic pricing, and insurance payouts when certain criteria are met.

This is where Smart Contracts come into play.

Smart contracts (also called self-executing contracts, blockchain contracts, or digital contracts) are simply computer programs that act as agreements where the terms of the agreement can be preprogrammed with the ability to self-execute and self-enforce itself. The main goal of a smart contract is to enable two anonymous parties to trade and do business with each other, usually over the internet, without the need for a middleman. blockchaintechnologies.com

Smart Contracts represent the final piece of the puzzle that was needed to completely replace the middleman by a real peer-to-peer architecture.

Blockchain and Smart Contracts, provide the tools and framework to create a new generation of marketplaces where supply and demand sides can engage in trusted trading transactions, according to various business rules, without the need of a central brokerage entity.

Consequently, the same way online marketplaces disrupted many traditional brick and mortar businesses, Blockchain and Smart Contracts will give birth to a new kind of peer-to-peer marketplaces that will unsettle the current ones.

Presently, that seems to be the biggest threat to the online marketplaces business model that has been incredibly powerful for the past couple of decades.

The shift will not occur in a year or two but it’s their most serious long term strategic risk.

This is one of the cases where it’s not a matter of “if” but rather “when” the new decentralized structure will take over as the technology keeps maturing and improving.

The peer-to-peer structure is the perfect fit for the decentralized nature of the Internet and has the benefit of handing over the power back to the people participating in the network.

Some interesting experiments are already taking place:

- OpenBazaar

OpenBazaar is a different way to do online commerce. Instead of visiting a website, you download and install a program on your computer that directly connects you to other people looking to buy and sell goods and services with you. This peer to peer network isn’t controlled by any company or organization — it’s a community of people who want to engage in trade directly with each other.

- La’Zooz

A Decentralized Transportation Platform owned by the community and utilising vehicles unused space to create a variety of smart transportation solutions. By using cryptocurrency technology La`Zooz works with a “Fair Share” rewarding mechanism for developers, users and backers.

- WeiFund

WeiFund is an open platform for crowdfunding campaigns. You can launch a campaign using one of WeiFund’s contract templates or integrate your own smart contracts…

WeiFund is built on Ethereum.

We may witness a true commerce revolution, once some of the ongoing trials start to work at scale.

Does it mean current online marketplaces are doomed?

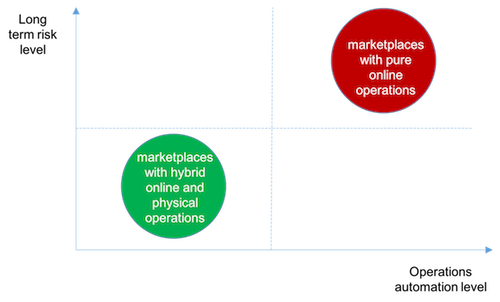

The surprising part is that today’s marketplaces with the best unit economics are the most at risk and the ones with much tighter margins are relatively more immune.

It sounds counter-intuitive, but businesses with the best unit economics are usually highly automated. Almost all of their operations are managed by a central software. Human intervention is kept minimal and mainly handles activities such as regulation, fraud and customer care.

Paradoxically, when marketplaces are highly efficient around pure online operations, they become the ideal target for replacement by a decentralized peer-to-peer model.

On the other hand, marketplaces that require non-automated operations, in addition to online operations to provide their services, are much harder to displace.

A good example is Amazon marketplace part of the business. (Putting aside the e-commerce, cloud, content and other areas).

Amazon offers independent sellers the possibility to list their products on their platform. Software fully automates the product discovery, ratings, and payment handling. But, Amazon also offers a service called Fulfillment by Amazon that can pick, store, package and deliver the orders on behalf of the sellers.

You sell it, we ship it. Amazon has created one of the most advanced fulfillment networks in the world, and your business can benefit from our expertise. With Fulfillment by Amazon (FBA), you store your products in Amazon’s fulfillment centers, and we pick, pack, ship, and provide customer service for these products. Best of all, FBA can help you scale your business and reach more customers.

This gives Amazon a much stronger position by combining the online platform scale with the magnitude of a physical network of fulfillment centers and their associated operations.

Blockchain and Smart Contracts can not displace that kind of combined online and physical services.

So what could other marketplaces, that are presently built around simple online operations, do to reduce their long term risk?

They could consider adding new layers of services on the top of their existing online activities. These new services should complement the existing ones and make the whole offering even more attractive to the end users.

A couple of examples:

Home sharing marketplaces could add a fully managed operations service, where hosts would hand over the keys, and everything would be taken care of. Not only finding guests and getting payments but also handling check-in/check-out and cleaning.

Freelance marketplaces could add a service where a job is requested for a particular scope, and they would take care of finding the right candidate and manage the project by committing to a timeline, price, and quality of deliverables.

These kinds of offerings may sound terrible because they come with higher overhead and lower margins.

Still, they would make the marketplaces much stronger in the long run and would reduce their risk exposure to the upcoming disruptive peer-to-peer structures.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@e_hicham/blockchain-and-smart-contracts-will-eat-online-marketplaces-ce86c56e62c0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read 👍🏼👍🏼

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @dogon! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @dogon! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit