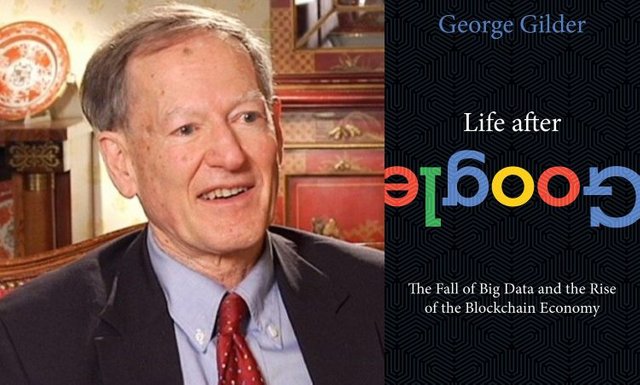

These 21 quotes have been distilled down from the previously posted “Gilder 95”. The number 21 was chosen as an homage to the total number of Bitcoins that will ever exist - 21 million. [Link to The Gilder 95: https://steemit.com/blockchain/@downing/the-gilder-95-quotes-from-gilder-s-life-after-google ]

“The concentration of data in walled gardens increases the cost of security. The industry sought safety in centralization. But centralization is not safe… The company store was not a great davance of capitalism during the era of so-called “robber barons,” and it is no better today when it is dispersed through the cloud, funded through advertising, and combined with the spurious sharing of free goods. Marxism was historically hyperbolic the first time round, and the new Marxism is delusional today. It is time for a new information architecture for a globally distributed economy… Fortunately, it is on its way.” (p.9)

“All wealth is the product of knowledge.” (p.13)

“Under Newton’s gold standard, the horizons of economic activity expanded. Scores of thousands of miles of railway lines spread across Britain and the empire, and the sun never set on the expanding circles of trust that underlay British finance and commerce. Perhaps the most important result of free commerce was the end of slavery. Reliable money and free and efficient labor markets made ownership of human laborers unprofitable. Commerce eclipsed physical power.” (p.13)

“A system of the world necessarily combines science and commerce, religion and philosophy, economics and epistemology.” (p.19)

“Money is not a magic wand but a measuring stick, not wealth but a gauge of it. Whereas money in the Google era is fodder for five-trillion-dollar-a-day currency - that’s seventy-five times the amount of the world’s trade in goods and services - you will command unmediated money that measures value rather than manipulates it.” (p.49)

“The currencies that central banks manage today have no anchor in gold and thus suffer from the self-referential circularity of all logical systems not moored to reality outside of themselves. In the United States, unmoored Markovian money can be manipulated at will by the Federal Reserve in the interests of its sponsors in government and their pseudo-private cronies.” (p.88)

“Unmoored money changes the culture of capitalism. Wall Street banks relish volatile currencies, their downside protected by government. Main Street and Silicon Valley want stable money for long-term investments, the upside guaranteed by the rule of law. The governments of the world, their money unmoored, favor finance over enterprise, shortening the time horizons of economic activity. Among fast traders the rhythms are reduced to seconds and the economy endures a hypertrophy of short-term finance.” (p.88)

“All wealth is ultimately a product of long-term investment based on knowledge and discovery. There is no way to escape the inexorable conflict between savers who want liquidity and investors who constantly destroy it with enduring investments.” (p.91)

“Midas’s error was to mistake gold, wealth’s monetary measure, for wealth itself. But wealth is not a thing or a random sequence. It is inextricably rooted in hard won knowledge over extended time.” (p.92)

“If anyone is in control of bitcoin, its distributed security model fails. Satoshi would become just another dreaded ‘Trusted Third Party,’ subject to subpoena by repressive governments or hacked by determined nerds or pirates.” (p.132)

“Bitcoin gains momentum with every governmental campaign against cash, which is the alternative peer-to-peer vessel for anonymous private transactions. Bitcoin appreciates every time a central bank promotes spurious growth with negative interest rates and inflation targets, raiding the retirement savings of pensioners.” (p.155)

“Within the segments, Google, Apple, Facebook, Amazon, et al. collected more and more private data and protected them with firewalls and encryption. But as time passed, they discovered that centralization is not safe. Putting data in central repositories solved hackers’ hardest problem for them: It told them which data were important and where it was, putting the entire Internet at risk.” (p.168)

“Nelson and Ali felt a surge of excitement about blockchain technology. Ali described it as ‘the most sophisticated and complex and yet elegant and beautiful program I ever came across. And the main thing it does is it gives power back to the people.’” (p.172)

“The cryptocosm can mobilize computer power in volumes that dwarf even the data centers of the leviathans. In this cause, the advances in computer science pioneered at Google serve to emancipate the world from Google’s silos.” (p.210)

“The premise of the cryptocurrency movement is the recognition that the old bureaucracies of socialism and crony-capitalism have failed. That is the problem, not the solution.” (p.244)

“The inevitable conclusion is that machines based on mathematical logic cannot exhaust the human domain; they can only expand it.” (p.245)

“As Ammous puts it, ‘Prosperity only happens when there is no easy way for people to produce money, and instead they have to produce useful things.” (p.254)

“Its [bitcoin’s] historical fate is to provide a haven from maniacal governments and central banks and a harbor for a great innovation, the blockchain.” (p.256)

“Bitcoin: A method of secure transactions based on wide publication and decentralization of a ledger across the Internet. Current credit card systems, by contrast, are based on secrecy and centralization and use protected networks and firewalled data centers filled with the person information of the transactors.” (p.277)

“Bitcoins are not coins, but metrics or measuring sticks for transactions that are permanently registered in the blockchain.” (p.277)

“Gold is a metric of valuation based on the time to extract an incremental ounce, which has changed little over the centuries, while gold has become more difficult to extract from deeper and more attenuated lodes. The gold metric is therefore not a function of technology and industrial process, part of what it measures, but a pure gauge of value.” (p.280)

Congratulations @downing! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @downing! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @downing! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit