So the below article is from Forbes (ho hum…yawn…). The author is Bernard Moon, who is a brother of a friend of mine. Bernard is part of the of a venture capital SPARKLABS Group, based out of Asia (South Korea) that is incubating new startups (think Silicon Valley but in Seoul, South Korea). SPARKLABS backers are some of the best private equity guys in San Jose. More importantly the work they are doing is mostly in the greater Asia region (fun fact: did you know that China (pop 1.3 billion) and India (1.3 billion) combined have 2.6 billion people out of 7.6 billion globally ( they represent 36% of the world) . And needless to say, they are kicking butt and taking names. The number of companies that they are backing and launching is pretty impressive. But that’s a different story for another time. Back to the topic at hand, I thought Bernard’s Forbes article was an amazing thoughtful piece that highlights what is going to happen to Blockchain, Bitcoin, global dinosaur mega companies and Asia over the next decade (or sooner).

Here is the link: Please read if you have a chance. I think it really puts into perspective the realities of blockchain technology. Here are the highlights for those that just want to skim…but I encourage you to read

• The First $100 Billion Dollar Blockchain Company Could Be The Next SAP (or Oracle ~ enterprise software companies)

• Is blockchain the panacea of all technology woes? NO, its not a cure-all technology but it will be incredibly disruptive for some industries such as “banking, finance, healthcare, cybersecurity, and any space where a lack of transparency or lack of tracking and inefficacies abound, such as creative works and supply chain management.”

• Keep Your Eyes on Asia (South Korea and China) – they might be the leaders of blockchain technology.

• “The next generation of global enterprise database companies might not just be based on technologies acquired from the region, but wholly originated from Asia. For example, Blocko, which went through our accelerator (SPARKLABS) in Seoul in 2015, has become the leading enterprise blockchain company in South Korea with over 90% marketshare. Their blockchain-as-a-service platform, Coinstack, has been implemented at Samsung, LG CNS, Hyundai and many other multi-billion corporations.”

– DOES THAT IMPACT YOU? I own a Samsung Galaxy and own some LG appliances....ummm yeah is does!

• “Another company in China, SunlightDB (a member of SparkLabs Beijing's inaugural class this year), is trying to create a whole new database based on blockchain technology. They are building a database that is highly secure where information cannot be tampered with, but also completely open. Contrary to some misconceptions of blockchain technologies, their database queries have been at least 10x faster than traditional databases.”

• "Outside of Asia and the startup world, blockchain implementations are occurring throughout the globe. In Dubai, DNATA (Dubai National Air Transport Association), one of the world's largest air service providers, is working with IBM to improve the cargo delivery processes through blockchain technology. The potential cost-savings will be in the hundreds of millions."

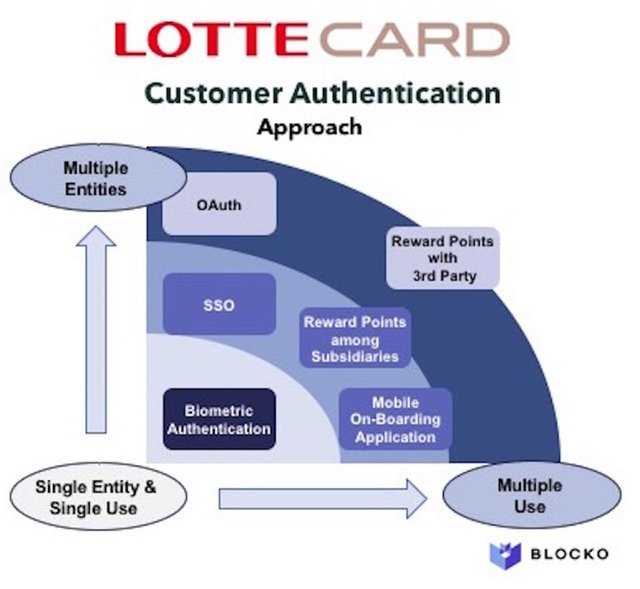

• "For one of South Korea's largest credit card companies, Lotte Card, Blocko set up a blockchain-based biometric log-in and payment authorization system which decreased authentication time from 7-10 minutes to 2-3 minutes." – Say what? e.g. I can bio-metrically ID a person now instead of a keycode or ID/ Drivers License?

• "Many U.S. corporations are piloting blockchain solutions, but I believe this coming year there will be a shift from U.S. companies dipping their toes into the water to more of them jumping into the decentralized waters of blockchain technology. 2018 will be a breakout year for enterprise startups and large companies (i.e. IBM, Accenture, Bank of America) playing in this space, and U.S. companies within the space might quickly catch up to the innovations occurring in Asia."

Question: Are there other ways to skin the “Bitcoin” cat besides investing directly in Bitcoin?

Answer: Yes. I think there are some companies that you will need to pay attention to. Yes, owning Bitcoin and other cryptocurrencies are obvious, but let’s not ignore the impact it will have on larger global companies. I would keep my eyes and ears on firms that are successfully implementing. Not sure at the moment who is going to be successful, it might be too early to tell. But if I were a betting man, I would hang my hat on Chinese e-commerce firms like Tencent, Alibaba, JD.com, Baidu, and WEIBO where I think Blockchain tech are more accepted and widely adopted. I would also keep my eyes on Google, Amazon, Apple, Priceline.com, and Facebook to see how/if they are implementing Blockchain Tech.

Lastly….Hello from UTAH!!!!! #BRIGHTON #PARKCITY #AMITOOOLDTOSNOWBOARD?

Follow me: @epan35

Lot of good info here, thanks for the heads up. Will these companies build their own blockchains or use existing ones?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hi @jrcornel, I would bet that it might be a combination. I suspect some firms are incubating their blockchain, if they think they have a strong R&D team, e.g Apple, Google, Amazon, FB but I think most firms will outsource. the technology is still early, but its open source, so things can rapidly change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good informative post... thank you and stay warm!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good read. Blockchains will become omnipresent in a couple of years like Internet is today. Blockchains will finally achieve what Internet set out to do but couldn't.

I keep hearing people saying that it is a bubble but Cryptos are still a long way to go in terms of evaluations for it to be compared to the dotcom bubble occurred in the late 1990s. So first off there is a still a long way to go. Second even if it is a bubble it doesn't matter. A healthy purging is always required to separate the grain from the chaff. The same happened in Dotcom bubble as well. We had some amazing companies like Google, Amazon et al which pretty much changed the world we live in.

With blockchains we have the added advantage of transparency, distributed decision making and the gains are shared by a large number of common people unlike the limited set of investors during the dotcom bubble.

So who cares if it is a bubble or not as long as you are investing in the good companies for the long term. I am suggesting all my friends to invest in Cryptos as an insurance against the failing governments and FIATS.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.forbes.com/sites/sparklabs/2017/12/15/the-first-100-billion-dollar-blockchain-company-could-be-the-next-sap/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin is great your investment will be double just wait and see God bless you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

what do you think about the recent declining bitcoin price.

and how your prediction of bitcoin in 2018

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @Rizalmahrez, Sorry for the delay. Still trying to stay on top of the replies and get comfortable with STEEM. I think Bitcoin is going to hit 25,000. Its going to be a bumpy road (it will trade between 10,000- 25,000. but who knows. But having said that, I would focus on various other ICOs (Ripple, Stellar) are two that I'm research right now. They have something that makes them differentiated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit