CRYPTOASSETS AND THE NEXT-GENERATION WEB

PART ONE: TDLT

Cryptocurrencies have gone from being a concept discussed only within cryptography circles to a topic of general discussion and occasional feature on mainstream news. It is also a topic that can cause some confusion, probably because it introduces new terminology unfamiliar to most people (such as ‘blockchains’ and ‘hashing’) and it also uses familiar words in new ways (for example, ‘mining’).

Fortunately there is a wealth of information out there to help the layperson get to grips with what cryptocurrency is and why it matters. Hopefully this essay will show that to be the case. I am not an expert in either cryptography or money, but I have been doing what I can to learn something about bitcoin, blockchains and all that. This essay series is as much a test of my understanding as it is a (hopefully) informative piece of writing. Any mistakes are my fault and feedback highlighting errors is appreciated. Anyway, let’s get on with it, shall we?

The Old Web

(Image by Dave Braunschweig)

The first question one might ask when first encountering cryptocurrency is: Why does this even need to exist? After all, we already have quick and convenient methods of payment from contactless cards to one-click shopping. In order to understand both the need and potential of cryptocurrency, you need to understand how the Internet was handicapped prior to the introduction of blockchain technology.

Before we had the blockchain, the Internet was good for spreading information but was not designed to facilitate the exchange of assets. One can understand why not when one realises what really happens when you ‘send’ an email. Unlike traditional postal mail, where your letter is physically moved from one address to another, with email what happens instead is that, by clicking ‘send,’ you are instructing your recipient’s computer to create a perfect copy of your email. That’s why you can just as easily ‘forward’ the same file to two or two hundred recipients.

Forgery used to be pretty hard to accomplish. Think of how skilled at art you would need to be in order to produce a fake Rembrandt that would fool an expert eye. But when it comes to digital products, the creation of perfect forgeries is a great deal easier. Anyone who has copied and pasted something has managed to pull this off.

Now, none of this matters when it comes to information that is meant to be duplicated. But it’s a whole different ballgame when it comes to assets that are meant to be exchanged. Let’s take that most familiar of assets-money-as an example. Imagine if digital money worked like email does. That is, you decide to buy something on Amazon and, when you click buy, a copy of your £10 appears in Amazon’s account. Since it was a copy, that means your £10 is still sitting in your account ready to be spent again. And again. And again.

In fact, this kind of thing does actually happen from time to time in MMORPGs. Such games have in-world economies and currencies to support their internal markets, and sometimes players will happen across a ‘dupe’ (short for ‘duplicate’) which is a bug that allows you to copy something the game doesn’t ordinarily allow you to copy. For example, in 1997 a ‘dupe’ was found inside Ultima Online that made it possible to copy gold. Players did just that, and so engaged in an economic no-no called ‘double-spending’.

Now, double spending is not a harmless activity, because it completely messes with money’s ability to accurately keep track of costs, credit and debt. In short, it renders money worthless and leads to economic collapse (which is what happens in MMORPGs with money that can be ‘duped’, unless the developers step in to sort things out).

Because the pre-blockchain web allowed for the spread of information but not the exchange of assets, it was vulnerable to double spending if people were to ‘send’ money directly to one another. Of course, we don’t send money that way. Instead, the old banking system places itself between every transaction, maintaining the books and charging fees for its middleman services.

There are always downsides to this way of doing things. Firstly, it imposes costs that would not be necessary if only you could make exchanges that negated the need for middlemen. Secondly, having centralised control over the money supply confers enormous power on whoever exercises that control, and power can always potentially corrupt. It is probably no coincidence that Hitoshi Nakamoto introduced bitcoin after the subprime mortgage scandal eroded faith in the banks.

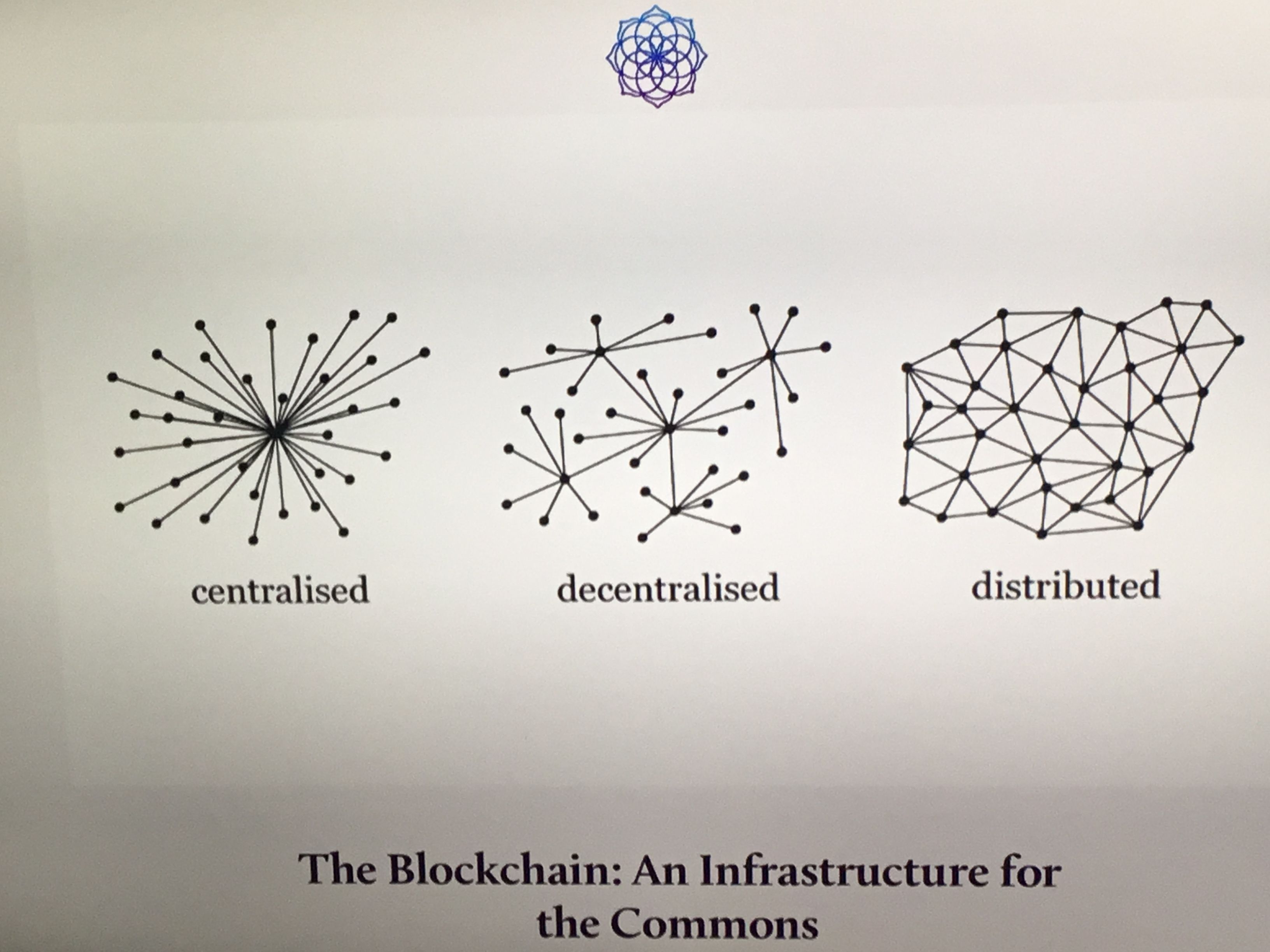

“Trustless Decentralised Ledger Technology”

(Image by Tim Gosselin)

Prior to 2009 there was no way of exchanging assets peer to peer. Now, thanks to blockchain technology, there is. So what is the ‘Blockchain’? I don’t intent to answer that just yet, because at this stage in our general discussion of crypto, it’s more useful to describe the general capability that something like the blockchain performs. You see, this is the first attempt at something we might call ‘Trustless Decentralised Ledger Technology’. Let’s unpack that in order to see what it means.

A good place to start would be with ‘Ledger’. You will recall from earlier how money has traditionally be handled by the banking system, acting as a middleman that keeps records of credit, debt and balances. Really, ‘money’ is not the coins, paper or plastic you carry around with you. They merely represent money. Money actually is that ledger the banks maintain.

If you wanted to do without a centralised ledger, what would you do? Well, you would opt for a decentralised ledger instead. You would accomplish this by giving everybody a copy of the ledger and ensure that all changes are in public view and met with consensus.

A rough example would be to imagine a community, one small enough for each person to keep track of every other person. Imagine that, any time somebody wanted to pay somebody else, they announce ‘I have X amount of money’. Everybody in the community then checks their copy of the ledger and sees that the would-be buyer does indeed have that money. “We agree”, they say, “you have that money”. The person then announces their intention to pay somebody else a certain amount. No physical money need change hands; simply by making the announcement the payment is made. Or, rather, its pending because first everybody must update their copy of the ledger, introducing a debt entry into the payer’s account and crediting the payee with an equivalent amount. Once consensus is reached that the payment is legitimate, the transaction has happened and is recorded in every copy of the ledger.

Now let’s suppose that somebody intends to cheat by adding an extra nought to the end of their balance so that whereas they previously had £100 they have now effectively printed an extra £900. This scam would be exposed the moment they claimed to have £1000 because everybody else would check their copy of the ledger and see only £100 in that person’s account. The same thing would happen if somebody tried the double spending trick.

The reason why this decentralised ledger is ‘trustless’ is because it is a decentralised system operating outside the control of any one person or institution. Still, you might be skeptical about having complete faith in the viability of a public ledger, and besides, such a system would be way too slow if expanded to national or international size. Unless…

Unless it was not people maintaining the public ledger but networked computers. You can see, then, how the Internet was always potentially able to facilitate peer to peer exchange of assets, simply by being a network of near instant universal communication. What needed to be built on top of that was A) a way of publicly displaying each record-keeper’s work and B) putting in place some kind of initiative to ensure sufficient resources would be devoted to the accurate upkeep of the public ledger. ‘Blockchain’, an early attempt at a trustless, decentralised ledger, went some way to accomplishing this.

REFERENCES

“Cryptoassets” by Chris Burniske and Jack Tatar

“Cryptocurrency: The Future Of Money?” By Paul Vigna and Micheal J Casey

“Second Lives” by Tim Guest

“Hidden Secrets Of Money” by Mike Maloney

Speaking of money in games, I have 10k Linden Dollars I'd like to sell. Would you be interested, or know anyone who might be? I would be trusty and give the Lindens first and the receiving party could pay me after they get them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post @extie-dasilva

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit