Content

- Traditional single-point financing in the supply chain

In general supply chain trade, all companies involved in the procurement, processing, assembly and sales of raw materials involve capital expenditure and income. However, there is a time difference between the capital expenditure and income of enterprises, which creates a funding gap. Need to finance production. Let's first look at a simple supply chain, as shown below:

Let's take a look at the financing of each role in the figure:

Core enterprise or large enterprise: large scale, good credit, and strong bargaining power. By taking the goods first and paying later, the financial pressure is transmitted to subsequent suppliers by extending the billing period; in addition, its financing ability is also the strongest.

Tier 1 supplier: Through the transfer of the creditor's rights of the core enterprise, bank financing can be obtained.

Other suppliers (mostly small, medium and micro enterprises): small scale, unstable development, low credit, high risk, and it is difficult to obtain bank loans; they also cannot have a long billing period like core enterprises; generally smaller enterprises have accounts The shorter the period, the micro-enterprises still need cash to get the goods. Such a comparison of one out and one in is like this: small, medium and micro enterprises lend money to large enterprises to do business without interest.

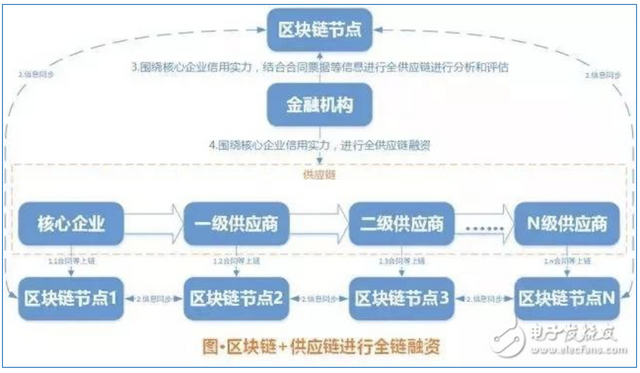

- Blockchain + supply chain finance

In the face of the above-mentioned financing difficulties for small, medium and micro enterprises in the supply chain, the main reason is the lack of an effective trust mechanism between banks and SMEs.

If all the nodes of the supply chain are on the chain, the data reliability of the core enterprise is guaranteed through the private key signature technology of the blockchain; while the contract, bills, etc. on the chain are the digitization of assets, which is convenient for circulation and realizes the transfer of value.