Critics argue that decentralized systems do not create trust, that they merely convert one form of trust (in financial institutions) to another form (technology). So, can a trust in a decentralized system be built?

One can argue that the trust in some of the blockchains has already been built among the early adopters. There’s Bitcoin’s open code which has been thoroughly battle-tested through numerous attempted hacks over the years. If this or a rise in market cap don’t speak volumes about the increasing trust, let’s see what are the advantages of decentralized systems and issues which should be tackled to further increase the trust and maintain it. After all, trust has a dynamic and multifaced character, and the blockchain technology is still in its infancy.

Motivation

There is no hidden motivation behind a public algorithm, while the motivations of those who control central authorities can be speculated. Yes, we have to trust technology instead of intermediaries, but decentralized technology doesn’t have any conflicts of interest with its users, while central authority, such as banks or centralized social network, might have. Data privacy breaches, e.g. Facebook – Cambridge Analytica scandal, are partially the reason why decentralized automated governance is so important. Even Cambridge Analytica’s former development manager and a Whistleblower, Brittany Kaiser, became a strong proponent of blockchain usage for data protection. On the other side, gambling cryptocurrency Dragon Coin, that Cambridge Analytica and she were involved with, has raised $320m. This is one of the biggest ICOs to date. However, the price of the coin has crashed 98.50% since the ICO (at the time of writing), raising concerns about the project and its team. One of the biggest problems came to focus after The Times revealed that one of its supporters is a famous Macau gangster. Cambridge Analytica’s fling with ICOs is a great example of how important it is to do your own research on teams behind projects, before getting involved in crowdfunding.

Tamper-proof and Transparency

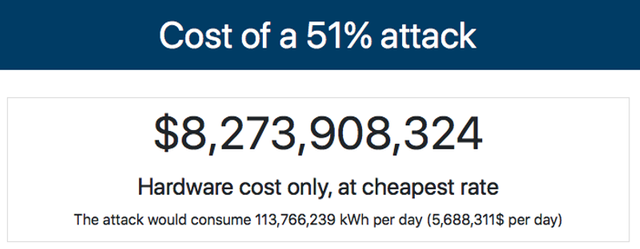

Majority of blockchains are being made in a way that they cannot be interfered with, due to their consensus algorithms checking transmitted data for coherency and authenticity. The process of tampering with the blocks is expensive and complicated for larger cryptocurrencies. The time and monetary cost to trick the system far exceed the gain, and with the coming economy of scale and calculations getting more and more difficult, the chances are becoming even slimmer for some. The cost of attacking Bitcoin would currently be over $8 billion, and that’s just the cost of the cheapest hardware without the cost of setting it up and running it.

That said, coins with much less hash power, such as Monacoin, Bitcoin Gold, Zencash and Litecoin Cash, have recently been hit with a 51% attack. You can compare the current theoretical cost of the attacks on different blockchains here www.crypto51.app, and as you can see, some are very cheap to attack. There are possible solutions to this which ICOs could consider, such as PoS, Coins built on top of other networks, Merged mining, Interchain linking, Penalty System for delayed block submission, Multi-Algo mining etc…

Blockchains can digitally secure contracts and store them in transparent, shared databases, where they are cryptographically protected from deletion, tampering, and revision. Immutability can be of great importance to many sorts of data: currency transactions, intellectual property, equity, information, reviews, agreements, tasks, digital assets – which makes blockchain a general-purpose technology. Blockchain can also lower privacy and censorship risk. Even the UN is exploring the ways to utilize these features. UNOPS teamed up with IOTA to see how the project’s distributed ledger can help the UN increase efficiency through streamlining of workflows, supply chains, and payments, and prevent corruption through transparency. The UN called it “the world of Industry 4.0“.

.jpg)

User-friendliness

Cryptos are not user-friendly – yet. Most of the losses in legitimate crypto projects come from insufficiently informed users and the technology which has not yet been simplified enough for mass market usage. Non-compliance with recommended safety procedures, as in the case of improper use of wallets, transactions, password generation or keeping, has often lead to loss of funds. Cryptos, in general, are in the early stages of development and not enough attention is given to the ordinary end user. That said, Average Joe will be able to become his own bank when we reach a point in which safety procedures become user-friendly. Projects which start catering to end user, sooner rather than later, will gain a comparative advantage.

FOMO and FUD

Even though speculations, hype, fraudulent ICOs, pumps, and dumps, are not the inherent feature of blockchain technology, they are currently some of the most important reasons why people lose trust in it. Newcomers need to do a lot of research to understand the product and its value, to avoid getting tricked by FUD and FOMO. Most of the ordinary people hastily and speculatively entered the market and got burned during the FOMOed end of 2017 and FUDed beginning of 2018. Instead of becoming wary of media hype and social media schillers, many people misplaced their mistrust by dismissing all crypto projects as a scam.

Traditional and crypto investing/trading have something in common – they are not for the faint-hearted. If you do not have in-depth market knowledge, and can’t control fear and greed, it’s better to avoid trading and investing altogether.

Environment

Crypto environment itself is becoming more and more decentralized, thus safer. If the current largest exchange crashed, such as Mt.Gox did in 2014, effects would not be so dramatic. This is because we now have a large number of exchanges with smaller shares in the market. Mt.Gox had a 70% share in the market, making the whole environment centralized and vulnerable. It basically acted as a single point of failure.

Another potential point of failure is argued to be unaudited Tether and its spread over the exchanges. However, new StableCoins, possibly more trustworthy, with different pegging and stabilization mechanisms are entering the market and should reduce reliance on Tether, as a non-volatile trading pair.

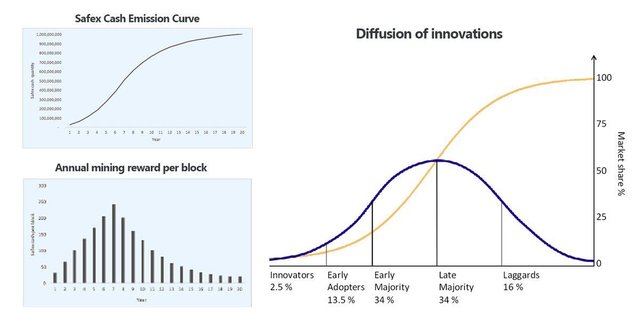

Another way of looking at the fragmentation of the environment is through the distribution of bag holders. In the early crypto days, ownership of the coins was more centralized than now, partly due to steep emission curve of Bitcoin and its incentive system, which led to a large number of coins being distributed to a small number of miners and investors. Those with the heaviest bags became known as whales, able to influence the value of the coin on the exchanges. The situation has improved since early BTC owners sold or exchanged part of their holdings to other cryptocurrencies. A rapid increase in the number of new investors and crypto projects has led to further fragmentation. Projects with more shallow distribution curves, such as Safex, will ensure the long-term continuation of this trend.

Regulation

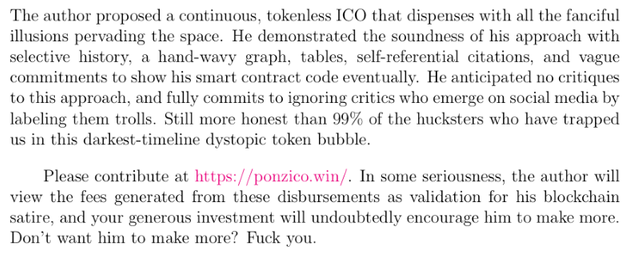

Trust in centralized systems exists largely due to regulations and predictability of outcomes. On the other side, the majority of crypto proponents are opposed to regulations. Unregulated crypto space has so far led to accelerated growth of innovations. However, it also attracted cons and incompetent opportunists. The lack of a safety net has led to a loss of funds in numerous exit scams, Ponzi schemes, thefts, and hacks. Some of the scams were made in such a blatant way, that it is hard to believe certain people were gullible enough to fall for them. There are people who invested $250k in a satirical project, called – PonziCoin, whose founder was shocked with his own success.

Excerpt from satirical PonziICO White Paper

But with all seriousness, some of the scams are so complicated that even sophisticated investors have a hard time detecting fraud. This is mainly because the scam is usualy tied to advanced technology or exotic monetary policy.

A thorough debate is still needed on how to legally improve crypto space without stymying progress. We have even seen some successful self-regulation, e.g. exchanges acting on suggestions of careful governments and organizations. We’ve also seen crackdowns by the not so crypto-friendly governments. It’s left to be debated if mindfully elaborated safety measures in the form of minimal regulations might improve the trust issue among the general public.

Do not rush into thinking that blockchain will take the world by storm in a short time. Hype is one thing, but development is still at a very early stage and adoption will probably be more gradual than we think. Some industries will adopt it earlier than others. Social network coins might be among the first to be adopted on a larger scale if we have a look at the ranking of Steemit platform by the number of transactions (blocktivity.info).

Many issues need to be solved before the mass adoption. Starting with technology, security, and regulation, adding up to governance and societal issues. It took more than 30 years for the Internet, TCP/IP, to move through all the phases—single use, localized use, substitution, and transformation—and reshape the economy. The blockchain is more of a foundational innovation than disruptive. It has the potential to create new foundations for global technology systems over the longer term, lead waves of institutional changes and create entirely new business models, building trust along the way.

In the following articles, I’ll talk about other issues such as price volatility, as well as the debate around immutability vs protection.

Let me know in the comment what you think are the biggest obstacles which we need to overcome in order to build substantial trust in blockchain technology?

Congratulations @hodlmodel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit