Lendroid is a trustless, open, peer to peer digital asset lending platform based on the Ethereum blockchain. It is a Trust-Independent Open Protocol for Decentralized Lending. It Enables Holding Leveraged Trade Positions and Short Positions of ERC20 Tokens.

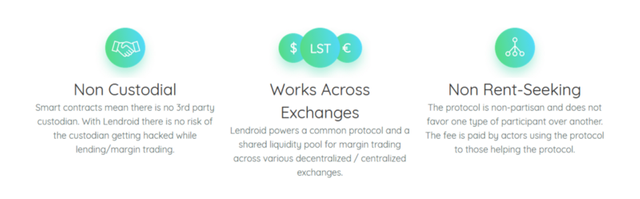

The Lendroid marketplace enables borrowers to avail instant low-cost digital asset loans and lenders to earn interest on the digital assets they lend. Additionally, Lendroid support token (LST) holders act as guarantors of these loans by locking up their LSTs as secondary collateral. The Lendroid platform is extensible by design and allows the creation of loan markets on any ERC20 token.

Lendroid Vision

Imagine a truly trust-independent protocol, where lenders and borrowers can discover each other and speak a common language. Where the interests of a Lender — the primary source of liquidity — are protected. Where the terms of the loan are inviolable, ‘on-chain’. A range of interesting applications and financial instruments based on lending can take root, take shape. And facilitating all of these exciting financial models would be, we hope, Lendroid.

Lendroid is itself non-rent-seeking. It is non-partisan. For one, it makes us feel good about what we’re doing. But the larger implication here is that there is no drag on those who choose to build on this protocol, or integrate with it in any manner. If you need a de-facto lending protocol for digital assets, we’re here.

Lendroid would enable a universally accessible liquidity pool, not a centrally-controlled one. The difference between the two is the key to true trust-independence.

Benefits

- Put digital assets to work to earn interest with low-friction.

- Hold leveraged positions on digital assets in a trust-independent manner, on chain.

- Can hold a short position of a digital asset.

A solution that can achieve all three. Once established and a lending pool is created, endless complex financial applications are possible.

We hope this would be a fertile playing field for the developer community to create digital asset derivatives, financial derivatives and the like.

Lendroid will be extensible into other complex financial models, but the beginning to all this — a holistic, comprehensive beginning to enable all this — is decentralized margin trading, we believe.

What is Margin Trading?

Margin trading refers to the practice of trading with borrowed funds instead of your own. So individual investors buy more stocks than they can afford to. If you pick the correct investment, margin trading can dramatically increase your profit. On the other hand margin trading can amplify gains as well as losses.

How Does Lendroid Work?

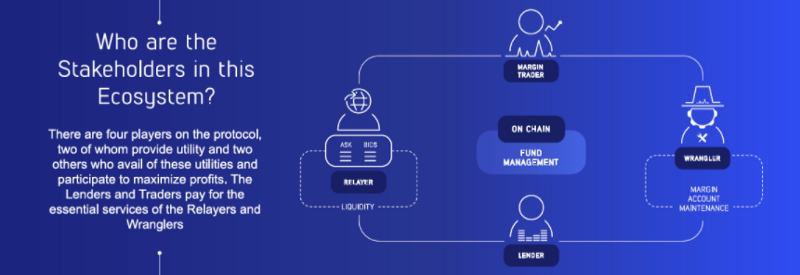

A trader (prospective borrower) decides to borrow from lending pool. The borrower put up digital assets as collateral in a smart contract. Automatic system determines if there is an initial match or not between borrower and lender. If the terms match up, smart contract is executed and funds are released for the borrower.

Lendroid creates a global shared lending pool as a supply for borrowers. Borrowers submit offers to this lending pool.

- If the trade ends with a profit, borrower can repay the lenders and take back his collateral.

- If the trade ends with a loss, borrower must compensate the losses and only after paying full amount of borrowed money, he can take back the collateral.

- If trader exceeds the limits of liquidation levels, Wranglers take over the trader account and trade positions.

A loan contract itself is pretty straight forward. But then, who fixes the terms of the loan? How do borrowers find and convince lenders? How do we make sure the borrower has the incentive to repay? What happens if the borrower fails to repay? etc

The main duty of Wranglers is watching over Lenders’ interests and protecting the general process of Lendroid ecosystem.

The Lendroid marketplace allows the creation of several loan markets.

Architecture of the Lendroid platform

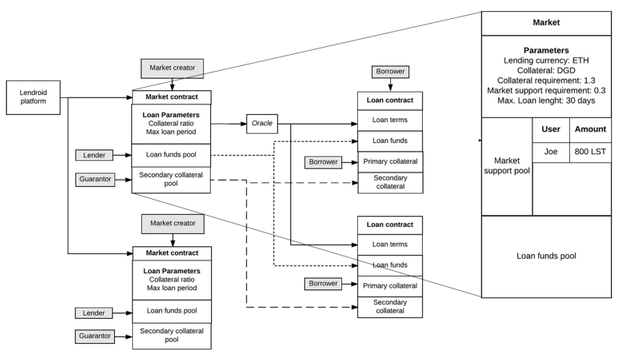

Lendroid support tokens(LST) are the native tokens of the Lendroid protocol. Market creators (Lendroid support token holders) propose new markets using a unique set of loan terms (combination of collateral type and ratio).

Market creation and funding

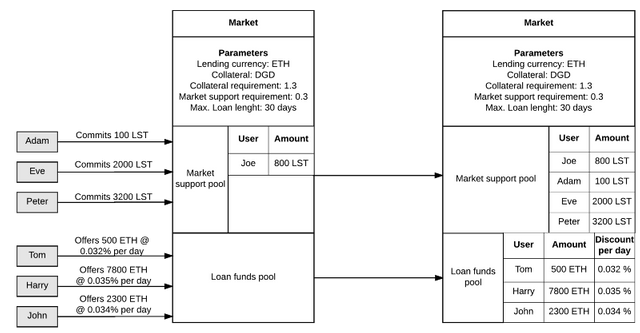

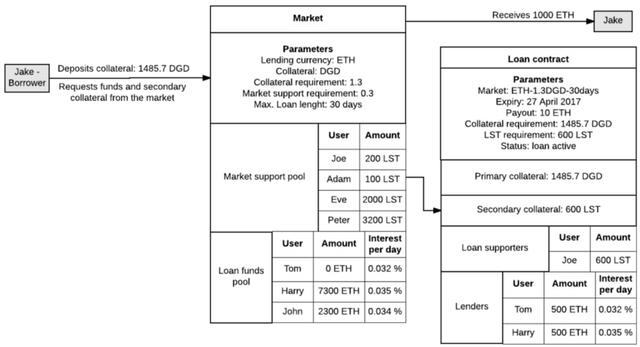

Lenders and guarantors discover, gather and pre-fund markets which offer loan terms they prefer (terms that they believe will keep the loan solvent, protect their investment and enable them to make money). Guarantors are LST holders who choose to extend support to markets that issue loans that they believe will remain solvent and payout properly, in which case they receive a portion of the interest. If the loan becomes insolvent, they stand to lose their deposit. It is a requirement for every loan to hold LSTs whose value is at least 20% of the borrowed value. The LST deposit acts as secondary collateral for the loan.

Loan issuance process

Borrowers show up, choose a market depending on the type of collateral they wish to lock, create a loan contract, deposit collateral as defined by the terms of the loan and receive the loan funds.

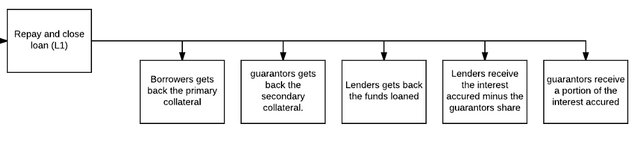

Loan repayment process

At the end of the loan period, the borrower has the option to extend the loan by adjusting the collateral locked or repay the loan along with the accrued interest, or stands to lose their collateral.

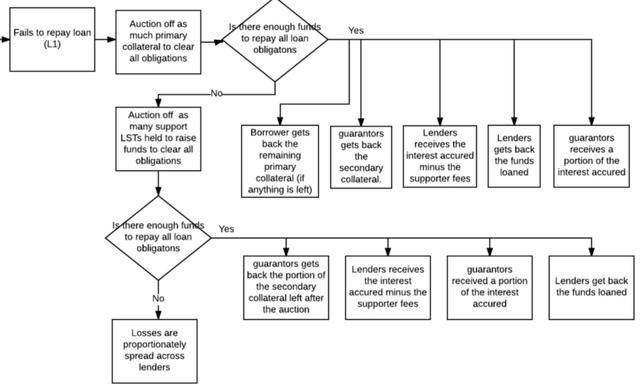

Loan liquidation process

If the borrower fails to repay the loan, the primary collateral held in the loan in auctioned off. If the funds raised in the auction is insufficient to clear all obligations as much secondary collateral (Lendroid support tokens) is auctioned off to raise additional funds. If even after auctioning off all secondary collateral locked in the loan there are not enough funds to repay all the lenders, the losses get spread proportionately across all lenders, and the lenders are paid out.

The lenders receive two layers of protection for the funds they lend. One from the value of the primary collateral and another from the value of the secondary collateral. This process increases the confidence of lenders and reduces the lender’s market discovery burden.

Lendroid Support Token (LST) & Token Sale

Lendroid Support Tokens (LST) is the main element and payment currency of Lendroid Protocol.

As Lendroid Team described, LST is going to have 3 major roles in the ecosystem:

- To lubricate process and drive utility on the protocol

- To incentivize participation

- To empower governance

LST is an Ethereum based token. LST tokens are being issued with adhere to the ERC20 tokenstandard. They can be stored in any wallet that supports Ethereum based tokens such as Mist, MetaMask, MyEtherWallet.

Symbol: LST

Max Token Supply: 12 000 000 000 LST

Released in Public TGE: 240 000 000 LST

Price: 1 ETH= 48 000 LST (without bonus)

Hard Cap: 5000 ETH

Registration for the TGE: 11th February 2018

Public TGE: 19th February 2018

Accepted Payment Methods: ETH

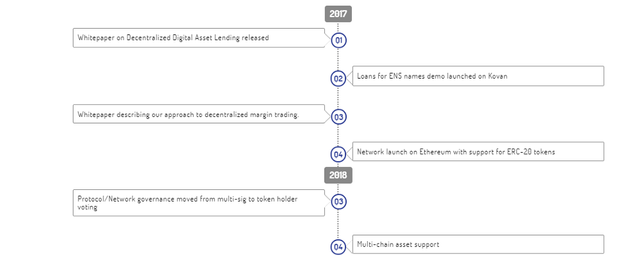

Road Map to Lendroid Token

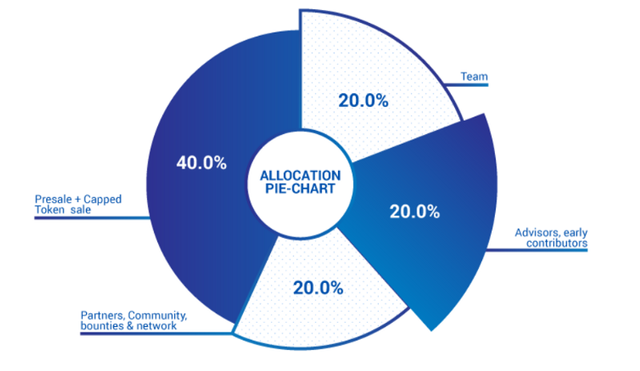

Tokens Distribution

Presale + Capped Token sale — 40%

Team — 20%

Advisors, Early contributors — 20%

Partners, Community, Bounties and Network — 20%

Roadmap

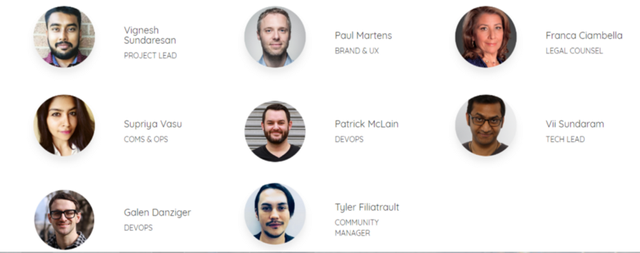

Meet the Team

More Info:

Website: https://lendroid.com

Twitter: https://twitter.com/lendroidproject

Whitepaper: https://lendroid.com/assets/whitepaper.pdf

Slack: http://slack.lendroid.com

Blog: https://blog.lendroid.com

Author: Hurricanecol

My Profile link: https://bitcointalk.org/index.php?action=profile;u=1576406

Eth Address: 0x43D58a3D64062e4E2cF6aD285c7FE3a8B25741cC